Yesterday in trying describe Janet Yellen’s testimony to Congress about the economy, pundits apparently were forced to concede that the “data won’t cooperate”, thus leaving the economy in Yellen’s head to be wholly different than anything described elsewhere outside the media echoes. Today’s release of durable goods provides yet another data point that “will not cooperate” with the dreamland of the Fed Chair. There is absolutely no way or means by which to interpret durable goods, and especially capital goods, as picturing an economy moving toward sustainable growth let alone already residing comfortably at that level.

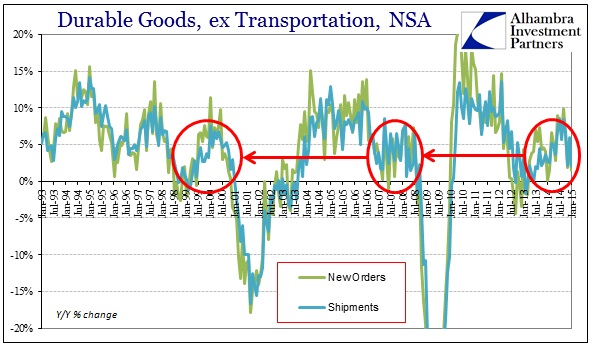

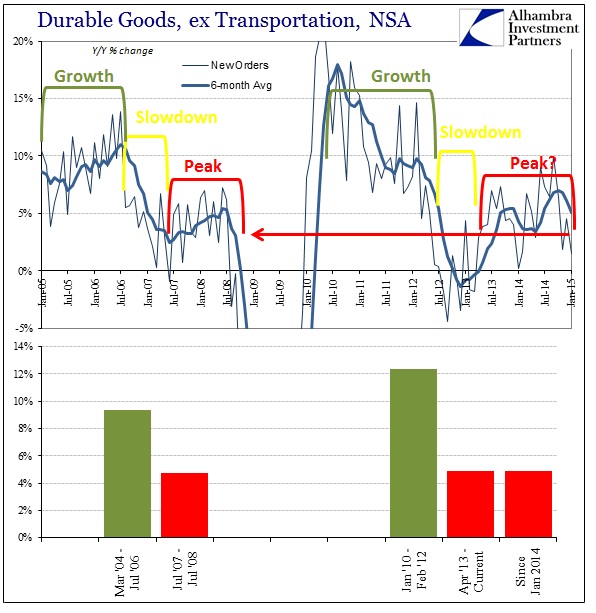

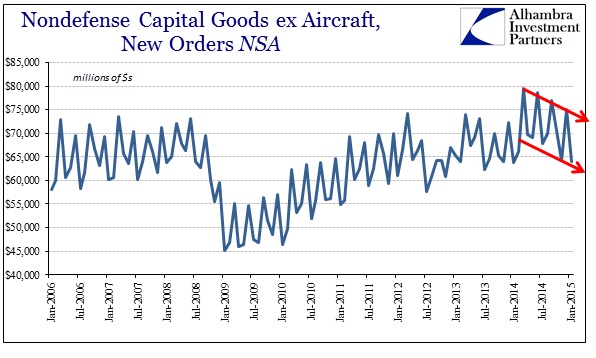

The pace of activity is already within a well-defined “rut” which I have described as the modern, interest rate targeting era marvel of the now-elongated business cycle. With the mini-cycles contained within that trend, the most recent months show yet again the downside of the latest mini-cycle which is not unlike the first half of the Great Recession and very much like the year and a half between the Asian flu and the dot-com recession.

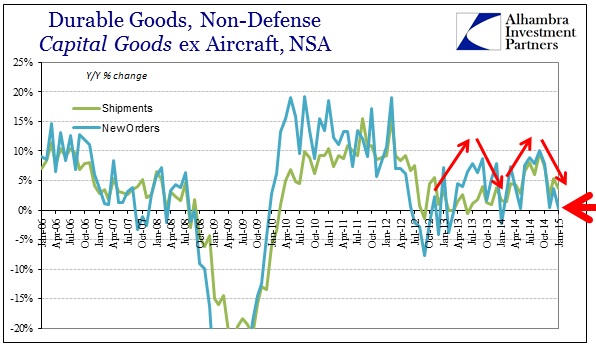

In terms of capital goods, there has been an obvious shrinking of activity since the peak in activity around June or July (“rising dollar”). New orders have been essentially without growth in two of the past three months, with January at just 0.33%.

Overall, capital goods are also stuck within the elongated cycle now on the downswing in the latest piece. Again, there isn’t any way to make this data fit what’s in the minds of economists, either in terms of the trend right now or the deficient growth rates of the past almost three years.

