Now that the FOMC has done it, we get to hear about how it was surely the “right” time for it. Unlike September, conditions are supposedly an order of magnitude more settled. That has given the policymaking economists the green light to make sure they start the normalization process before “overheating” becomes the central concern. With August a fading memory, the unemployment rate looms largest for economists. This is not to say that they are convinced the economy is already taking off, only that their models tell them that it is about to (any minute now).

With August’s unpleasantness supposedly behind, there is nothing left to justify yet another orthodox non-action.

Top Fed officials have been saying for months they believed the economy was nearly strong enough to tolerate an increase in the benchmark short-term rate from near zero, where it has been since December 2008. But they have hesitated to move.

The last instance was in September, when the Fed pointed to worries about turbulence in financial markets and uncertainties about growth overseas—particularly in China—as reasons to stay put.

The October FOMC meeting, and the financial conditions contained therewith, apparently sealed all preferences. From Barclay’s (via BusinessInsider):

When we moved our rate hike assumption to March 2016, we assumed that the volatility in financial markets would be longer lasting and the Fed would have trouble resolving their differences about the viability of rate hikes before year-end. The October FOMC statement and Chair Yellen’s testimony to Congress were more hawkish than expected, suggesting the committee saw downside risks from global developments as having diminished and activity pointing to a “live possibility” of a rate hike in December.

Of course, the unemployment rate is quite flawed, as even the FOMC might admit, and it was curious to see the Fed’s own industrial production statistic so clearly in recession signals released just today, but those, I think, have been flashed to secondary considerations in lieu of this assumed financial placidity. That, again, owes to the models that project a much better economy even though there truly isn’t one right now. Thus, as long as financial markets don’t threaten outright revolt, Janet Yellen seems content to let the modeled trajectory reveal itself.

Even today, there seems to be little other than reassuring talk about how “markets” have settled, which only raises questions about exactly which markets all these people, economists and experts are watching. For one, perhaps only the stock market is so firm as almost everywhere else there remains a high degree of turmoil. While the multi-trillion junk bubble certainly stands out, the far more widespread and contagious funding markets globally, eurodollars and wholesale projection, maybe even rival US corporates for open disorder.

The disruption in “dollar” flow globally cannot be overstated as a practical matter. Since the Fed only models a relatively closed US economic system, the eurodollar makes no imprint upon their math (which is why their models have had such an atrocious track record). So the FOMC makes a rate decision about financial markets appearing conforming only without the great bulk of them, especially the credit-based reserve currency that runs everything, included in that shallow perspective.

