Though most of Russia’s territory belongs in Asia, it would be difficult to characterize Russian finances as “Asian.” Most of the dirty work is done in the financial centers of Moscow, but in the past year and a half under the “rising dollar” paradigm, Russian financial existence may be more Asian than geography alone might permit. The similarities are perhaps deeper and more aligned than most seem to realize, a desperate proposition at this particularly moment in financial history.

Several years ago, Russian authorities made a very concerted effort to turn what might have been viewed as backward, secretive and banana republic-type banking and funding markets into if not Western-style powerhouses than at least accessible to those interests. On the outside, it appeared as if Russia was trying to modernize in order to be competitive within the current financial order. The Russian government went to great lengths to make it happen, including a building boom in Moscow pre-made with which to house its outwardly intended financial standing.

To do all that, city leaders are inviting business to glittering new skyscrapers, including the Mercury City Tower, which at 75 stories is the tallest building in Europe.

“The idea is to upgrade the position of Moscow in ratings, to become closer to the leaders of innovation and to the big boys of international financial centers,” Andrei V. Sharonov, the deputy mayor for economic affairs, who led a roadshow tour promoting the city in Asia, said in an interview.

That was early 2013, toward the end of what was believed then at least a moderately successful effort and a more stable global financial environment before the events of that summer. The Russian government, in both Medvedev and Putin, had built up the infrastructure and had made all the “right” contacts:

Mr. Medvedev had named senior Western bank executives to an advisory council for transforming Moscow’s financial sector. They included Jamie Dimon, the chief executive of JPMorgan Chase; Vikram S. Pandit, the former chief executive of Citigroup; and Lloyd C. Blankfein, the chief executive of Goldman Sachs.

Ostensibly, especially in media commentary, it seemed as if Russia was out to gain financial status with which to compete with larger regional financial centers, especially the other oil states in the Middle East. The assumed goal was to get Russia’s economy out of strictly the oil and gas business and more so on board with the US and UK’s prime exports the past four decades: financial innovation. To that end, the Russians hardly moved the needle, as volume and banking activity scarcely displaced anyone. As the article quoted above pointed out, the Global Financial Center Index still ranked Moscow 65th out of 79 cities.

I doubt very much that was the intent all along, though it made a great cover story in selling the narrative that Russia was and is just your average , friendly neighbor. In the course of the past few years, I believe the true objective was actually met and it has nothing to do with the Ukraine, Syria or Georgia; or even Dubai or Saudi Arabia. In making these wonderful contacts with truly eurodollar banks and their chiefs, there opened opportunities on both sides – bringing together a BRIC nation brimming with commodity collateral selling at a huge price with at least some banks still eager to provide heavy wholesale, “dollar” financing.

At the center of the eurodollar connection would be Vnesheconombank. Tightly tied to especially the Putin government, VEB, for short, would open a collateralized financial relationship between Russia’s commodity wealth and the usable cash (“dollars”) necessary to join and increase global access. In parlance of the Asian “dollar”, it was a vast expansion of Russia’s global dollar short.

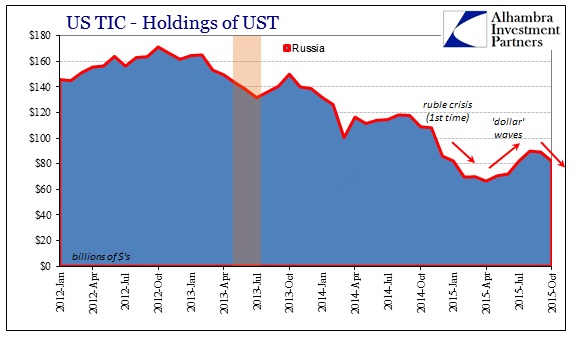

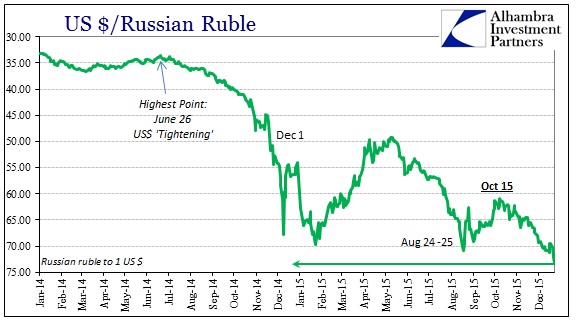

When both oil and the “dollar” turned so caustic last year, it set Russia up for the typical, dual body punch from which there really is no escape. The former Communist nation had done as was expected after the Asian flu of the last 1990’s and accumulated “dollar reserves”, but it did not matter even when in late 2014 the country’s central bank took to heavy liquidations of whatever “dollar” resources they could find – including, of course, US treasuries.

