I always believed that at some point “markets” would view the announcement of yet another “extraordinary” monetary program with actual candor rather than conditioned disbelief more befitting a magician’s audience. The primary focus would be not about future conditions, which is the entire point of monetarism in the rational expectations age, but what the “need” for more “stimulus” says about right now. In other words, at some point there should be (have been, given persistent impotence) an “oh sh–” moment where the central bank essentially confirms that all its prior sunshine was just hollow posturing for “your benefit.” That is the basis for all of this, as no central bank in the age of proliferating negative nominal rates can squarely claim an interest rate issue. Maybe ten years ago they could say that reducing interest rates would provide “stimulus” to the real economy in the form of cheaper borrowing (cheaper is a relative term that is not specified, and it does make a huge difference as to who might be on the “winning” end of it), but we are past even the point of ZIRP as less-than-zero rates are now a seeming standard for bills, notes and even bonds now. The zero lower bound has been obliterated and made applicable in ways never imagined by pre-crisis thinking.

The Governing Council took this decision in a situation in which most indicators of actual and expected inflation in the euro area had drifted towards their historical lows. As potential second-round effects on wage and price-setting threatened to adversely affect medium-term price developments, this situation required a forceful monetary policy response. Asset purchases provide monetary stimulus to the economy in a context where key ECB interest rates are at their lower bound. They further ease monetary and financial conditions, making access to finance cheaper for firms and households. This tends to support investment and consumption, and ultimately contributes to a return of inflation rates towards 2%.