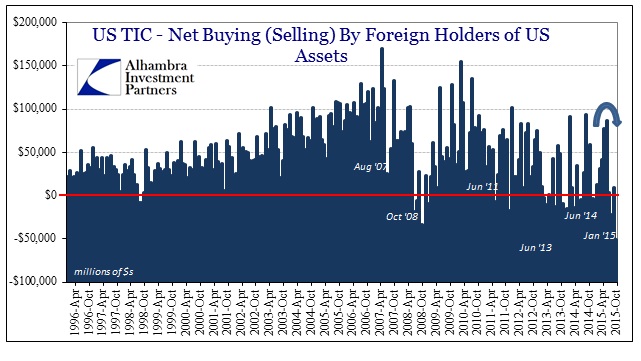

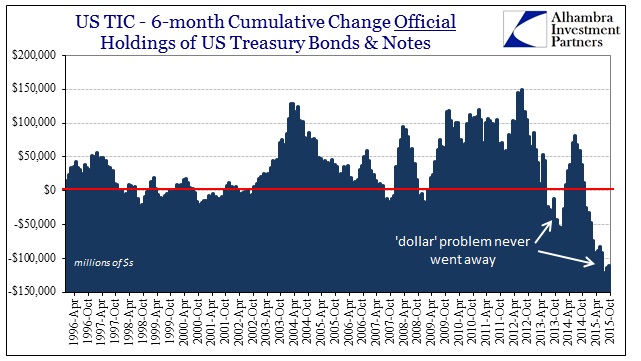

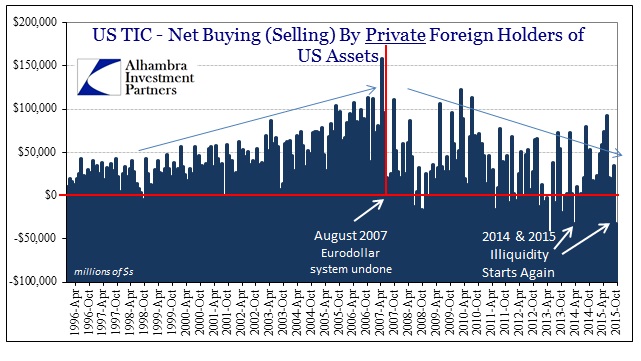

According to the TIC figures updated through October, the unsettled illiquidity from August has only persisted. Around the time the Fed became convinced there would be no more trouble, the “dollar” assured actual markets of the opposite – which goes a long way toward explaining why junk would crash to 2008-levels, something the perpetually optimistic policy models refuse regression. That point is amplified on the “official” side of the ledger, as it is painfully obvious that central banks around the world (and not just China) have a “dollar” problem perhaps beyond even that which they experienced in 2008.

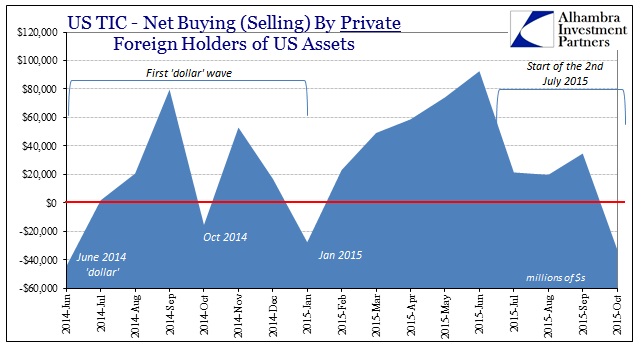

The progression on the private side, though, truly demonstrates that the “dollar” issue painfully resisted resolution in August or September, actually deepening thereafter. The negative activity past August seems to indicate a single process, a continuation of the second “dollar wave” rather than its exhaustion and replacement by a third (which might seem like semantics, but I feel it important as a matter of analytical distinction). If there was a pause in that second event around September and early October, it was relatively minor and inconsequential. The point of a deeper “dollar” contraction into October must be factored as a blatant contradiction of the mainstream interpretation of financial markets setting aside prior turmoil and becoming the settled state the Fed has been waiting for.

As usual, bank balance sheet factors are at the center of all this. With reported dollar liabilities continuing to contract, central banks are left little choice but to try to supply what private eurodollar institutions are not. Judging bank liabilities by quarter, given the “seasonal” nature around the end of each, Q3’s negative cumulative total was perhaps surprisingly less given the general liquidations that occurred. That might speak to the lagged nature of liquidity affecting markets downstream, but it also might suggest a more holistic approach to understanding how bank liabilities perform core funding operations.

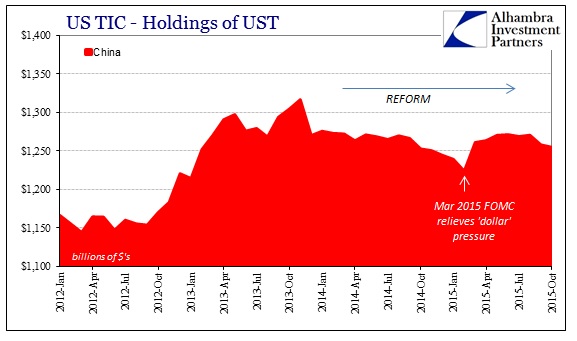

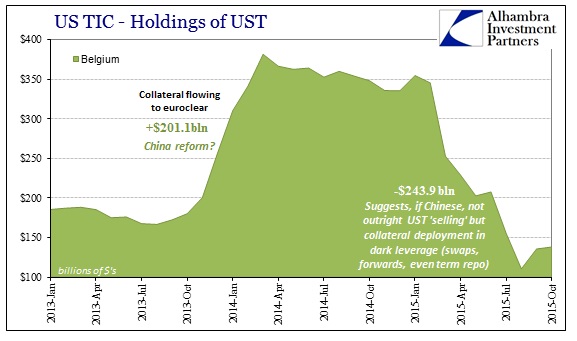

In any case, the cumulative quarter-end/quarter-beginning subtraction of bank liabilities around the Q3 change into Q4 was again in the same level of deterioration as prior quarters. That would suggest banks are doing the same as they have been but downstream responses to the changes in core liquidity and financial resources are variable and magnified by individual considerations. In that light, it is interesting how TIC reporting for individual national holdings have changed in the past few months. China’s holdings, reported as China, declined in September and October (when “outflows” were supposed to have ceased) while the proxy of collateral in Belgium actually increased significantly for the first time in well over a year and a half.

