By Tyler Durden at ZeroHedge

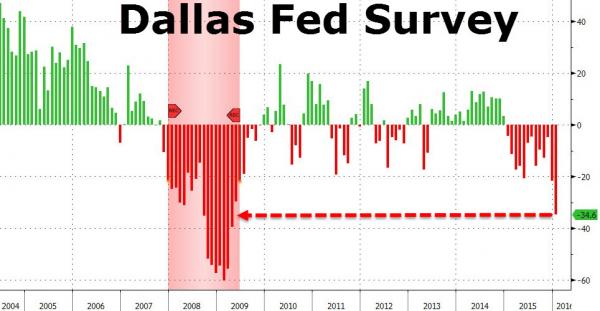

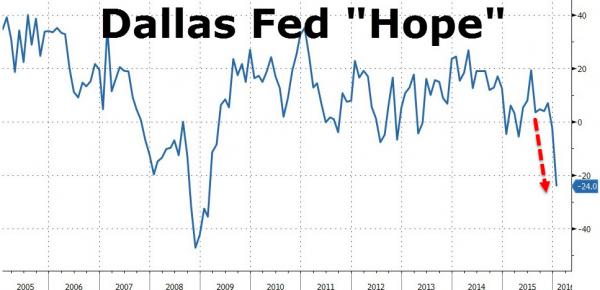

For the 13th month in a row, The Dallas Fed Manufacturing Outlook was contractionarywith a stunning -34.6 print following December’s already disastrous collapse back to -20.1, post-crisis lows. With “hope” having plunged back into negative territory (-2.2) in December, January saw a complete collapse to -24.0 as one respondent exclaimed, “we expect the continued depression in the oil and gas industry to negatively impact our customer base and result in significant demand reduction.“

Bloodbath…

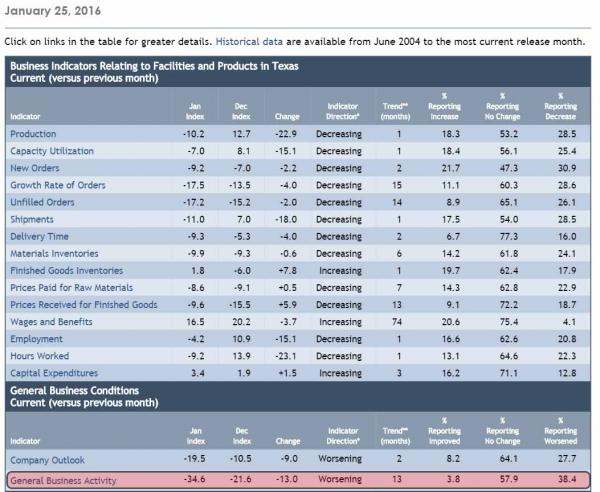

And its across the board with production, employment, and shipments all collapsing…

As hope is crushed…

But the punchline was the respondents, virtually all of whom confirm the recession, and one even casually tossed in the “D”(epression) word:

Primary Metal Manufacturing

- The impact of the continued decline in the energy sector, compounded with several new regulations from both the Environmental Protection Agency and Occupational Safety and Health Administration, is depressing economic conditions even further from 2015. Our top 10 customers continue to indicate declines in manufacturing and new capital expenditures for 2016. Outlooks continue to be adjusted down from six months ago, and we are seeing several foundry closings in our industry due to the state of our industry and strong offshoring projects.

- Our projected increase in business is related to market-share gains at the expense of our main competitor (foreign owned) who is having service problems.

Fabricated Metal Product Manufacturing

- We expect the continued depression in the oil and gas industry to negatively impact our customer base and result in significant demand reduction.

- I believe that if the stock market continues to deteriorate, spending on housing replacement products will decrease. Large purchases on housing seem to parallel consumers’ 401k performance.

- It is getting pretty ugly, and the strength of the dollar is really making us noncompetitive.

Machinery Manufacturing

- The continued downturn in the energy sector and its impact on oilfield services companies is brutal and financially punishing, leading to significant reductions in our labor force and facility closures.

- Seasonally, it is a slower time of the year currently. There aren’t any indicators of any big change in the next six months.

- Our increases in volume do not stem as much from ideal economic conditions as much as from breadth of development in multiple states. Brand expansion and awareness are more of the catalyst than the typical industry indicators. Our customers in Texas are experiencing significant decreases in business volume. As a whole, I would rate the economic conditions in Texas and many other parts of the country as poor.

- Oil and gas prices and their impact on capital spending by our customers continue to be our biggest concern.

I expect the Fed to recognize the weakness in the economy and the fact that we are in recession and drop interest rates again.

Computer and Electronic Product Manufacturing

- Demand slowed more quickly than is typical in December. Early demand is weaker in January, leading to the belief that growth in 2016 may be elusive.

- It is time for Congress and the president to work on tax reform. Small businesses, especially in manufacturing, are suffering due to the high dollar, high taxes, and regulations.

Transportation Equipment Manufacturing

- The drop in offshore oil production globally affects helicopter flight activity, reducing equipment turnover from large fleet operators.

- Our outlook is contingent on the energy sector not completely ruining budgeting activity for most Texas municipalities. If that happens, the six-month outlook may turn negative.

- Our business is cyclical, with our main selling season happening in March through June. Our production will increase during the winter months in anticipation of the spring selling season.

Food Manufacturing

- Domestic sales have softened across our channels and category. The strong dollar remains a challenge to our export business. Agricultural raw material costs have decreased, helping with other cost challenges.

Apparel Manufacturing

- July will be when we start getting busy for our Christmas shipments.

Paper Manufacturing

- We see a slight downward bias at this point.

Printing and Related Support Activities

- We are part of a company with four separate, very different businesses. They are all business to business, and they have all struggled with sales growth the past year. We’ve been able to improve profitability on a 1 percent sales increase, but sales have just stalled. Our old customers have shrunk, and we’ve managed that meager 1 percent only by on-boarding a lot of new business.

And now cue to the career Goldman banker recently put in charge of the Dallas Fed…