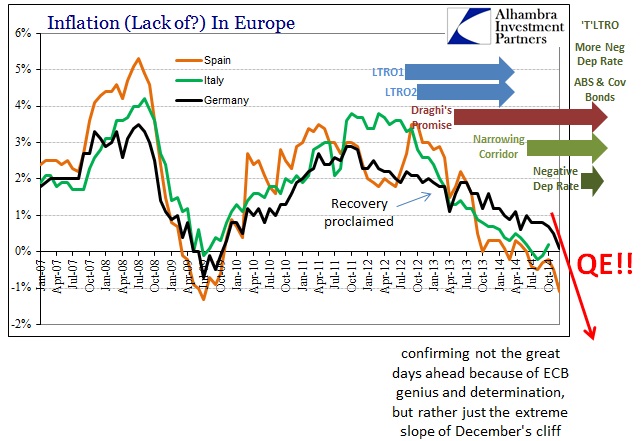

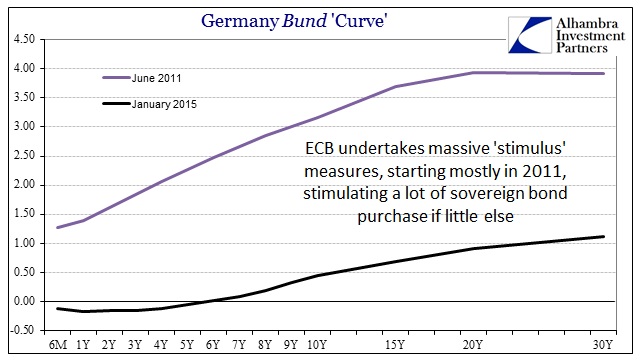

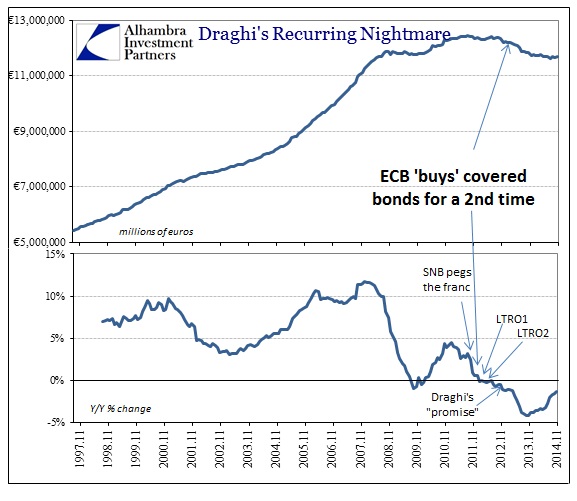

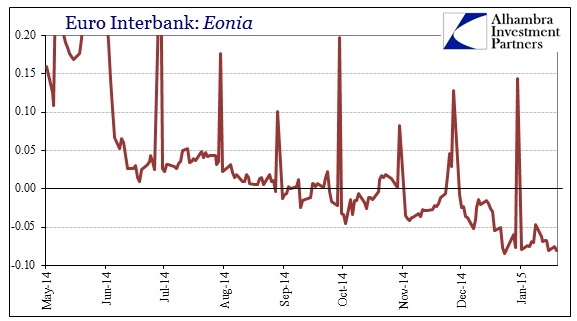

The first paragraph quoted above is highly disingenuous. Reading it without preconception or awareness of Europe these past few years would lead to the conclusion that the ECB has been allowing markets to self-correct, to no avail, and is just now getting to work. Curiously missing are any references to the massive, dramatic, and highly intrusive programs that have been a steady presence for going on five years now. The first OMT, aimed, ironically given the current worries, at Greece was June 2010. Five years forward and they are no closer to solving Greece as to living up to that paragraph’s contentious monotony. The second paragraph is simple bluster, as there has been no “portfolio effects” in Europe, at least not in the direction they intended. It was instead, as negative nominal interest rates signify, a backwards “portfolio effect” whereby the banking system has intentionally eschewed basic lending in favor of pocketing an unearned, ECB-driven speculative profit on rising sovereign bond values. The first chart below is very much related to the second, and in more than one way:

It’s not as if Europe is some desert stripped of all its liquidity, as the continent is really drowning by now-naked monetarism.

It’s not as if Europe is some desert stripped of all its liquidity, as the continent is really drowning by now-naked monetarism.

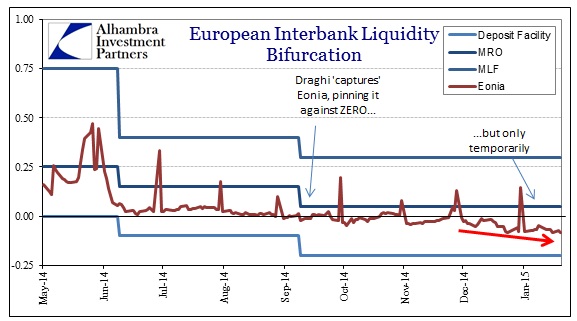

All this simply means that there is no “money supply” issue in Europe any more than there has ever been. Nothing since 2007, anywhere, can be properly characterized as a “supply” problem. Indeed, as the persistent and now deepening negative nominal Eonia shows, there is no shortage of interbank liquidity by which to fund all the ECB’s dreams. It is instead, idle uselessness as banks themselves do nothing with what they have been “given.” What it would take for that to reverse is actual economic progress rather than more of the same. That brings us closer to the real “magic” of QE, in that we are now, in 2015, supposed to believe that inflation expectations are all that matters. The Eurozone has been flooded with the European equivalent of “reserves” for half a decade, but now all of sudden they will somehow impart the correct coding upon investor psychology. Whereas banks were actively shedding loans and private economy credit amidst the massive LTRO’s, which were a direct funding, and at the time of economic distress, they are now supposed to ignore the renewed distress because they feel like agreeing with the ECB? The problem with appealing to, and relying upon, psychology is that it is not homogenous. The ECB clearly expects a “rational” response to its moves, but that “rational” response they have mathematically modeled already presumes that “money supply” expansion will be convincing in terms of real prices. It very well could be, also thinking “rationally”, that economic agents instead sense not determination on the part of the central bank but desperation. In that case, the results are opposite whereby “deflation” becomes even more entrenched because the central bankers, in their haste, have just confirmed exactly how bad the world actually is. In the context of prior inabilities to do exactly what they are trying to do now, there is far more of anxiety than anything else. These ECB figureheads are the very people who see nothing but good things and recoveries as far as one can imagine, who can say nothing positive about markets, the economy and everything in between. But now that perpetual optimism has been not just punctured but ruptured by, “most indicators of actual and expected inflation in the euro area had drifted towards their historical lows. As potential second-round effects on wage and price-setting threatened to adversely affect medium-term price developments” – meaning the spreading infection of downgraded economic disease. It is all about monetary “flow” rather than supply, which is why the emphasis on psychology is paramount. You can lead a bank to reserves, but the bank has to turn them to loans of its own calculations of the real world; calculations that continue to look horrendous. Monetary flow is not so easily constructed on simple command from a structure that is ill-suited to make such directives. Opportunity is a far more tangible concept than central banks give credit for, as they look upon it as a mathematic variable to be flipped by an adjustment on the other side of some equation. There is no such equality in the real world, as often such behavior is actually less than a zero sum game (sell loans; buy gov’t bonds). What is clear, given the history of especially the activities since the LTRO’s, is that the ECB simply doesn’t know what else to do. December’s inflation figures cemented this last option, but acting from a position of extreme weakness is easily discernable in any psychological environment.