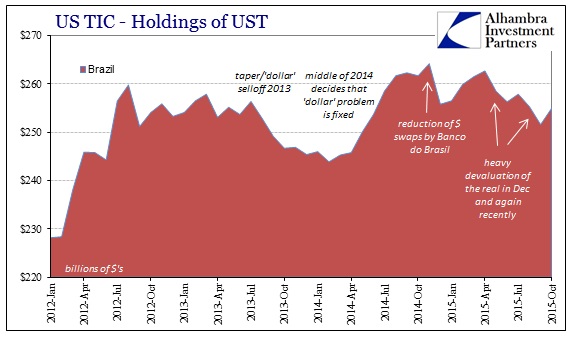

Brazil is unsurprisingly locked in a death struggle with its “dollar short”, as Banco do Brasil has taken to tangling within the local swaps market once again. It didn’t work when the central bank started in the middle of 2013, but given the utter economic devastation in Brazil, what else can they do at this point?

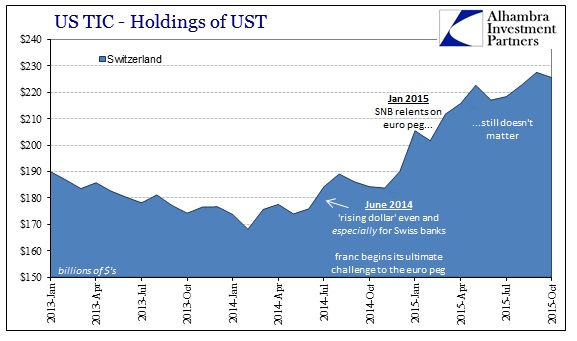

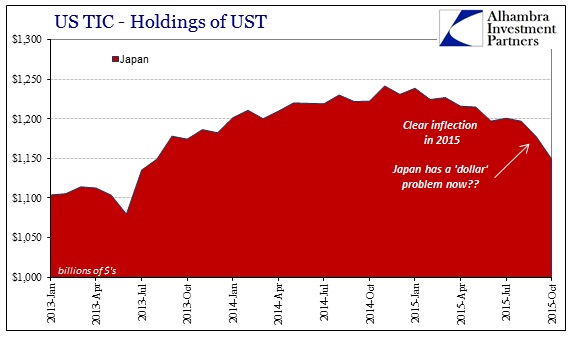

Meanwhile, Switzerland continues to project even more balance sheet expansion for the Swiss National Bank (absorbing dealer activities that Swiss banks no longer appear willing to accomplish in eurodollar markets) while Japan, of all places, appears like China to be “selling UST’s.”

That last one, Japan, might be the most telling in this regard. There is no outward reason for Japan to be bleeding UST’s on record, a curious result that very curiously goes along with the both the “dollar” waves and in particular a heightened liquidity warning into October. There are any number of theoretical reasons Japan’s TIC reportings might behave in this manner, but little as far as confirmation for any of them (my personal belief is that this relates to Japan and really Japanese banks acting as a “dollar” conduit for Chinese banks obtaining eurodollar liquidity; and thus the Asian “dollar” is truly Asian in more than just yuan and China).

The sum total of all of this, regardless of idiosyncrasies and specific pathology for each eurodollar network node, is that even a basic survey of the global “dollar” market shows nothing like that which the FOMC models in its dawning economy scenario baseline. What is more likely, that some mysterious and unexamined force has been pushing the fateful recovery off course all year but will suddenly and assuredly dissipate on time or that the eurodollar itself, in declining supply, has been guiding such “deflationary” tendencies all along? The Fed doesn’t model the eurodollar because it doesn’t believe it money; the global trade and financial network, priced in all sorts of markets and commodities, beg to differ.

It is possible that Janet Yellen’s math will be right for once, but increasingly markets beyond her limited catch are already positioning for the increasing likelihood and risk that she is yet again behind the curve; only this time, as those prior, not in moving too slowly for an economy about to overheat but rather in moving opposite money she doesn’t factor.