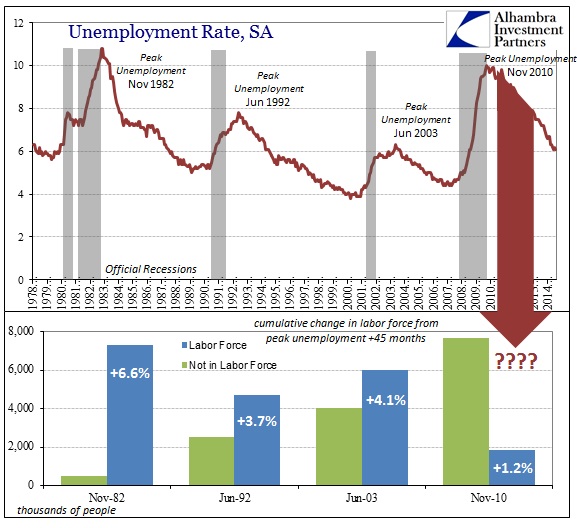

If you limited yourself to only the official unemployment rate the picture you get of the economy is seemingly one that fits very much inside historical expectations. The rate rose and fell just like it “should” in a recession/recovery cycle. That raises the question about why this period has been so divergent with past expectations. When even the Federal Reserve looks to something other than the unemployment rate (though of equally dubious features and deficiencies) to gain some insight into the economy’s actual station you know that traditional correlations have broken in some broad fashion.

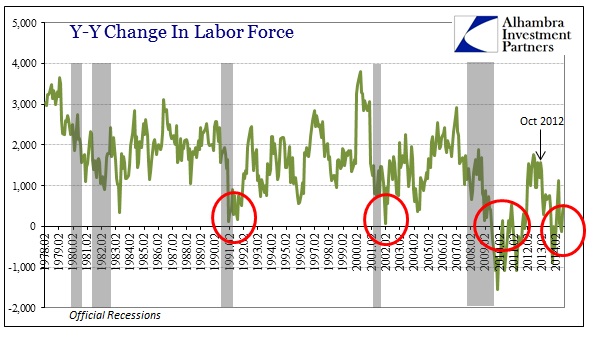

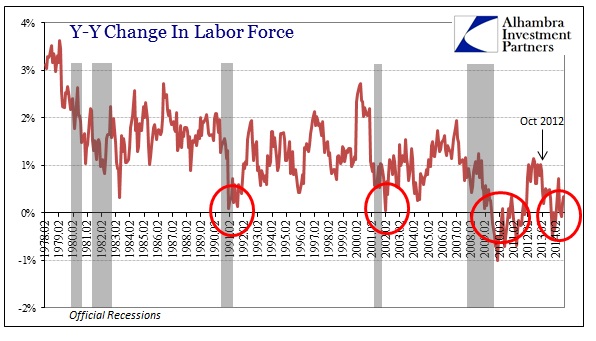

There is a relatively clear demarcation between those times when the unemployment rate was highly correlated to other indications of economic activity and the period when its status seems to be more in doubt. This “recovery” has certainly been the most evocative of discussion and doubt, but that really extends backward to the prior two. While the “recovery” after the dot-com recession created the term “jobless recovery” it can also be seen in the cycle ten years before.

The term “jobless recovery” is itself an oxymoron since the main function of any economic advance is to broaden participation. Thus a “jobless recovery” is nothing of the sort, indicating more so the re-arranging of numbers rather than full achievement – the hallmarks of redistribution.

Measuring from “peak” unemployment forward, there is again a clear difference between the recovery after the deep recession in 1981-82 and those that have come after. Even in the early 1990’s, the labor force was obviously changing as the number of new potential entrants to the jobs market began to shift more toward staying out. Yet, there were still enough payroll gains to attract significant growth in the labor force (undisturbed by changes in population and demographics).

The Great Recession “recovery”, or “Lesser Depression”, has seen something altogether worse. Where the track of the unemployment rate appears very much normal, it has almost nothing to do with a healthy economy. In fact, in this instance, the unemployment is actually the primary indication of all that is wrong!

