It seems as if there is a little more complexity taking place in mortgage finance, and therefore the housing “market”, as the simplified idea of rates running the show isn’t holding water. On the surface, the general theme is one that contours to the outline of conventional mortgage interest as it ran through last year’s selloff. It stands to reason that a sharp, short rise in rates might trigger a disruption in the refi trend and even purchasing activity, but that, I think, is ultimately too deferential to just the demand side.

When analyzing mortgage trends, it cannot simply be left to potential borrowers for counting all the marginal changes. There is no less importance on the other side, as banks’ collective propensities are just as essential to the vagaries of affording houses as credit scores and wage income. And that, after taking a holistic approach to this, seems to be much more the “impediment” than willingness of potential buyers and refi candidates to engage due to changes in rates.

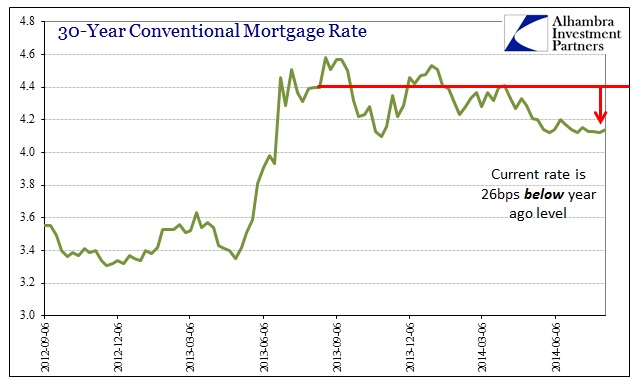

Looking at interest rates alone, last year’s imprint is clear enough as to suggest such simplicity, but mortgage rates right now are not that much above where they were when all this began. Depending on the data series being used, the current 30-year fixed is only about 80 bps above the absolute low reached right before Bernanke first publicly uttered “taper.”

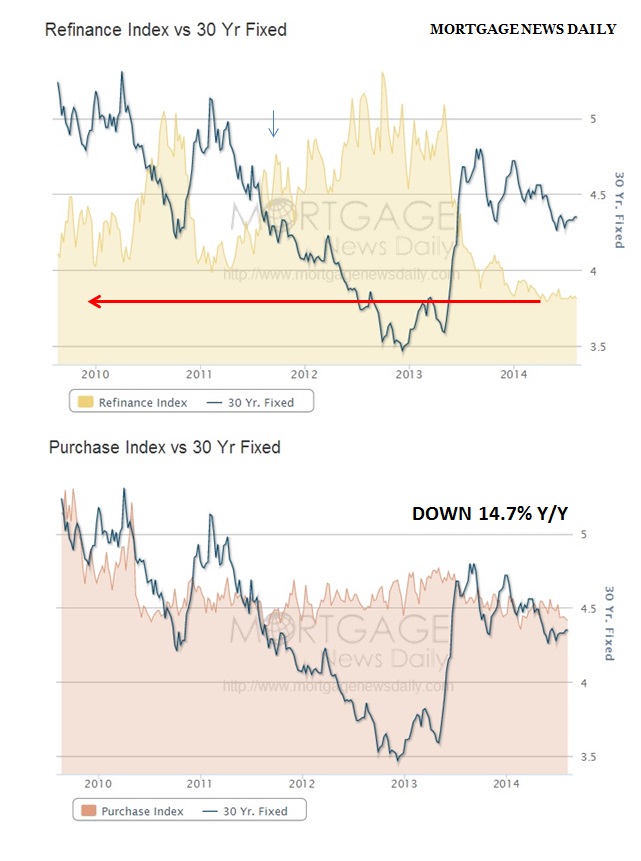

However, mortgage rates have actually been trending in the “right” direction, on and off at first, for more than a full year. In fact, the average mortgage rate right now is about 25-30bps less than it was a year ago. Despite what should be a demand-side boost, mortgage applications continue to sink, and not by small measures.

The Mortgage Bankers Association’s refi index is at a level not seen in a very long time, far lower than anything of this “recovery” period. There has been a clear disassociation of refi activity and interest rates, which is itself a clear break from the close correlation of the prior paradigm (before taper threats). That is a woeful sign for consumerism, as even though the trickle of refis likely had a relatively muted impact on the monetary goal of spending, it will now be completely reversed going forward – regardless of interest rates it appears.

