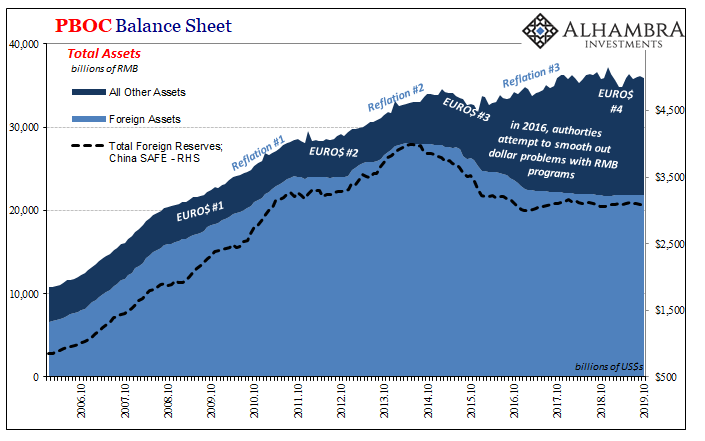

Speaking of externalities, that’s all this is. The eurodollar market stops providing China with “dollars”, or makes it that much harder for its banks to source them (from Japan, mostly), fewer end up in the monetary authority’s hands. Without that push on the central bank’s asset side, the liability side where all the money is gets caught in a vise. The eurodollar squeeze becomes an RMB strangle.