Structurally, even orthodox Keynesians have come around to actually identifying another clear demarcation in function. As Paul Krugman noted in his affable affirmation of “secular stagnation”,

“We now know that the economic expansion of 2003-2007 was driven by a bubble. You can say the same about the latter part of the 90s expansion; and you can in fact say the same about the later years of the Reagan expansion, which was driven at that point by runaway thrift institutions and a large bubble in commercial real estate.”

Correlation does not prove causation at all, but it is more than curious that an economy gaining serial bubbles suddenly stops training itself on recession/recovery cycles. It’s made all the more compelling by the volumes of academic scholarship dedicated to the orthodox plan of “filling in troughs without shaving off peaks.” The primary appearance of that is to “elongate” the economic cycle, to depress the amplitude of downturn as well as the upswing, in order to better “manage” economic growth. That dangers of attempting as much are explicit in the very phrase itself, acknowledged at least as a possibility by those that claim it could not happen.

Yet, nearly every labor and economic statistic in this “cycle” demands recognition that it has happened. Not only have these “cycles” become elongated, denoted by the labor force’s post-1980’s tendency to not participate as much on the upswing, the overall shift has been one in which the peaks are clearly shaved in addition to elongation – the two are apparently and unfortunately not mutually exclusive.

That leaves quite a mess to clear up, and no real definitive means to do so outside of total reform (which orthodoxies don’t undertake on their own – instead inventing convolutions to try to doctor and conjure explanations that satisfy at least apathetic attention while preserving the bureaucratic paradigm). It also leaves the economy on a new kind of plane we have not witnessed in history outside of perhaps the Great Depression itself.

Given new incoming data, including that in today’s employment reports, it very much looks as if the amplitudes have waned and that not only recovery has been shorn of its bounce but that contractions too may be much shallower. In other words, the economy doesn’t really recover but remains in a depressing and durable state lingering between shallow contraction and absence of that.

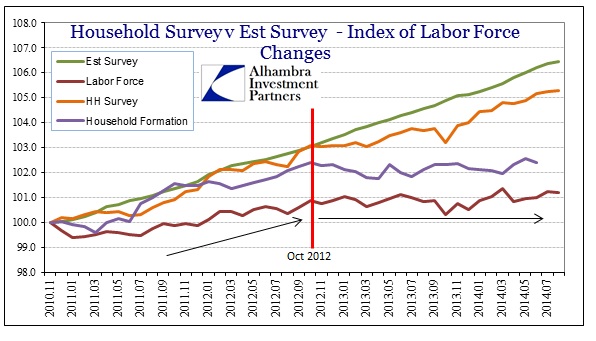

I don’t think it will ever become an official recession, outside of more heavy and major revisions (which are all too possible), but it certainly appears as if the change in economic trajectory past the middle of 2012 is a low-amplitude “cycle.” The question now is whether that has finished its course, or whether elongation means many more months on the same, slow downward slope.

The data on the labor force, as well as income, suggests further erosion. That would make sense if the paradigm I have sketched here is valid. If monetary intrusion unites both cycle elongation together with structural deformations (of the negative variety), existing now alongside the most intense and sustained monetary intrusions should logically impart the same patterns in proportionality – lower ultimate trend coupled with startling elongation.

That may also offer a potential explanation for why we see so many divergences in the data, particularly jobs and payrolls. The more heavily adjusted the series, the more it is captured by “trend-cycle analysis” that views elongation as indifferent to historical experience. The mainstream statistics model “recovery”, deficient of slope undoubtedly, but still recovery on its central axis. Yet, the less adjusted series cannot follow that trajectory because there is no broadening of the upswing, instead the slow erosion shows up as irregularities and deficiencies that don’t appear to be outright recession (and also not outright recovery).

To summarize all of this: essentially the bubble economy, dating to monetary changes toward more active “management” through finacialism, have transformed economic behavior to something like what we have seen in Europe since 2009. In more general terms, the basic malformation is not all dissimilar to the Japanese experience of the past quarter century, regardless of the appearance and maintenance of “inflation” or “deflation” (just different forms of instability). As financialism spreads, so does disharmony, not just in function but in breaking correlations among economic accounts and statistics that were once seemingly so unconquerable.