By Tyler Durden at ZeroHedge

2015’s stock market range (from high to low) is among the narrowest since World War II. This ‘compression’ has led the horde of asset-gatherers and commission-takers to suggest that stocks are a “coiled spring” ready to burst higher from this newly-formed permanent plateau. However, as S&P Capital IQ’s Sam Stoval notes, that is the exact opposite of what to expect based on history. In fact a narrow range year is typically followed by a low return year, not a high return year.

Anyone expecting a jump in the Standard & Poor’s 500 Index after its relatively narrow range this year may be disappointed, according to Sam Stovall, S&P Capital IQ’s chief U.S. equity strategist. As Bloomberg reports,

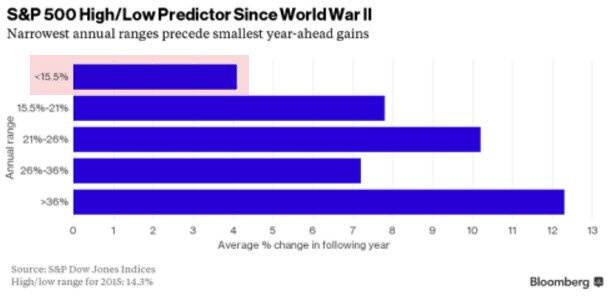

The chart below shows how Stovall drew his conclusion, by tracking percentage gaps between the S&P 500’s closing highs and lows each year since 1945, as compiled by S&P Dow Jones Indices. He divided the differentials into five ranges, from smallest to largest, and calculated the index’s average percentage move in the next year for each range.

This year’s gap is 14.3 percent, which would fit in the narrowest band of Stovall’s “high/low predictor.” Years with similar stability were followed not only by the smallest average gain the next year, as the chart illustrates, but also by the smallest proportion of advances: 57 percent. Comparable figures for other ranges were as high as 79 percent.

“If you thought that a narrow annual trading range would be akin to compressing a spring that led to a jump in the following year, you can forget it,” the New York-based strategist wrote.

“In other words, 2016 will likely endure increased volatility, but without much in the way of price appreciation to show for it.”

Source: ‘Coiled Spring’ Stock Market Likely to Disappoint in 2016 – ZeroHedge