I don’t want to devolve into a Clintonian argument over the basic meanings of certain words, but that may be the best course in analyzing and discussing Europe’s circumstances in the very new age of negative interest rates. Reuters says there is “clear proof” that Draghi’s desperation and new bluff is “gaining traction.”

An all-time low for euro zone money market rates bolstered the region’s bond rally and held down the euro on Tuesday, providing clear proof that the European Central Bank’s latest support measures are gaining traction.

What do low money market rates have to do with “gaining traction?”

The rate banks in the euro zone charge one another to borrow overnight – known as EONIA – hit an all-time low of 0.053 percent too, a move the ECB will hope will feeds to firms and consumers, boosts growth and prevents deflation setting in.

That statement actually argues in the opposite direction of what the author is concluding, in what looks to be another Fox Butterfield example. Banks that were content to leave “reserves” on deposit at the ECB now face (as of tomorrow) an interest cost to doing so. The ECB is attempting to spin that change as a forceful measure that will get banks to do something “more productive” with that “cash”, like lend into the real economy as the Reuters article uncritically asserts. But the “record low” rate for Eonia shows quite clearly that banks are doing nothing of the sort, instead trading one “riskless” opportunity (deposit at ECB) for another (lend overnight at Eonia).

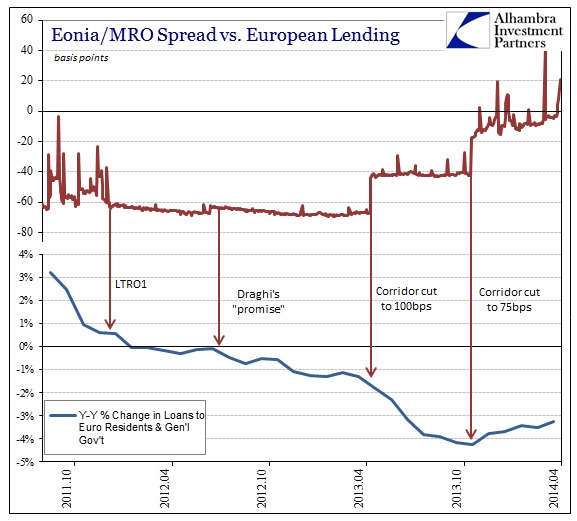

Moving accounting ledger balances around from one line item to another doesn’t accomplish what is being proclaimed as “traction.” It makes a nice news item, spooned out for public consumption, but there has been absolutely no relationship or correlation between artificial Eonia and lending in Europe.

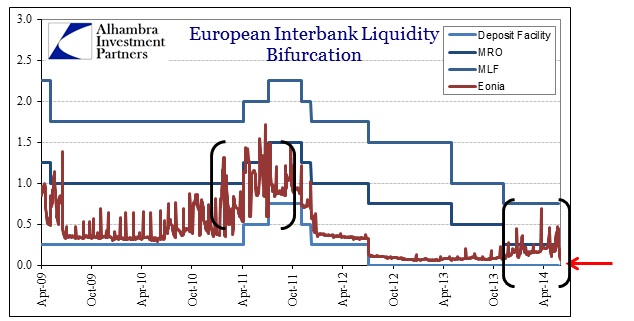

I say “artificial” because that is exactly what it is. The behavior of overnight, unsecured interbank lending even recently is not at all like what it was when there were actual market forces at work (at least with a lot less central bank intrusion; it has always been there but has increased by orders of magnitude since 2007). The ECB has used Eonia as a paint-by-numbers sketch to project whatever it wants of the “market” rather than allow transactions to settle via a risk/return basis.

The latest Eonia indication is already nearly 5bps below the new MRO midpoint that goes into effect tomorrow. The Eonia/MRO spread is supposed to be positive as Eonia is unsecured overnight whereas the MRO is an ECB repo alternative. With the spread already negative, once again, the risk/return idea has clearly been overrun by this latest intrusion.

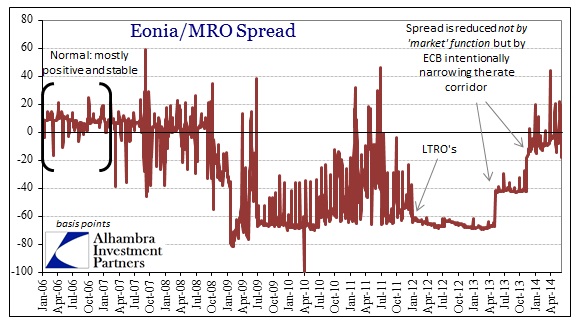

The spread under more normal conditions of actual market forces looks like the far left hand side of the chart above. While the far right side, more recent indications, seems to be closest to matching the behavior of that period, it is only so because the ECB narrowed the rate corridor in successive “rate cuts.” In other words, the spread is not normalizing, it only looks that way on the surface. The ECB has created that appearance with its policy changes, sort of cheating and hoping nobody, like Reuters, noticed (if Eonia won’t come up to the MRO like it’s supposed to, the ECB will bring MRO down to Eonia).

Yet, despite all the jiggering for the sake of appearance (which includes LTRO’s and now Targeted LTRO’s to suppress volatility) lending has continually contracted. While interbank markets may no longer be allowed to consider risk and return, you better believe that banks have done so in setting balance sheet targets for actual loans. If there is a liquidity problem in bank lending (which I really, really doubt) then it is trumped by NPL considerations and the sordid state of non-sovereign borrowing candidates in Europe. Recovery indeed.

If your entire goal is psychology, then playing around with Eonia makes sense. Unfortunately, a fake Eonia doesn’t erase the European disaster. It only removes one more indication as to what’s absent for a real recovery – market forces allocating resources, including credit, on a sound and reasonable basis.

All central banking measures are at their heart a play for psychology via skewed pricing in this manner. The Reuters article cited above actually gives this away in accidentally pointing out what is probably (likely?) the real goal for all of this “traction”:

The euro tumbled back towards a four-month low against the dollar at $1.3540, while there were new lows for Portuguese and Irish borrowing costs, two of the countries bailed out during the euro debt crisis.

The euro’s tumble is what I and many others believe was the point of all the fakery – to get the non-observant to commit elsewhere thereby “alleviating” a too “strong” currency. But in one last burst of Butterfield, the second part of the quote above again belies the “traction” idea as it relates to actual lending. If banks are already buying more “risk free” sovereigns (and I have little doubt it is banks doing the majority of buying, particularly if the euro is falling and thus precluding large further inflows from China and Japan – at least to this point) they surely aren’t lending.

In orthodox terms, what the ECB is attempting amounts to “preparing the battlefield.” They are making conditions as favorable as possible (at least to look that way) for future lending, where the euro devaluation adds the spark that changes the risk/return calculus as far as lending conditions and the economy. If it works, then some more “inflation” via currency channels should, they believe, loosen the drag on the recovery, thereby fully mitigating the negatives holding back broad credit expansion.

Once again, orthodox theory posits that it is “deflation” causing the problem and therefor its removal amounts to recovery – i.e., Japanification. Emulating Japan may mean there is nothing left in the ECB arsenal, particularly as Japan has grown poorer very quickly under exactly this scheme. I sincerely I doubt, though, that the ECB would agree since they are all following the textbook. Monetarism 101 is all about how deflation is priority #1 through #100.

It is still far too early to make any pronouncements, traction or otherwise. However, we have seen this all before and Eonia artificiality has yet to produce the lending panacea long hoped for. This time may be different, but I suspect that it is not, nor that it was ever really the point. The main idea is to reject market observations and movements in favor of naked coercion, a policy impulse that goes back a long, long way.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com