All this simply means that there is no “money supply” issue in Europe any more than there has ever been. Nothing since 2007, anywhere, can be properly characterized as a “supply” problem. Indeed, as the persistent and now deepening negative nominal Eonia shows, there is no shortage of interbank liquidity by which to fund all the ECB’s dreams. It is instead, idle uselessness as banks themselves do nothing with what they have been “given.” What it would take for that to reverse is actual economic progress rather than more of the same. That brings us closer to the real “magic” of QE, in that we are now, in 2015, supposed to believe that inflation expectations are all that matters. The Eurozone has been flooded with the European equivalent of “reserves” for half a decade, but now all of sudden they will somehow impart the correct coding upon investor psychology. Whereas banks were actively shedding loans and private economy credit amidst the massive LTRO’s, which were a direct funding, and at the time of economic distress, they are now supposed to ignore the renewed distress because they feel like agreeing with the ECB? The problem with appealing to, and relying upon, psychology is that it is not homogenous. The ECB clearly expects a “rational” response to its moves, but that “rational” response they have mathematically modeled already presumes that “money supply” expansion will be convincing in terms of real prices. It very well could be, also thinking “rationally”, that economic agents instead sense not determination on the part of the central bank but desperation. In that case, the results are opposite whereby “deflation” becomes even more entrenched because the central bankers, in their haste, have just confirmed exactly how bad the world actually is. In the context of prior inabilities to do exactly what they are trying to do now, there is far more of anxiety than anything else. These ECB figureheads are the very people who see nothing but good things and recoveries as far as one can imagine, who can say nothing positive about markets, the economy and everything in between. But now that perpetual optimism has been not just punctured but ruptured by, “most indicators of actual and expected inflation in the euro area had drifted towards their historical lows. As potential second-round effects on wage and price-setting threatened to adversely affect medium-term price developments” – meaning the spreading infection of downgraded economic disease. It is all about monetary “flow” rather than supply, which is why the emphasis on psychology is paramount. You can lead a bank to reserves, but the bank has to turn them to loans of its own calculations of the real world; calculations that continue to look horrendous. Monetary flow is not so easily constructed on simple command from a structure that is ill-suited to make such directives. Opportunity is a far more tangible concept than central banks give credit for, as they look upon it as a mathematic variable to be flipped by an adjustment on the other side of some equation. There is no such equality in the real world, as often such behavior is actually less than a zero sum game (sell loans; buy gov’t bonds). What is clear, given the history of especially the activities since the LTRO’s, is that the ECB simply doesn’t know what else to do. December’s inflation figures cemented this last option, but acting from a position of extreme weakness is easily discernable in any psychological environment.