By Jeffrey P. Snider at Alhambra Partners

Now that we have a very good idea that small companies are having trouble with their bottom lines, that leads to the debt question. The major procyclicality associated with high yield bubble behavior is that it extends the “useful” life of smaller businesses beyond where they otherwise would have potentially scaled back or gone into bankruptcy. In macro terms, that is growing inefficiency due to the accumulation of “bad” business models and executions.

The primary problem with cyclicality is that by keeping money losers afloat it only congregates the eventual defaults and retrenchments together into one big event rather than spread out over many months, even years. There is no doubt that ZIRP and the perpetuation of “emergency” QE force some “reach for yield” into exactly this kind of procyclical behavior, but there is another perhaps more relevant aspect that is completely unexamined.

Again, we know the desire for yield among investors overrides common sense, but it is not simply a yield game in finance. Trading desks at major banks need “something to do”, thus there have to be some kind of assets to trade in order for the credit desks to “make money” (in addition to underwriting fees). Credit desks are not some backwater or hidden operation where there is little to no attention, rather these are the primary operations in the shadow/investment bank model.

The “problem”, at least from the finance perspective, has been the obliteration of the mortgage market post-2007. Mortgage trading (US $) fed the bottom lines of nearly every financial institution from Wall Street to London to Asia and beyond. However, if you add mortgage bonds, agency bonds and ABS, total outstanding has fallen by $2.1 trillion since 2007 (through the 2013).

Such deleveraging is a net positive, though, of course, it would have been far more favorable to never have engaged a bubble in the first place. But the silver lining in any collapse is the removal of the primary imbalance that acts as an impediment to financial and economic recovery.

That would not serve the financial system very well, and it certainly does not accord with orthodox monetarism. So the leverage had to be rebuilt, though for other reasons that the orthodoxy continues to discount or ignore. Monetarists believed that rebuilding credit to the 2005-levels of bubble obsession would be the key to the economic rebound. Financial institutions have to deal with the real world, and so they have concentrated elsewhere to whatever inefficiency such credit rebuilding might feature.

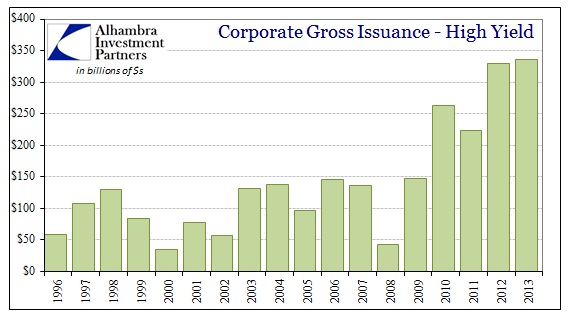

As you can see above, the credit market simple moved from mortgages to UST and corporates. Where total UST outstanding grew $7.3 trillion in those six years, corporate debt exploded by $3.6 trillion (with a T) – that kept a lot of shaky businesses afloat, and for those “better off” it kept the share buybacks flowing (or, like Apple, got them into repurchasing behavior in the first place).

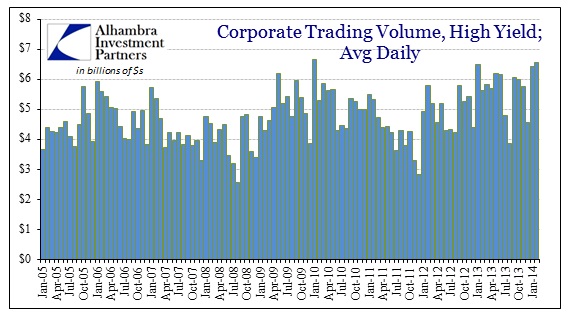

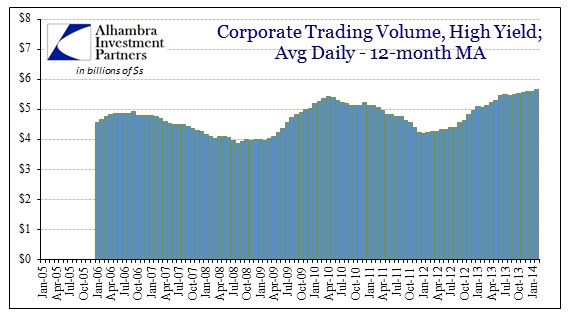

That also means institutions are trading more corporates and UST than ever before. That includes high yield. And if it isn’t clear in the raw data above, the 12-month averages are at all-time highs for trading volume in both market segments.

Credit trading in total took a major hit in 2008, but the rebirth in early 2009 was quite astounding for both the scale and speed. Bank desks found their substitutes in relatively short order, really even before the stock market found any bottom. The high yield market suffered a second setback in the middle of 2011, but reignited right around September 2012.

And it hasn’t just been high yield debt trading that saw a rebirth in the age of QE3. Leveraged lending trading bottomed out in the week of October 19, 2012.

That week happened to be noteworthy for being the first flood of QE3 settlements from the September 2012 trades in the TBA market. About $15.9 billion of MBS and agency trades settled on October 11, with another $9.7 billion settling over the following eight days.

The effect on leveraged loans might include that reach for yield or even some psychology over QE cash, but it also likely flowed through the “need” for fixed income trading. After all, QE removed even more MBS from the “markets” which pushed credit desks to find even more replacements. I don’t believe it is coincidence at all that average deal size and amounts starting rising right as QE3 started influencing and distorting.

As I said above, putting finance above all else establishes this trend where companies remain funded by very much artificial debt beyond their productive use. The comparison to China right now is all too easy because it seems like it is a “stimulus”, but factoring cyclicality and efficiency it is simply another bubble-like distortion. Greenspan used the term irrational exuberance but there is nothing irrational about it; intervention creates new channels of redistribution that are, when factoring all factors, very much rational behavior. The problem is not irrationality, but of the insistence of policymakers on theorizing homogeneity – that they will stimulate “useful” credit without inquisition about how the real financial world might actually behave.

When you put together an apparent stream of money-losing firms with easily obtained debt in an age where financial agents are “making money” almost exclusively off volatility and expectations of such, the tendency toward responsible intermediation is severely diminished, if not completely disregarded. That was the animating element behind subprime mortgages and it is not at all surprising to see it reborn, even if the scale is somewhat less. It may not lead to financial ruin again, but, economically speaking, there still looms a reckoning.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com