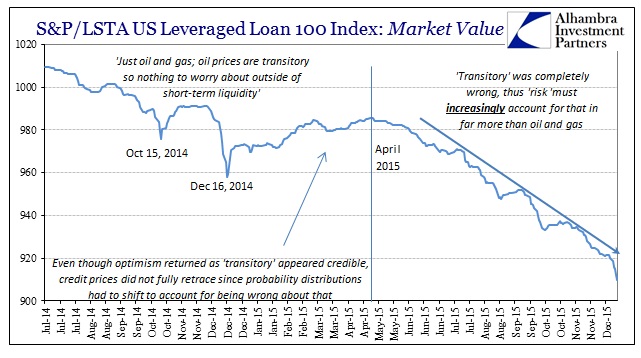

Any ideas about junk bonds outperforming because of the booming economy confirmed by a monetary policy rate hike has been killed and buried. Conventionally, it was assumed that interest rates are not the primary “risk” parameter for high yield corporates of all flavors, and that is correct. Junk issues and lower tier obligors are creatures of the credit cycle, thus we are forced to conclude that the blowup in corporates spreading down the scales is a direct contradiction to “transitory” and the economic scenario envisioned by rising interest rates (as a matter of intentional policy).

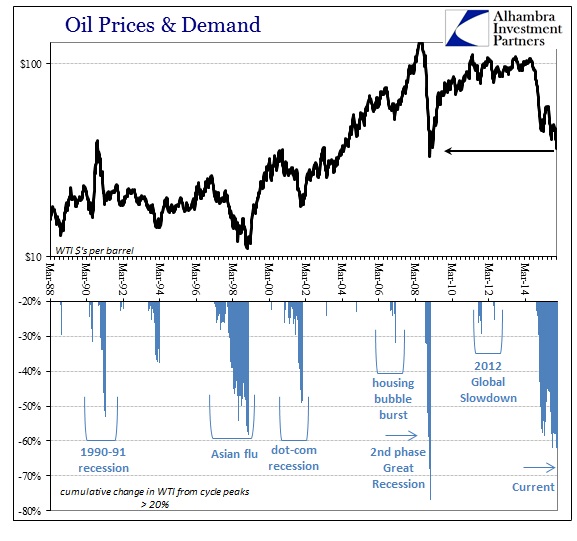

Now that it is becoming more widely accepted that oil prices are not set for the expected return, even among economists that vociferously resisted any such idea, that leaves a few other fundamental conventions twisting precariously in the blowing financial winds. Oil prices were not long ago the primary, if not only, silver lining that could be derived from the oil collapse. If oil prices were going to work against the “anchored inflation expectations” that monetary policy depends so much upon, at least there was some “benefit” in that low oil prices were widely predicted to spur some sectors and if not completely offset any damage to inflation expectations then at least provide a cushioning “tax cut.”

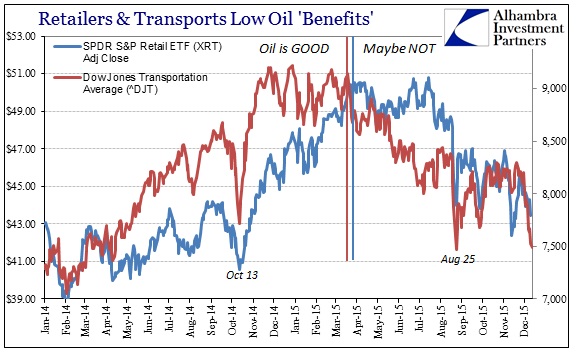

Mainly, retailers and transportation sectors would be at the front end of that “stimulus.” If you take the part that oil prices are meaningless in relating the general economic direction, both of those sectors should have done, and continue to do, very well as oil prices provide benefits on top of the economy as it continues to perform. From February:

But in general, low oil prices “are an unambiguous positive for the U.S. economy,” says Chris Lafakis, Moody’s Analytics’ senior economist, who notes that there will be many industries that could reap higher profits as a result…

Many industries that depend heavily on consumer spending will get a big boost from lower oil prices, says Lafakis. “Lower oil prices act as a tax cut,” he says, adding that if oil prices fall from an average of $93 per barrel in 2014 to an average of $63 in 2015, that would be the equivalent of a $90 billion tax cut for the American consumer. “That’s not a small stimulus we’re talking about,” he says.

