Before World War II, in Japan there were four large conglomerates situated as vertically-integrated family-centered monopolies. Called zaibatsu, they were Mitsui, Mitsubishi, Sumitomo, and Yasuda, and many other smaller rivals. Each group would not just own companies in all industries, they would also organize and contain an assimilated banking concern (horizontal integration) to carry out capital and funding needs for within the group. In 1946, the Allied occupation authorities ordered them dissolved.

That meant that the individual companies formerly firmly pressed within each of the zaibatsu holding company orbits were freed and set about to their own designs. What they did, however, was to turn again toward the same organizing principles as zaibatsu but more loosely in affiliation. There was still the same kind of pooling of resources and general organization around a major holding concern or even a bank, though much more informally. These more flexible integrations and ties were called keiretsu.

Throughout the Japanese post-war “miracle” period, the keiretsu were directly in the middle. By the 1970’s there were the “big six”, each with a bank and financial services firms along with vertical and horizontal integration among many different industries. Further, to prevent any takeovers or other “interference”, the memberships of any keiretsu would cross-own shares and make other internal financial commitments as needed (debt). As you can appreciate, this was one of the major impediments to unraveling the banking collapse in the early 1990’s.

The entanglements work both within and without the keiretsu right up until the current time, meaning in more recent function it is more conceptual than perhaps it had been in the past. For example, Hitachi is part of both the Mizuho and Fuyo organizations simultaneously, accessing banks and financial services among both while cross-holding shares also in both groups. Honda Motors is, on the other hand, “strongly” independent, as it claims to be. Even so, with no formal ties, Honda is in practice tightly wound into the Mitsubishi keiretsu, with banking and funding needs performed at Mitsubishi Bank while several Mitsubishi firms, Tokyo Marine & Nichido Fire Insurance and Bank of Tokyo-Mitsubishi UFJ for instance, are large shareholders in Honda to this day.

Further, there are layers to all these keiretsu associations that just cannot be appreciated from the outside in how industrial Japan functioned. They had presidents groups and chairmans groups in each that served to coordinate policy among the whole group, some of which held very specific rules for engaging and participating. It was (is?) typically the bank at the center of each keiretsu that would host the monthly shacho-kai, or president’s assembly. These meetings were kept private and often proclaimed to be nothing more than social gatherings, but it was clear that they were significant in producing corporate harmony and something like individual keiretsu hegemony.

Penetrating the keiretsu structure was, as you can imagine, an impossible task. The Oxford Handbook of Business Groups, leaves little doubt on that account:

Several analysts have used network clustering algorithms to infer groupings in the Japanese corporate network…In this methodology, keiretsu materialize as blocks or clusters of firms occupying structurally equivalent positions in the network. We present the 1978 results because, of blockmodels generated by Lincoln and Gerlach every 3-4 years from 1978 to 1998, the earliest year gives the clearest picture of distinct keiretsu clusterings. In each succeeding period, the empirically derived groups were less sharply drawn and corresponded less well to external criteria as shacho-kai affiliation. By the mid- to late 1990’s, the CONCOR map of the large-firm network reveals general keiretsu dissolution, whether of the big-six horizontal groups or such historically prominent vertical groups as Hitachi, Matsushita, Nissan, Nippon Steel, and Toyota.

Even if the keiretsu are no longer what they once were, there is at least good anecdotal evidence (I won’t present here) that still looser affiliations remain – especially among the inner layers of what were keiretsu structures of the large industrial and trading firms tied closely to the banks.

In recent years, particularly beginning in 2011 with the devastating earthquake and tsunami but really once the yen was so disastrously “devalued” at the first whisper of Abenomics (and the actual body blow of QQE), Japanese production has moved increasingly offshore. Much of that, as I have chronicled over the past few years, has ended up in China. That suggests that as Japanese formerly keiretsu penetrated further into mainland China, they likely brought with them their banking “core.” At the very least, Japanese banks with close ties to these offshoring Japanese firms were likely introduced to Chinese industrial counterparts.

I should clarify at this point that this is speculation on my part, reasonable I think, since finding and exposing direct data is exceedingly difficult (one of the reasons why I included the history above). It is my limited contention (at this moment) in trying to develop an operating theory of wholesale “dollars” that vitally encompasses as broad a spectrum as reasonably possible, that the offshoring trend plus QQE provided, from the Chinese perspective, an injection of external financing as well as an additional conduit to connect Chinese firms and banks to the global trade network; i.e., a Japanese route for China’s “dollar short.”

The timing seems to align very well with general outlines provided by the events of the past especially two and a half years. Japan underwent QQE and yen alteration which gave Japanese banks “something to do” just as China’s “dollar short” grew large and really unwieldy; the 2012 global economic slowdown bit into China’s “dollar” recycling system. Japanese corporates were ramping up business with and within China, meaning more complete financing to go along with trade financing was undoubtedly in demand. Add back the eurodollar bank withdrawal starting in later 2013, particularly after November 20 of that year, and there is very good reason to suspect that Japanese financial importance vis a vis the “dollar” was amplified for Chinese counterparties.

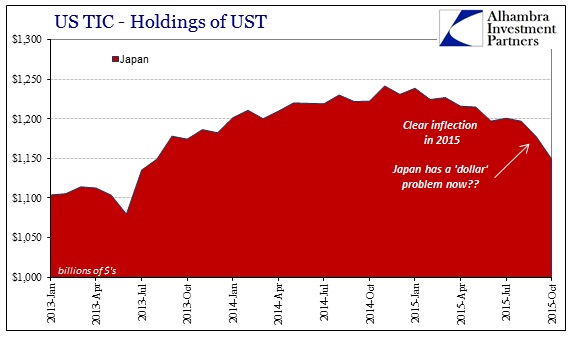

It is, for me at this point, the most reasonable estimation as to why Japan suddenly appears with a “dollar” problem, especially since Japan almost certainly does not have one. As a conduit for wholesale financing flowing to and now away from China, it is possible that it would appear that way (depending upon a whole lot of additional assumptions that need verification). It isn’t just the TIC data, however, that argues for some kind of Asian influence with eurodollar funding and even domestic money markets of late. While the Open Market Operation Reverse Repos (RRP), the program the Fed is using to help establish a money rate floor, continues to be underwhelming on all counts the “other” RRP is in overdrive – the pre-existing reverse repo program the Fed has used as an “accommodation” to foreign governments, central banks and other overseas banking concerns. More on that here (subscription required).

If this is correct, then it will tell us hopefully a lot more about the shape of illiquidity as it is further presenting itself heading into 2016.