In terms of real estate and new home construction or home sales, purchasing activity has been far less provoked by all of this but no less in terms of direction. Mortgage applications for home purchases are running nearly 15% below year ago levels, and this despite that favorable direction in mortgage rates.

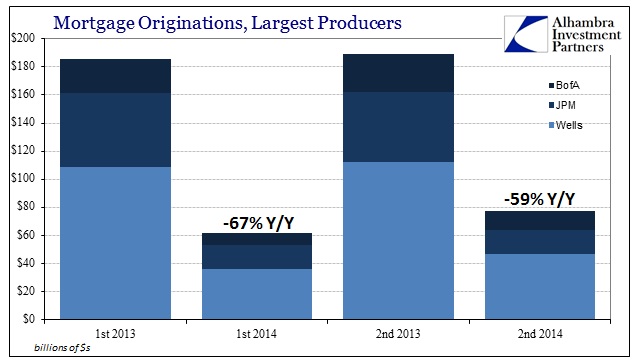

At the three largest mortgage providers, there was some increase in originations and volume in the second quarter over the first, but nothing that would indicate a sharp reversal on the horizon.

Where total mortgage lending volume at these three banks was off by two-thirds Y/Y in Q1, in Q2 the decimation was only 59%. We will have to see about how that plays out in Q3, though mortgage pipelines entering the quarter were still way down vs. last year’s levels (about 65% on average). The current view of applications doesn’t bode well for it.

So again, with interest rates moving in the “right” direction and having done so for over a year, why has mortgage activity remained so elusive? On that demand side, there is the possibility that further economic erosion is much worse than all the commentary devoted to convincing everyone of the opposite, but that shouldn’t necessarily account for the scale seen here and its persistence.

I think there was a very important clue given just after the worst of the selloff, which, if you remember, hit MBS much more directly and provokingly than almost any other segment of the credit markets. The rout around June 22 was especially dramatic, with carnage being whispered as similar to that of certain days in 1994 (and other historic bond crashes). Not long after that, the major mortgage banks (which excludes Citi of the largest financial firms) began announcing rather large job cuts in their mortgage departments.

Layoffs that reached what we eventually saw through the end of last year are not some temporary response to a singular “market” event, they are a grand sign of bank calculations of profitability over the longer term. The mortgage business has been more than a little misunderstood for the better part of two decades, along the lines of the changing nature of credit from traditional thinking to the shadow/investment side, as profitability has been driven not by a carry spread between funding costs and the mortgage rate. That ages-old bread and butter is anachronistic to the modern investment bank.

That is doubly true when financial repression is as severe as it has been since 2001 when Greenspan first pushed the limits of monetarism. The keys to profitability in mortgage lending were the availability and cost of leverage (both funding and regulatory) as well as volume. However, a rather unappreciated part of this, as it relates more so to MBS holdings, is price appreciation.

Under a regime of constant, near-constant or “telegraphed” repression, holding MBS becomes far more lucrative as prices are changing in your favor. That is true even where negative convexity (due to the inversion of prepayments to lower interest rates) comes into play. In addition to volume of loan production (and all the servicing, underwriting and securitizing fees that come with it) a bank can make far more profit on “trading”, counted under “fixed income” or FICC revenue, than that basic carry spread.

The taper selloff, then, seems to have been a signal to the large banks, and their smaller cousins, that the interest rate course was no longer “guaranteed” to be so steady and favorable. After getting their taking a beating in the selloff, the message seemed very well received. Now the banks are focusing their resources in other directions, including, no joke, a very determined effort to chase high yield and leveraged loans (the “boost” in C&I loans, for example, is as much about banks redeploying resources away from mortgages as anything else).

If that is the correct interpretation, and I think we have enough time and data to make a good determination here, then that very much complicates the housing mini-bubble as it desperately seeks to regain some traction. I think that is why we are seeing some of the regulatory movements that have been offered, particularly the GSE’s promising to reduce the putback “penalty” levels. It seems like a rather determined enticement to the banks to bring their resources back in this direction rather than C&I and other places that are now seen as actually profitable (until they aren’t, of course) vs. mortgages that can no longer be counted on so much. In other words, the collapse in mortgage finance is as much about supply as demand, though we will never be able to fully categorize the distinctions.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com