Lower gas prices will be a big boon to the transportation industry, says John Challenger, the CEO of staffing firm Challenger, Gray & Christmas–thanks to the fact that a lot of transportation companies’ costs come from fuel. Thus shipping companies like FedEx FDX, -0.69% and UPS UPS, +0.08% freight airlines, trucking companies and marine transportation companies are likely to see a boost.

By Mr. Lafakis’ math, then oil prices at $35, averaging somewhere just in the $40’s, would be an inordinately tremendous consumer boost. As late as mid-August, just before the global liquidations, this was repeated as conventional wisdom:

As oil prices continue to drop, certain industries stand to benefit. These fall into two main categories. The first should come as no surprise: industries, like airlines and transportation, for which oil is a direct and significant cost (lower oil prices improve their profitability). The other industries that benefit from lower oil prices are those that are dependent on consumer spending. When consumers spend less on fuel, they have more disposable income for other purchases.

It does appear as if that theme was the dominant trading practice exercised in the first part of the oil collapse. Both retailers and transportation industry stocks were well-bid as oil prices fell apart in late 2014 and into 2015 (particularly after the events of October 15, 2014). The transportation sector, at least as viewed through the Dow Jones Transportation Index, remained elevated until early April while the retailer segment, using S&P’s retail sector ETF tracker, continued well on into mid-July.

Since that transition in mid-year, oil prices have again persisted rather than rebounded and of late have turned to new “cycle” lows. Yet, neither transportation nor retailers have traded as if further benefits were accruing in terms of that “stimulus.” This is not to say that stock investors have boarded the recession view, only that there is a clear shift in risk perception that has undoubtedly rebalanced and reprioritized risk parameters. If the left side of the chart above was risks being viewed very favorable in terms of the economic fallout of low oil prices, the right is undoubtedly (much) less certain.

It may not be anywhere close to the paradigm shift of junk debt, but it shows, I believe, how risk resetting is taking place in far more than just junk. The spectrum of risk being traded even in the most favorable of places, such as stocks, has clearly been altered and there is now less uniformity on what all this financial reconstitution might actually mean. “Everyone” was with Janet Yellen, and a great deal still are, but the doubts about her (and economists’) ability to survey the economic landscape are strikingly different now – to the point that seriously lingering, very low oil prices are traded exclusively negative all around.

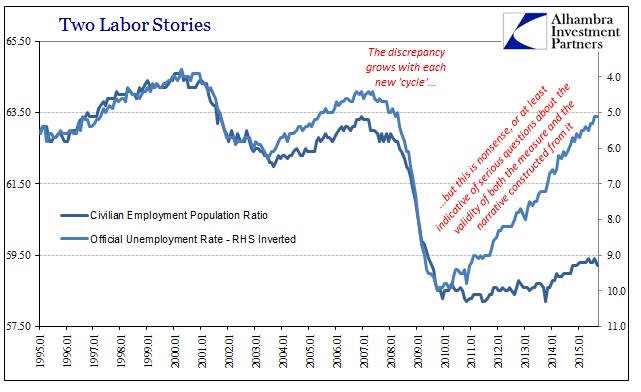

Like junk bonds, the economic component of the traded probability distribution has been widely altered. Increasingly, it seems as if convention recognizes the deep repercussions and reverberations of continued, persistent financial disorder; none of which was expected except by the radical change in money markets that see only a continued deterioration. As my colleague Joe Calhoun noted this weekend, people are truly starting to worry that people are worried. I would only add that it works against them, economists, that they stubbornly refuse any worry.

Common sense declares, as does recession history, that if oil prices so collapse and remain so “dreadful” that something far worse and more primordial is truly at work in the economy – and that is nothing good and that is increasingly what is being revealed.

1. Dollar doesn’t matter, indicates strong economy relative to the world

2. Dollar matters for oil, but lower oil prices mean stronger consumer

3. Manufacturing slump doesn’t matter, only temporary

4. Manufacturing declines are consumer spending, but only a small part

5. Manufacturing declines are becoming serious, but only from overseas

6. Maybe domestic manufacturing recession too, but the rest of the economy is strong

7. Rest of the economy might not be as strong as thought, but only an “earnings recession.”

8. Maybe full recession, but only a small probability.

9. …