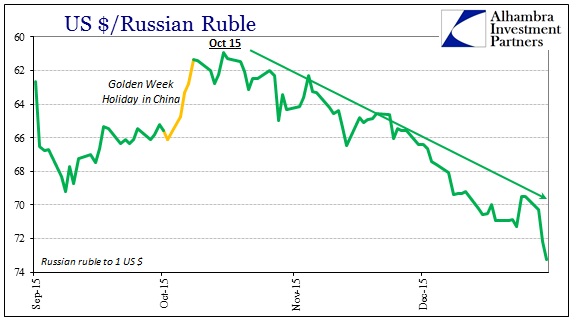

The ruble crashed anyway, because if there is one thing the “dollar short” cannot abide it is danger in the underlying collateral. In that respect, the ruble trades with oil not just in what that means for the Russian economy, which is disturbing anyway, but more so under the purview of wholesale finance – rolling over the “dollar” short becomes more and more difficult and costly. With oil dropping again recently, the ruble is once more at a new and devastating low.

It is not at all surprising, then, that VEB has been in the news in the past few days; the bank is in great and desperate trouble.

For years, Vladimir Putin used Vnesheconombank (VEB) to pay for “special projects,” from the Sochi Olympics to covert acquisitions in Ukraine to oligarch bailouts. Now, the state bank needs a rescue of its own and it could be the Kremlin’s costliest yet.

VEB was supposed to be the financial supercharger of the Russian president’s state-directed capitalism, using its government backing to raise billions at low rates on western markets and pumping them into ventures the Kremlin wanted funded, some concealed from public view with code names like “Lily of the Valley.” [emphasis added]

The Bloomberg article reporting the trouble at VEB places blame on “Western sanctions” and they may have something of that effect, however, given the ruble, in my judgement, the far larger problem is the “dollar.” It is the same abject lesson that is being repeated now all across Asia and the EM’s, particularly Brazil and China. Each of these countries came to the “dollar” table thinking they had “bought” enough insulation in forex reserves to play what is truly a dangerous game of eurodollar finance in wholesale terms. And time and again in the past year we see quite the opposite; that bank and forex “reserves” of dollars and whatever else have been utterly useless in protecting or even dampening volatility and disorder (the Chinese, who have the largest pile of believed dollar and forex reserves in human history still regularly suffer the great disruption of “dollar” irregularity).

Because of those believed-resources, central banks have been engaging exactly how they are “supposed to”; often resorting to the same wholesale means (forwards, swaps, repos, etc.) that most often present the very channels of disarray. And in each instance, China and Brazil most visibly, they find themselves in wholesale quicksand; the more they struggle, the deeper they sink. If VEB heads toward full-blown bailout and perhaps eventual displacement from the eurodollar entirely, we can add Russia to that dubious list.

As I have written the past few months, the nightmare scenario for each of these countries and their central banks is one where you realize that wholesale imbalances are the entire problem to begin with so that no matter what you do you are sunk. Unless eurodollar banking itself turns around, and in very quick order at that, there is nothing that can be done – nothing. In other words, the problem was getting involved in the first place, as wholesale finance under the decaying “dollar” paradigm is akin to a roach motel. In simple terms, the unsolvable problem of the “dollar short” is the short part of it. Once in that position, removal is impossible without a hugely violent paradigm shift; a financial and economic nightmare.

Currency destruction around the world, and more than just China, Brazil and Russia, is the wholesale trap being sprung, the nightmare more and more animated.

Some of Africa’s largest economies, including Nigeria, Angola, Ethiopia and Mozambique, are restricting access to the greenback to protect dwindling reserves. That is causing problems for businesses from Mr. Ozigbo’s Transcorp Hotels to international giants like General Electric Co. and Coca-Cola Co., all of which are struggling to get the dollars they need for imports or to send profits back home.

The shortage comes as the inflow of dollars from resource exports, from oil to cotton, has plummeted with the prices of these commodities. The commodity rout also is putting pressure on local currencies, which some central banks are trying to support with their dwindling supply of dollars.

It’s not just the collapse in global trade, it is, as Russia is demonstrating, the precedent collapse in global, eurodollar finance.