By Tyler Durden at ZeroHedge

The following brief summary of the global economic situation should, once and for all, end all debate about whether the world is “recovering” or is now mired deep in a recession.

From DB’s 2016 Credit Outlook

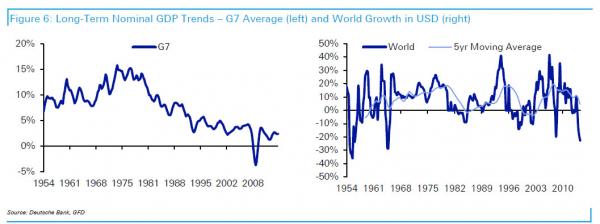

Debt has continued to climb since the crisis with Global Debt/GDP still on the rise, with no obvious sign of when this rise stops for many major countries. Indeed much of the post GFC increase in debt has been raised on the back of the commodity super-cycle which is currently unraveling in EM and the US HY market. Outside of this, the US overall has de-levered to some degree but even there debt levels remain very high relative to all of history excluding the GFC period.With limited tolerance from the authorities to see defaults erode the huge debt burden, the best hope for a more normal financial system is for activity levels to increase so we can slowly grow the economy into the debt burden.However this requires strong nominal GDP growth and we continue to see the opposite. The left hand graph of Figure 6 looks at a global weighted average of Nominal GDP growth in the G7. On this measure we are still seeing historically weak activity.

In dollar terms the situation is even worse. The right hand chart of Figure 6 shows a much more volatile global NGDP series which converts the size of each economy in dollar terms and then looks at the growth rate YoY. With the recent strength in the USD we are seeing a huge global dollar nominal GDP recession – the worst since the 1960s. Whilst this might not be a series that is followed, it does show the sharp contraction of dollar activity levels in the global economy over the last year or so which has to have ramifications given it’s the most important global financial market currency.

What DB did not point out but is obvious, is that the synthetic dollar squeeze of the past year has made the global collapse now even worse than what was experienced during the great financial crisis, and it is getting worse by the day.

And so, with the world trapped in the worst USD-based GDP recession in 50 years, here is the question for Yellen: with every other central bank easing and the Fed tightening, what happens to i) the USD in the future and ii) to future world growth in USD.

Source: The Truth Comes Out: “This is the Worst Global Dollar GDP Recession in 50 Years” – ZeroHedge