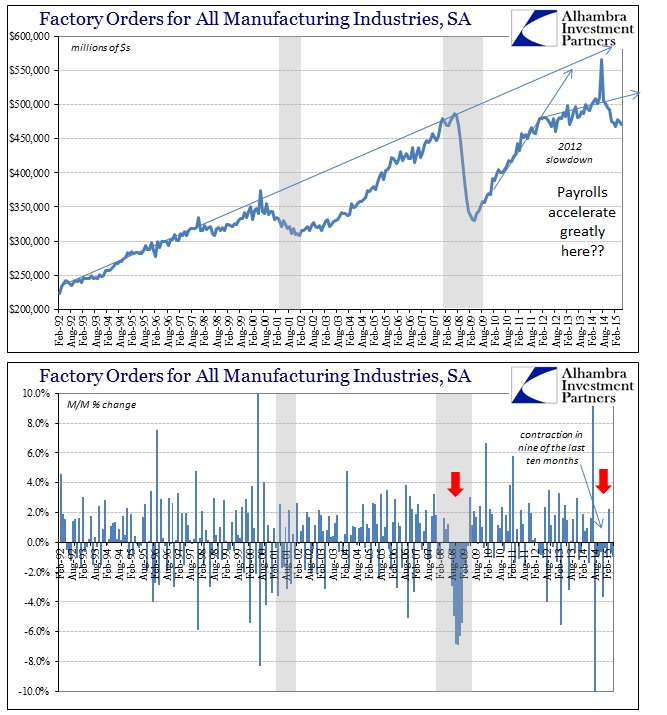

While the payroll report commands almost all attention, the view from factory orders is simply much more significant. Even if we accept that payroll growth is steady at something greater than 200k per month, that is still at least two steps removed from actual economic activity as is intended from that same orthodox framework. Jobs are supposed to lead to income which is supposed to drive further spending, so the jobs figures themselves aren’t even the true gain. It is always just assumed that spending goes with jobs without ever dissecting the processes that lay in between.

The unalloyed ugliness of factory orders, completely recessionary, should at least call into question exactly how payroll expansion is “working” in this segment of recovery time. From my view, again with the trend-cycle statistics, it is another data point that more than suggests there are no payroll gains right at the start, and thus the real state of the employment market is being demonstrated by the outright contraction in the labor force (again).

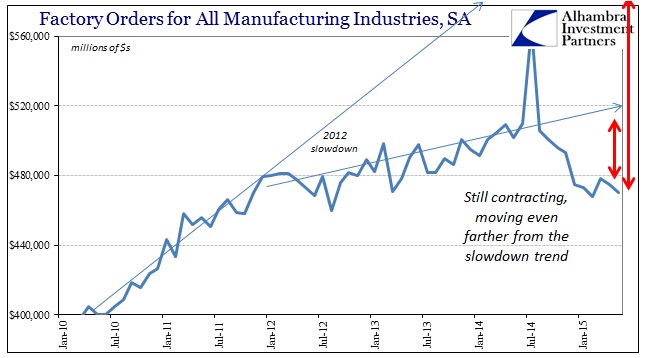

When factory orders sink as bad as they have in 2015, it almost doesn’t matter except for the narrative that accompanies it (which is not unimportant, especially as Janet Yellen tells it all that matters is the words). If the US economy is not already in recession it is remarkably, even admirably, acting very much like it. The short version is whether or not there are meaningful job gains none of it is translating into further actual economic activity.

The state of contraction here actually suggests the inventory version of the economy, which may itself be traced to that same faith in Janet Yellen. For whatever ultimate reason, businesses simply overproduced by an unusual amount last year, and this year means cutting back to re-align necessary production with actual sales (as opposed to those imagined by the Establishment Survey and the FOMC). This kind of inventory cycle has occurred before just in the past few years, of course, but this is very different which suggests that even prior weakness was minor by comparison.

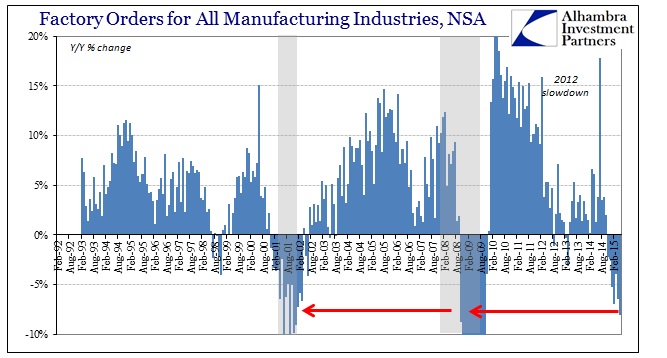

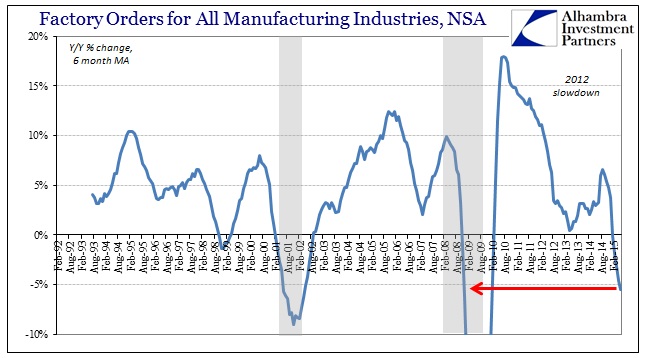

You don’t see factory orders contract by 8% in a given month and expect that there is some “isolated” weakness somewhere which is easy to ignore, as economists have been telling. An 8% decline is altogether more sinister, which is why factory orders are far more significant than the overly adjusted, heavily subjective “employment” report – even when those payroll figures aren’t exactly all that great themselves.

