So far in China this year there have been defaults and “bailouts” in the credit markets, but they are tiny in relative comparison to everything else. That they have occurred at all is why they have grabbed so much attention. We all have some inkling of the credit and monetary inequities that are roiling inside the Chinese economic gut, but our window into that is maddeningly slim and opaque. Thus, any secondary indications that can provide even a little insight are infinitely more valuable than they would be of their own accord.

Despite the yuan peg (band) to the dollar and the massive Chinese merchandise surplus with the US, there remains a dollar “problem” for China to grasp. The convention about such surplus is that “China” (thinking as a monolithic whole or block) can use those surplus dollars to finance its importation of resources. It certainly seems like it should work that way as it would be the most efficient arrangement. The problem in that regard is the yuan/dollar peg. It creates a liability mismatch that has to be closely managed.

Chinese companies that export to the US (Foxconn) are not the same companies that import resources for all that manufacturing and assembling. The exporters gain a surplus of dollars, but have to turn them over (through Chinese banks) in large part to the PBOC (China’s central bank) to maintain that peg. Importers in turn have to obtain dollars to purchase materials on the global markets because there is, as yet, no depth in yuan trading outside narrow, bespoke bilateral arrangements. Brazil, for example, does not want yuan because it will also need dollars for its own global trade importations. Thus is the world of one reserve currency.

That means that the Chinese corporate sector is “short” dollars to conduct global trade. Exporters had a surplus but gave it up to the PBOC, and importers have to borrow dollars from either foreign banks onshore or native Chinese banks that themselves have to borrow dollars. Somewhere in that dollar chain lays eurodollar market rollovers.

That links US dollar “tightening” to Chinese liquidity. In that corporate sector, dollar lending is often collateralized by copper and iron raw material located in London. That ties copper prices often to US dollar conditions. That also means we can go backwards, tracing idiosyncratic Chinese problems back to copper prices.

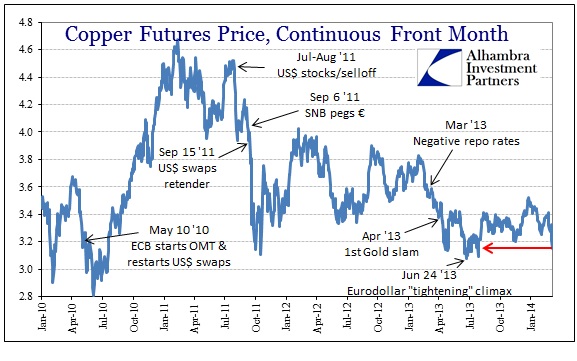

All the major dollar events of the past six years are represented in swift and dramatic copper cascades (very much reminiscent of, if not coinciding directly with, gold as collateral). That includes collateral problems that began showing up in odd places as early as February 2013 and the shifting swaps regime.

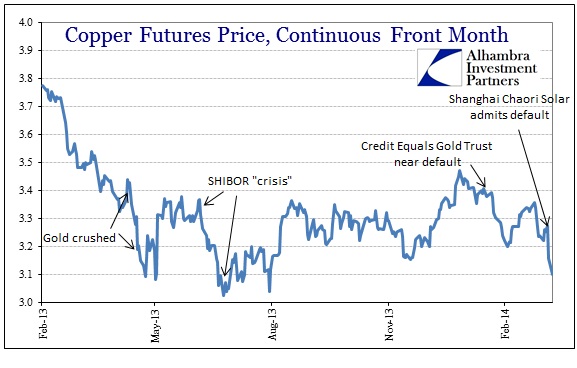

It is no surprise, then, that recent turmoil and uncertainty surrounding both technical trust defaults (and then bailouts) and the actual default (so far) of Shanghai Chaori Solar apy to appear in close proximity to the latest copper selloffs. The front month price of copper futures now is heading back to where it was when Chinese liquidity was last in the obvious throes of desperation (which, again, was at the exact same time eurodollar markets tightened so dramatically, and credit markets all over the world were selling off as a result).

From that we can surmise more Chinese interbank dollar liquidity problems than are evident in other indications. That would make sense as this sea of copper is also as rehypothecated as financial assets are and can be. If dollars are being tightened to Chinese participants, which would be consistent with markets that are pulling back even slightly to wait and see the ultimate disposition after small defaults, that inward strain on rehypothecation would lead to what looks like copper margin calls. Firms would have to sell to raise dollar liquidity levels.

That extends to the contours of the Chinese credit system itself. Internal and domestic credit, absent hardened government mandates and order, looks to be reacting to both sides of that trade arrangement. January credit growth came in much higher than anticipated, even adjusting for the calendar effect of the New Year, but much, much lower in February. That could very well be related to a rush of financing to get in ahead of what was anticipated to be more difficult conditions now that these markets are more unsettled.

In direct terms of global trade, Chinese trade balances absolutely collapsed in February. From the Financial Times:

Over the weekend Chinese trade data showed an 18.1 per cent year-on-year drop in exports in February, compared with an expected gain of 7.5 per cent. With imports growing at 10 per cent, China’s trade balance recorded a $23bn deficit, reversing from a $31.9bn surplus in January.

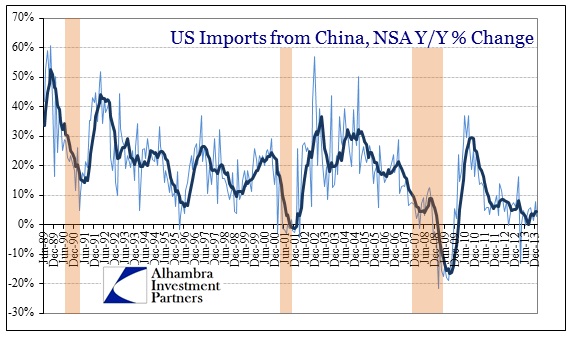

A good part of that decline came from the US, as demand for Chinese goods was nearly cut in half. The view from this side shows the elongation of trade problems, which certainly undercuts the weather explanation that is being used yet again even here (the chart below from the Census Bureau side only shows through January).

This total dollar/yuan process offers a possible explanation for the yuan’s recent “devaluation.” As exporters run fewer dollars through Chinese banks but Chinese banks are “allowed” to “sell” them into the market rather than directly to the PBOC (to offer a secondary channel for dollars to flow to those Chinese corporates and banks “short” them) it should end up as a weaker yuan alongside rapidly falling copper prices. The PBOC “approves” that process via “widening” the dollar/yuan band, especially on the lower side as it has, cutting its daily fix again today.

It would also be consistent with the orthodox summation of currency “remedies” for ailing exports (just ask Japan how that is going). Again from FT:

The perception that the renminbi could only strengthen fuelled the so-called carry trade of borrowing US dollars cheaply offshore and then cycling them into China for the higher interest rates and currency appreciation. That in turn led to wildly inflated trade data as Chinese companies used fake invoicing as a means to bring money onshore.

What we can take away from all this is that China is one massive mess of dollar entanglements, cornered by an export focus that won’t recycle to the previous peak, further wrapped inside a credit bubble beginning to show signs of cracking. The “usual” remedy for such a system is to try to “export your way out of it.” And that may be the forward intent if it doesn’t get too complicated by eurodollar mechanisms ahead, but it also may signal a far darker worst case (that may be more probable than anyone admits now) – China in 2014 is Japan in 1989. There are enormous similarities that make such a comparison compelling, enough to further study how that analogy might work out alongside their differences.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com