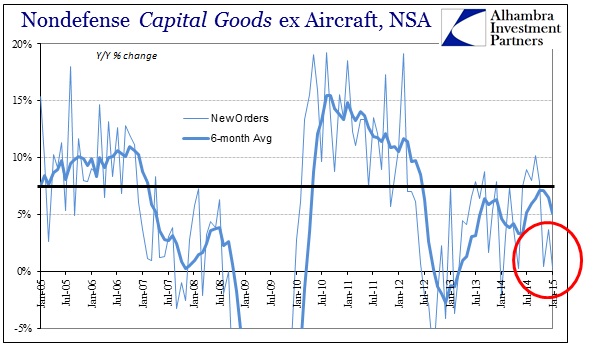

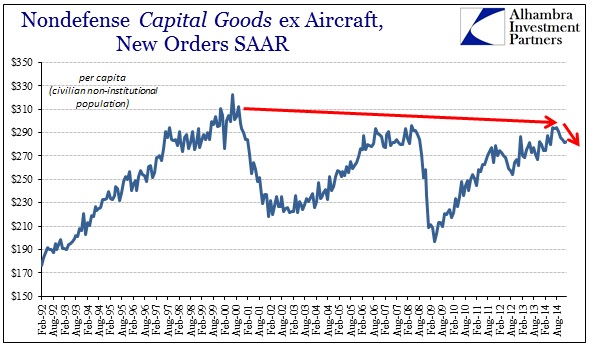

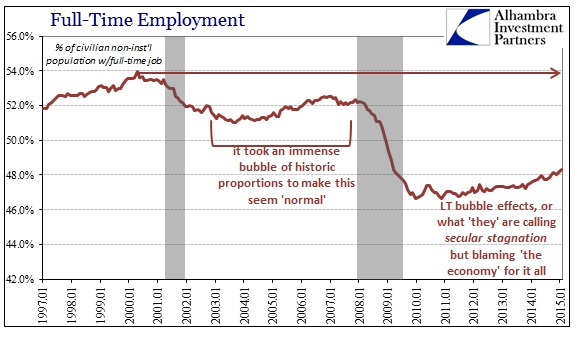

Beyond those cyclical concerns, there are also the structural problems that appeared “suddenly” around the end of the last century. As with the labor market, the level of capital goods investment has essentially flat-lined for a decade and a half overall, with the obvious recessionary impressions in between. Unlike prior and actual economic expansions, the last fifteen years have seen productive investment levels (as much as capital goods may be a proxy for it) that are not even keeping pace with population expansion. In other words, that would seem to offer one plausible explanation as to why labor utilization has similarly plateaued at exactly the same time period.

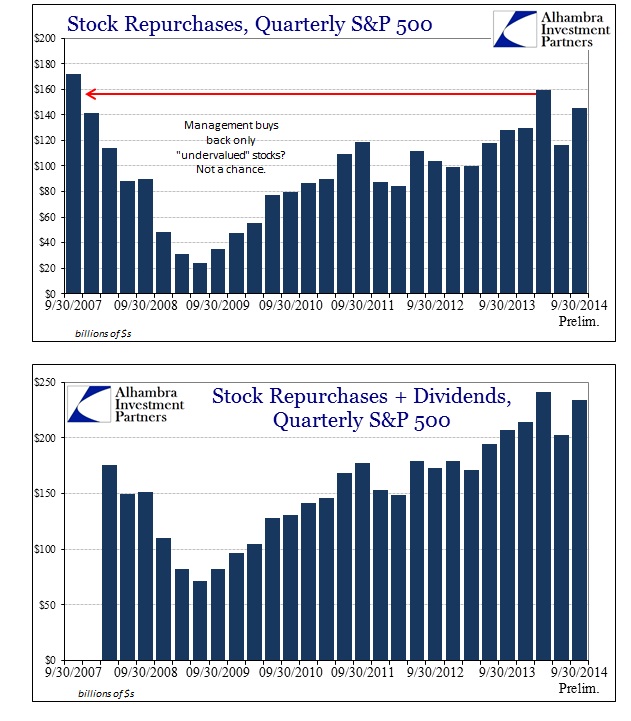

While there is a clear shortage of productive investment that explains the lack of wage expansion this century, there is no shortage of paper “wealth” that has artificially and only temporarily filled the gap. The only problem for such “aggregate demand” is that monetary redistribution ends up concentrated, as paper assets tend to collect and cluster only in financial hands whereas productive investment, true capitalism, spreads out through earned income. In that respect, what we see of durable and capital goods, is trouble in all the time frames, from short (mini cycle downswing) to intermediate (elongated peak) to longer terms (structural deficiency in productive investment).