The chatter that continues over Japan’s spiral into (further) economic impoverishment is simply astounding since it is taken as “expert” by the media. A credentialed economist will look at some numbers and simply take them as meaningful, especially if they are the “right” sign in the “right” direction. This is either wholly obtuse or intentionally misleading.

Stronger exports would support an economy that shrank the most in more than five years after Abe raised the sales tax in April for the first time since 1997.Bank of Japan Governor Haruhiko Kuroda has signaled support for yen declines, saying a weak currency that’s in line with the economy is a plus overall.

“This is positive news for the Bank of Japan,” said Junko Nishioka, chief Japan economist at Royal Bank of Scotland Group Plc in Tokyo and a former central bank official. “Today’s data supports the BOJ’s view that exports are gradually picking up and that this will continue.”

Exports are decidedly not picking up in any way shape or form, save the one facet that doesn’t really matter – nominally. Mr. Nishioka may have missed the news lately that the yen has had a revisit to devaluation, going back to August, and that nominal changes are not really indicative of much under those circumstances.

It is true that exports rose 6.9% in September, again nominally, but they yen devalued something like 10% against the dollar (year-over-year), a pretty good proxy for where the yen trades against most of Japan’s major partners (especially China). In other words, it is an illusion just like all of Abenomics has been.

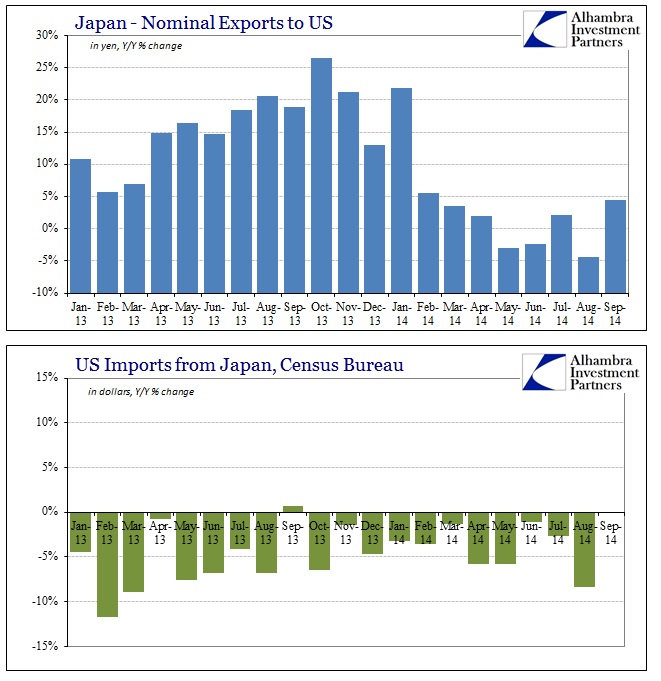

There is no more clear illustration of this, which every economist and media outlet should be able to find in only a few seconds’ time, than the stark difference between what the Japan’s Ministry of Finance reports as exports to the US (in yen) against what the Census Bureau estimates as imports from Japan (in dollars).

The Census Bureau hasn’t reported September’s trade figures yet, but we can reasonably guess that there will be a negative sign in front. We only need to go back to late 2013 to be assured of that – in November 2013, for example, Japanese exports to the US were up 21.2% in nominal yen when devaluation was at its most “encouraging”, forging great and steady optimism in these same credentialed economists then as now, but that still meant -1.4% in dollar terms. In fact, from the US perspective, imports from Japan have fallen every single month except one (September 2013 which was barely positive at 0.7%) during the whole devaluation episode. Coincidentally, this persistent decline goes back to the very month that the yen began its “encouragement” for economists.

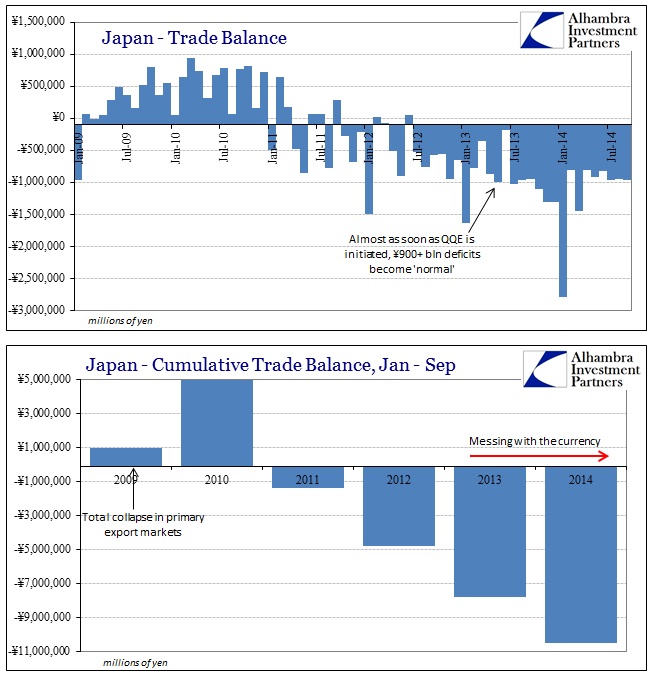

This applies equally to the “confounding” (to orthodox theory) behavior of exports and imports across all of Japan’s trading partners. Japan once ruled Asia as the dominant manufacturing power, but now has become fully and persistently in deficit to China as Japanese firms move elsewhere. The moment QQE began, ¥900 billion trade deficits became the norm.

Contrary to all expectations, both modeled and publicly proclaimed, Japanese imports continue to expand with declines in the yen – the very signal that Japan is destructively offshoring production capacity. As the yen makes imports more expensive nominally, the fact that imports grow rather than shrink (and proportionally faster than exports are growing, thus the massive and consistent deficits) shows that there is no elasticity in what is being imported (or Japanese consumers and businesses would switch to something less expensive).

While the narrative in that direction tends to focus only on energy, which is certainly a major factor, Japan’s trade balance with China and the rest of Asia proves that it is far more damaging than just energy importation – they are now importing what Japan Inc used to supply.

Given that credentialed economists were very optimistic at the start of Abenomics, their interpretations over fluctuations in currency and trade behavior really should be discarded out of hand without question. QQE and yen devaluation in Japan have accomplished nothing but impoverishment, and the increase in nominal exports this month are nowhere near reassuring, instead displaying yet another signal to brace for worse times ahead. The textbook monetary approach is being revealed as a textbook case of economic demolition.