by Tim Knight at Slope of Hope

I’ve been trading the stock market for nearly thirty years, virtually non-stop. Today (that is, Monday, August 24) easily ranks in the top five strangest, craziest days in the thousands upon thousands of trading days I’ve ever witnessed. I felt like I was entering a cage of gorillas that had just ingested a large quantity of PCP. It felt dangerous and really, really unpredictable.

As I mentioned on my lengthy Saturday post:

I expect (and, again, hope – – because, God forgive me, I’m actually long five ETFs in size right now) we get a meaningful relief rally, carrying us up to the psychologically-important 17,000 level. At that point, please don’t be anywhere between me and my keyboard, because I am going to be shorting anything with a ticker symbol in size.

Well, God most certainly did not forgive me. If this permabear’s time machine was working, he’d go back to Thursday morning, warn the slightly-younger Tim to not cover a single position, and further warn him not to buy a single thing.

Instead, I waited sleeplessly through Sunday night and early Monday morning for the opening bell to see how big a chunk of flesh those longs would take out of my 55 (much smaller) short positions. Well, the “tax” was quite hefty. Hedging as I did wiped out half of the profits I would have had otherwise, just as covering wiped out half my profits the prior Friday. I had relinquished tens of thousands of dollars of extra profit just to be – – well – – “safe.”

I think we can all agree that approximately nobody anticipated the Dow falling 1,000 points right from the start of Monday morning. Frankly, the kind of “lift” I am seeing at the moment I am typing this (with the ES up 42 points) is more along the lines of what I thought would happen.

But the past few days have generated countless stories of triumph or woe, because in a market this volatile, you are going to have some accidental millionaires, and you’re going to have some people absolutely wiped out, never to enter the markets again. Keep in mind the VIX was at 10 – 10!!!!!! – only a few weeks ago, and today it roared into the mid-50s. This is without precedent.

I tend to think in metaphors and analogs, so here is what I have in mind for your consideration: think about a forest. In a large forest, from time to time, there are naturally-occurring fires. These take place due to, say, a lightning strike, and what happens is that all the dry underbrush lights up and damages the forest to a certain degree. Some trees are killed. Some animals are killed. There is loss.

But, once the fire burns out of its own accord, life begins anew. The soil is rich with nutrients. More sunlight gets through to the surviving trees, and they flourish. The forest grows stronger. And, sooner or later, another fire will take place, but through this repeating cycle, in spite of Bambi getting killed from time to time, things improve and are relatively stable.

The same can be said for a financial market which is allowed to rise and fall based on naturally-occurring market forces. Some people get hurt along the way. Some people prosper. But, on the whole, the system works, and it works in such a way that it is fair and, in the grand scheme of things, beneficial.

What we have, instead, is a forest that hasn’t been allowed to catch fire. The forest has been drenched with water every day, for years on end, to ensure that no spark can take hold. Lightning still takes place, but it is simply snuffed out on wet tinder. The layers of dead limbs, leaves, and other crinkly detritus accumulate on the ground, and soon you have a forest that is several feet deep in tinder.

So, in this instance, when a spark manages to get through, you don’t have a run-of-the-mill fire: you have an apocalypse. The natural give-and-take of the organic system has been suppressed, and a towering inferno rages with a ferocity that seems surreal. You have, at long last, a calamity on your hands.

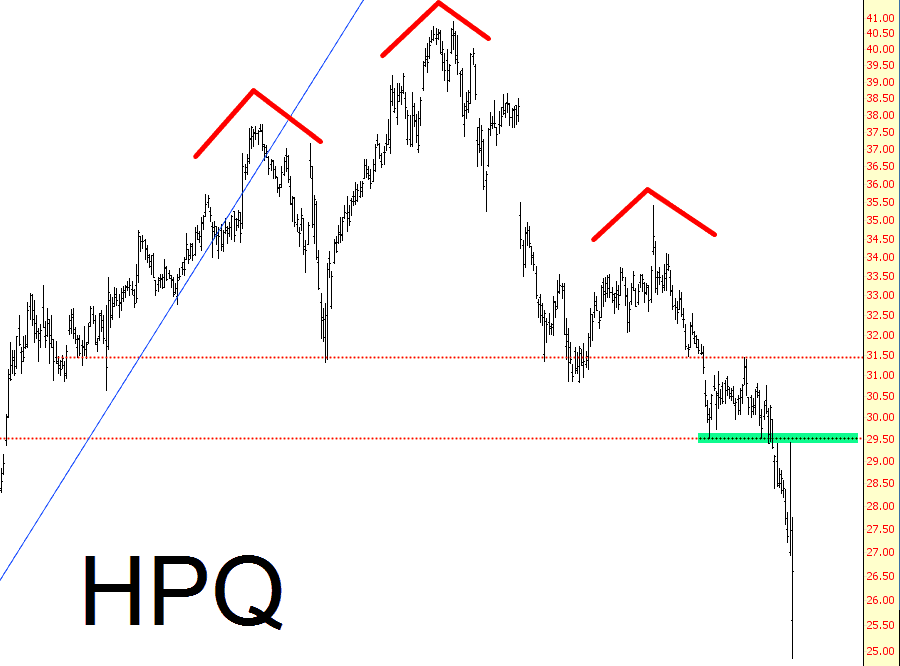

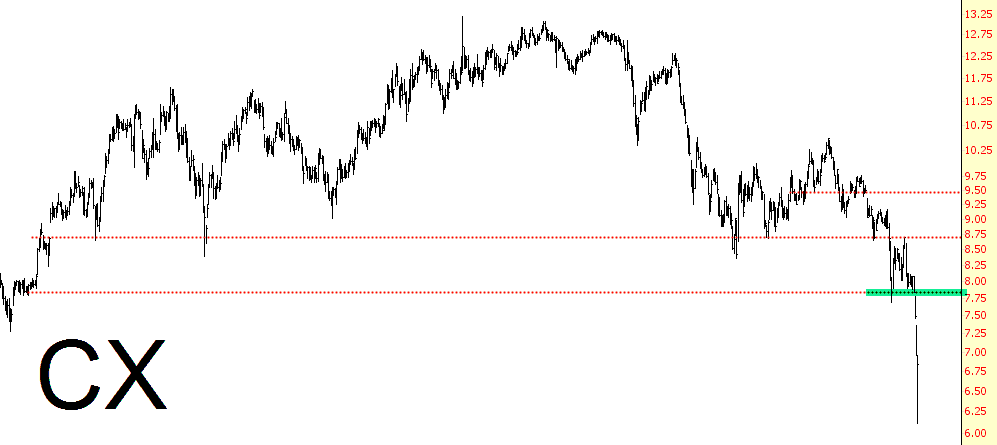

And that, my friends, is that we’ve been witnessing the past few trading days. Fire Marshall Yellen (and retired Fire Marshall Bernanke) have utterly perverted the natural order of things, and we are only now beginning to pay the price. The fire, I firmly believe, has only just started. We will indeed have some violent relief rallies along the way, but as we look at charts like these……….

……….my only conclusion is that the sensational bearish setups are firmly in place and, once the bounce is complete, you will be witness to a fury of plunging price quotes that will, in the end, prove that Monday, August 24th, was simply a shot across the bow.

Source: The Raging Fire Within | Zero Hedge