If this were just a weather-related anomaly, then factory orders would by now, for May, be completely on the other side of zero. Instead, several months into the spring, the rate of contraction has actually gotten worse. Even the 6-month average is now -5.5%, which is matching the lows of the dot-com recession (which was driven by a serious implosion in capex, after dot-com businesses no longer were payable entities without bubble cash). Again, this is not the normal weakness that this most inefficient bubble period has been accustomed to.

That is, it seems, the primary problem with both the direction of the economy, as given by a broad series of accounts, and the narrative about it (the incredulous nature with which economists and media commentary treat what is plainly a serious and growing decay).

American factories have struggled this year because a strong dollar has made U.S. goods more expensive overseas, hurting American exports. Falling energy prices have also trigged sharp cutbacks in investment spending by oil companies.

Those factors, combined with an unusually harsh winter, sent the economy into reverse in the January-March quarter. But economists are optimistic that economic activity rebounded in the April-June quarter to growth of around 2.5 percent and will strengthen further in the second half of this year.

They expect continued solid gains in employment will boost household incomes and spur stronger consumer spending, which accounts for 70 percent of economic activity. A separate report Thursday showed that the labor market created a solid 223,000 jobs in June, and the unemployment rate dropped to a seven-year low of 5.3 percent.

“Continued solid gains in employment” have done absolutely nothing for the economy so far, as retail sales continue as some of the worst of the last quarter-century, but since there isn’t anything else to write that would fit the orthodox idea of a strong economy only beset by “residual seasonality” and strong snowy weather that is all that is offered as a counterbalance – especially referring to an unemployment rate that fell only because the labor force shrunk yet again. Like Ben Bernanke’s self-defense of QE, if there were actual signs of a looming resurgence they wouldn’t be forced to use the unemployment rate and more of the same non-specific allusions to some growth that might occur at some point that have been a staple of economic commentary since QE2.

The scale and the persisting accumulation of declines preclude any interpretations of isolated and unimportant negativity, especially in broad context. That is the problem with the mainstream economic ideas since the 2012 slowdown, as the standard for recovery, even the economy itself, has been so reduced as to “allow” any small improvement to be classified as grand evidence of the long-awaited full bloom. So in the case of the across-the-board negativity such as factory orders, all that is left is fatuous nonsense. It misses the true nature of what “should” be happening right now, as even if factory orders were flat instead of -8% that would still be quite concerning.

If there were signs of an impending rebirth, factory orders (orders, after all, are forward-looking!) would be growing by 10-15% as in 2010 and 2011.

The entire structure of monetary experimentation is falling apart; up to and including how the government collects and issues statistics on the most basic of assumed economic functions. The extreme and growing divergence between both expectations and asset prices and what is showing up as real recession elsewhere is playing out like cognitive dissonance, but it should be clear by now that monetary theory is being, in full, disqualified and disproven. Recession or no, the economy isn’t even living up to its redacted post-2012 self, which is quite an alarming impeachment of especially QE.

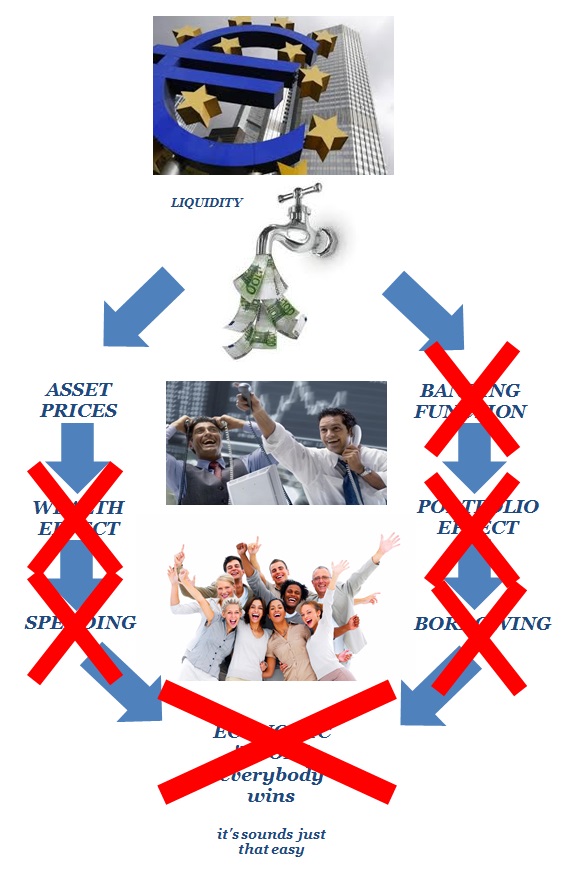

This was intended for Europe’s version of monetarism, but it stands equally representative of any central bank “recovery” under orthodox theory: