Not long before he died, Nobel Laureate Ronald Coase penned an article for Harvard Business Review that pretty much summed up the state of 21st century “economics”:

The degree to which economics is isolated from the ordinary business of life is extraordinary and unfortunate…Economists write exclusively for each other giving up the real-world economy as their subject matter.

His piece was appropriately titled, Saving Economics from the Economists. Back in February, I borrowed another of Coase’s passages from 1972 that very closely foreshadowed the age of econometrics, and how mathematics in economics would remove all common sense in favor of statistics.

In other words, because economists were in a rush to quantify everything into simple variables that could be used in regressions (in his example, tax policy), they lost an element of common sense and “practical” economics; to the point that they would no longer understand why GM was not in the coal business. It’s a powerful critique that has, I think, been realized in the modern strain to some great degree.

The current state of economics through its practitioners places far more emphasis on models than anything else, turning “economists” into nothing more than statisticians. That isn’t necessarily antagonistic on its own, as statistics and models certainly have valuable uses, but that is not how economists present themselves or their cumulative work – and it certainly is not how their “work” is applied in the very real world. The public posits these people as something like experts on the economy when they are experts on nothing like that (recent history reinforcing that observation, being the first rule of actual science). That perception has been cultivated enormously.

Jason Fraser from Ceredex Value Advisors flagged a Boston Fed research paper from December 2013 that may be the most pertinent and emblematic example of exactly these thoughts about the modern “science.”

With nominal interest rates at the zero lower bound, an important question for monetary policy is whether, as predicted in prior theoretical work, an increase in inflation expectations would boost current consumer spending.

As the authors, both senior economists at the Boston Fed branch, note in their introduction, inflation expectations have played a crucial and central role in plotting and carrying out monetary policy in the past nearly six years of ZLB formulations.

Since the financial crisis, both Krugman and Rogoff have consistently advocated for higher inflation, and Woodford (2012) has promoted nominal GDP targeting, which works in part through its effects on inflation expectations. Looking back to an earlier liquidity trap episode, Eggertsson (2008) argues that an increase in expected inflation contributed to ending the Great Depression.

Most of the rest of the piece is dedicated to quantifying the various parts of this assumption. The authors looked at panel data to come up with micro estimates for various spending patterns, income projections and, of course, inflation expectations. The meat of the argument comes down to this:

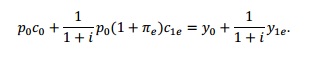

Consider a two-period choice problem—the periods being “present” and “future”—with a single consumption good. The present price of the good is denoted as p0. Letting πe denote the expected rate of inflation between the present and the future, the expected future price of the good is given by p0(1+pie). The consumer receives a known amount of nominal income in the present, denoted by y0, and an expected nominal amount in the future, denoted as y1e, not including interest earned (paid) on savings (borrowings) made in the present. These income endowments are net of existing (inherited) debt or bequests. Therefore, endowments can be negative (positive) if, for example, pre-committed debt payments exceed (fall short of) cash inflows and bequests. The consumer can save and borrow at nominal interest rate i, which represents the nominal rate of return on savings or the nominal interest rate on debt. She chooses present consumption, denoted c0, and planned future consumption, c1e, to maximize the expected present discounted value of utility, subject to a present-value budget constraint. The budget constraint can be written as follows:

This is just a convoluted way of stating the primary “glitch”, that if income doesn’t keep up with prices you have a very big problem. Once again, we have a complicated regression formula for what is really common sense that needs little such false objectifying. But, as Ronald Coase alluded, if you don’t put common sense in these mathematical terms it eludes economists altogether.

That is ultimately what the paper concludes, that basically income expectations have been negative for Americans throughout this “recovery” and so trying to influence higher inflation expectations not only may not have worked (common sense: it didn’t) the attempt may have actually made it worse (common sense: it did).

No evidence is found that consumers increase their spending on large home appliances and electronics in response to an increase in their inflation expectations. In most models, the estimated effects are small, negative, and statistically insignificant. However, consumers do appear more likely to purchase a car as their short-run inflation expectations rise.

These findings are surprising because theory predicts that consumption of durable goods should be more sensitive to real interest rates than consumption of nondurable goods. In addition, consumers in our sample, on average, did not expect their nominal income growth to match inflation, and therefore an increase in expected inflation would create a negative income effect that discourages spending in both the present and the future. The findings suggest that, as a policy measure, raising inflation expectations may not be effective in boosting present consumption.

That reinforces the alternate reason for taper in the new regime. The orthodox policy group may be finally waking up to the idea that inflation as a conceptual economic “tool” is flawed in isolation – prices should be measured against income to incorporate the full effects of redistribution.

In general, there are a number of reasons why the effects of inflation expectations on spending may be less economically significant and less robust than theory (and participants in some recent policy debates) might expect. While some of these reasons, such as nominal rate illusion, were discussed by Bachmann, Berg, and Sims (2012), a prime culprit not much discussed in the existing literature concerns income expectations. While the expected real opportunity cost of current consumption, figured in terms of foregone future consumption, falls as expected inflation rises regardless of future income, higher expected inflation may reduce expected real income unless income is fully and continuously indexed to inflation, thus putting a damper on consumption in both the present and the future. [emphasis added]

There is so much in the passage above that it, perhaps, deserves its own lengthy discussion (which I’ll save for some other day). What should be most striking is why income expectations have not been joined irrevocably with inflation expectations from the beginning – why does it take a paper in 2013 to really introduce this into the canon of the faithful? Prices can and do vary and move independent of income despite orthodox concentration of “inflation” as solely an element of income. It is the difference between prices and income that is most important, redistribution, not whether you can see one in the other.

Unfortunately, this is not an isolated case as the tangled statistical web of econometrics has debased all common sense conclusions in favor of this kind complex math that has lost all feel for the real world. Yet, these are the people that claim to be able to create and control an economic “recovery” in the complex economic and financial system globally. Instead, it makes perfect sense why we continue to get nothing but a repeating bubble cycle.

As much as I think my analysis here demonstrates enough the conversion of economics toward defining statistical irrelevancies and turning common sense into trivialities of math, the punchline is the final recommendation in the concluding segment.

In an account of how Roosevelt brought about the end of the Great Depression, Eggertsson (2008) argues that a commitment to an inflationary monetary policy was coupled with a commitment to an expansionary fiscal policy. By creating expectations of both higher future inflation and higher future income, these policies reinforced each other in stimulating current demand. [emphasis added]

Keynesianism and monetarism are two sides of the same coin, not set in opposition but in close cooperation of sharing much the same principles and philosophical dispositions. But this is taking it to another step, trying to be clever in offering the monetarist side a way out of its repeated failures. Yes, the authors acknowledge, inflation expectations policy through QE and endless ZIRP have failed to create the economy policymakers both expected and proclaimed, but it’s not the Fed’s fault – the federal government didn’t increase expectations for “higher future income” through more and repeated “stimulus.”

It used to be the private economy’s job to create growth and income, but now it doesn’t even rate as a variable in the equation. The headwinds are mysterious?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com