By Tyler Durden at ZeroHedge

Last summer, China unleashed an unprecedented array of measures – up to and including the arrest of “malicious short sellers” and prominent hedge fund mangers – to prevent its stock market bubble from bursting. It failed. A few months later, the chaos has spilled over from the relative containment of the capital markets and has engulfed not only the country’s FX reserves, and capital account, but also the entire economy.

As a result, China’s government has gone all in, and as Bloomberg reports, is stepping up efforts to ward off a potential financial crisis, warning bank executives that their jobs are on the line unless they control risks and putting restrictions on an increasingly popular way of evading capital controls. These moves come in response to China’s slowest economic growth in a quarter century fueled concerns that bad debts will cripple the banking system and a catalyst for why virtually every hedge fund is now short the Yuan.

As Bloomberg puts it politely, these actions “add to evidence that President Xi Jinping’s government is moving with increased urgency to rein in financial-system risks.”

We disagree: these are the same panicked, “after the fact” reactions that only a government on the verge of losing control will engage in. As for their ultimate success, just compare the current price of the Shanghai Composite and its recent all time highs.

Here is a quick summary of the Chinese actions to if not prevent, then at least delay, financial and economic collapse.

First, in January, China aggressively stepped up measures to halt and slow down capital outflows that hit $1 trillion last year by boosting capital controls first described here last September. The tightening marked a reversal after years of easing that spurred global use of the yuan, a trend that turned on China when speculative bets against the currency offshore jumped.

Some of the primary measures have included:

- Increased scrutiny of transfers overseas – Some Shanghai banks have recently asked their outlets to closely check whether individuals sent money abroad by breaking up foreign-currency purchases into smaller transactions and to take punitive action if violations were discovered, according to people familiar with the matter. Each person can send $50,000 abroad annually and so large sums can be transferred by utilizing the bank accounts and quotas of a range of individuals, a tactic known as smurfing.

- Curbing the offshore supply of yuan to make shorting costlier – The PBOC told some onshore lenders to stop offering cross-border financing to offshore counterparts late last year, and on Jan. 11 advisedsome Chinese banks’ units in Hong Kong to suspend offshore yuan lending unless necessary. It’s also widened the scope of reserve requirements to include some yuan holdings of overseas financial institutions.

- Restricting companies’ foreign-exchange purchases – Companies can only buy overseas currencies a maximum five days before they make actual payments for goods, having previously been free to make their own decisions on timing.

- Suspension of foreign banks – DBS Group Holdings Ltd. and Standard Chartered Plc were among overseas banks suspended from conducting some foreign-exchange business in China until the end of March. The bans included the settlement of offshore clients’ yuan transactions in the onshore market and was introduced as a widening gap between the currency’s exchange rates in Shanghai and Hong Kong encouraged arbitrage trades.

- Outbound investment quotas frozen – China has suspended new applications under the Renminbi Qualified Domestic Institutional Investor program, which allows yuan from the mainland to be used to buy offshore securities denominated in the currency. It has also refrained from granting new quotas for residents to invest in overseas markets via its Qualified Domestic Institutional Investor program since March.

- Delaying the Shenzhen stocks link – China originally planned to start a link between the Shenzhen market and the Hong Kong bourse last year, but the plan was delayed amid a mainland equities rout.

- UnionPay debit-card clampdown – New measures were introduced in December to crack down on illegal China UnionPay Co. card machines, which were suspected of being used to channel funds offshore via fake transactions, most notably in Macau casinos.

- Underground banking clampdown – China busted the nation’s biggest “underground bank,” which handled 410 billion yuan ($62 billion) of illegal foreign-exchange transactions, the official People’s Daily reported in November. The Shanghai branch of the SAFE said last week that it will crack down on illegal currency transactions, including underground banking.

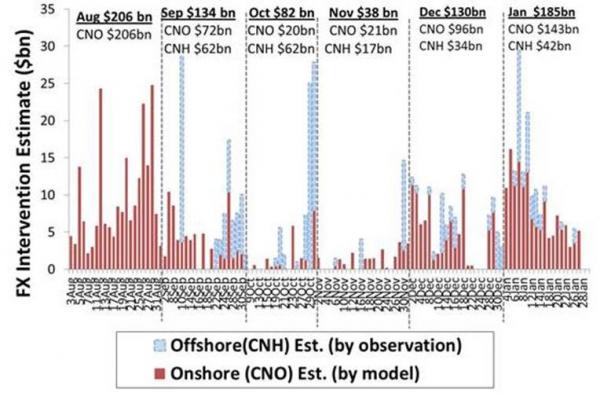

However, a recent estimate by Goldman Sachs put the total January FX interventions (and thus capital flight) at $185 billion, well above the December total and the second highest since August. This would means that whatever China has done so far has failed to stem the tide of capital outflows.

Which explains the latest, second round of interventions. Once again, courtesy of Bloomberg, these are as follows:

- impose restrictions on buying insurance products overseas – Moving to plug one popular way for moving money out of China, the currency regulator is imposing restrictions on buying insurance products overseas, people with knowledge of the matter said Tuesday. Purchases of insurance products overseas using UnionPay debit and credit cards will be capped at $5,000 per transaction effective Feb. 4, according to the people. Purchases of insurance policies by mainland visitors in Hong Kong reached HK$21.1 billion ($2.7 billion) last year through September, following a 64 percent surge in 2014, according to the city’s industry regulator.

- Threaten bank chiefs with termination if targets are missed – Shang Fulin, chairman of the China Banking Regulatory Commission, told an internal meeting last month that banks would be forced to restructure, inject new capital or change their senior management if key risk indicators fall outside “reasonable ranges,” people familiar with the matter said Tuesday. Those indicators include bad-loan coverage and capital adequacy ratios, Shang told the meeting, the people said.

- Crackdown on Wealth Management Products – China’s central bank has told lenders it will require greater control over the amount of wealth management product funds they give to brokerages and other financial institutions to manage, people familiar with the matter said Tuesday. The People’s Bank of China told banks it will also impose more limits on the amount of proprietary funds managed by other institutions, and that it will tighten control of leverage taken on when buying bonds, the people said.

- Lower minimum required down payment for a mortgage – The central bank said Tuesday it will allow banks to cut the minimum required mortgage down payment to 20 percent from 25 percent for first-home purchases to the lowest level ever as it steps up support for the property market. A rising stockpile of unsold new homes is hampering government efforts to spur investment expanding at the slowest pace in more than five years.

Expect many more actions and interventions over the coming months, all of which like last year, will be self-defeating as the harder China presses on its porous “capital” firewall, the more holes that will emerge.

Ultimately, what will happen is that the “Shanghai Accord” idea, in which China announces a dramatic one-off devaluation, is implemented which is perhaps the only shock-approach that could possibly stem the capital flight even if it comes at the expense of a global deflationary wave.

The only question is whether China will have any FX reserves left by then, and just how widespread public anger and civil discontent and disobedience will be as a result of mass layoffs and plant shutdowns as China, courtesy of mean reversion, finds itself in the same depression which its epic debt-creation engine in the period 2009-2014, and since shut down, saved the rest of the world from.

Source: Full Summary Of Chinese Actions To Prevent An All-Out Economic Collapse – ZeroHedge