Normally the lack of volatility in “markets” would be a welcome event. Stability is something to be courted not disbarred and exiled. Sure, the big banks will make noise about how they can’t “make money” in such an environment (as they are right now about credit markets) but that will only force them to find something more productive to do rather than scalp off volatility (or so we might hope).

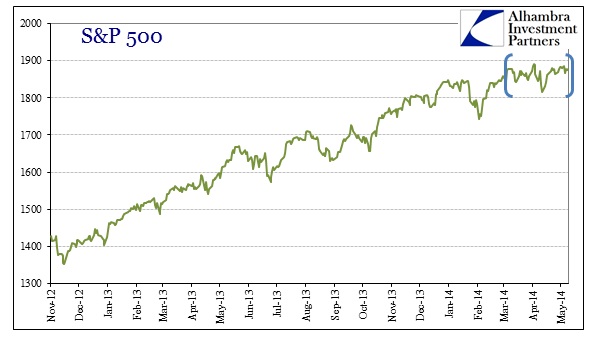

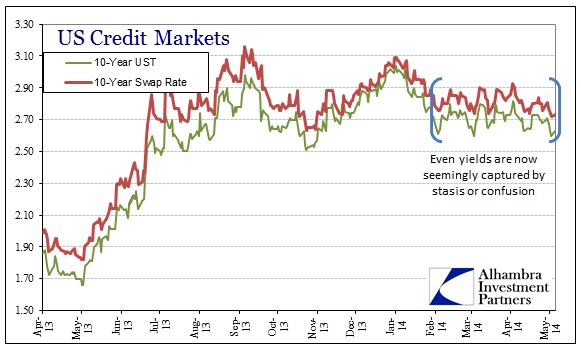

I have noted this damn peculiar phenomenon before in credit markets, and then added gold to it last week. I think we can now add the S&P 500 and even JPY. Rather than signify a stable environment, I firmly believe there is growing unease about which way to go – as if nobody wants to make and carry large bets in a defined and intentional direction. That is about as far from an organic market as you can get, as if everyone is waiting around for someone else to do something. Is Pavlov late?

To heighten the mystery, more than a few of these stasis periods date to early February and Yellen’s official ascension. Take it for whatever. At any rate, today’s entries into this mysterious club:

Last week’s:

Previous:

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com