In addition, and very much related, to durable and capital goods disappointment, some major bellwether earnings have weighed on jubilation over the “robust” economy. Caterpillar in particular was troubling, but as the lineup of excuses expands, the idea of “decoupling” is now even more pronounced. So, in addition to the energy sector dragging down earnings, overseas results will also add to the trouble – but none of it is supposed to be much of a US concern.

The U.S. economy, by contrast, is not highly dependent on sales abroad—U.S. GDP is composed of just 10% exports, while consumer spending makes up north of 70%. So, while weakness abroad certainly isn’t good for the American economy and it is a bad sign for export-heavy companies like Caterpillar, it’s not something that should worry most workers or business owners stateside.

In the U.S., strong job and GDP growth, low inflation, and the jolt of cheap energy prices should all conspire to make 2015 the strongest year yet in the economic recovery.

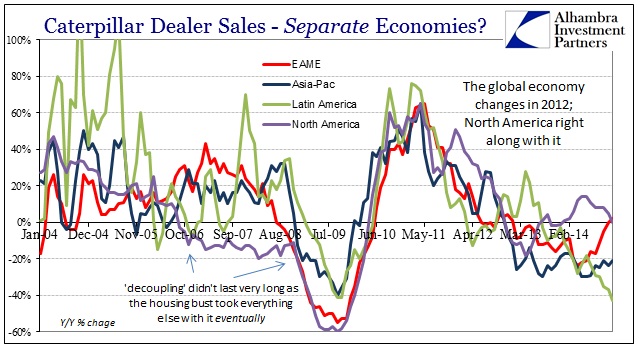

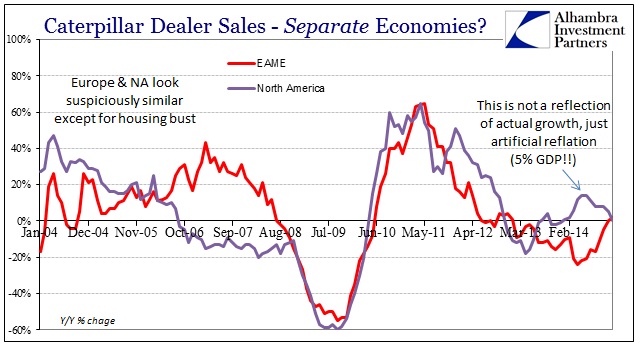

It’s interesting in that if you actually look at Caterpillar’s dealer sales volume, the idea of decoupling never makes it past the housing bust. It is actually very clear that the global economy is the global economy, and that one piece is never long out of alignment with the majority.

The “decoupling” fantasy from 2008 lasted only until Lehman Brothers recoupled global economic existence in the nightmare of a collapse. But that has now been repeated, with 2012 standing in where 2006 and the housing bust started the decline last time. If anything, the global economy, as using Caterpillar as a proxy for productive investment agrees and correlates so closely with so many other indications, has been more closely aligned in the post-crisis era than before – which is not a comforting factor given where all this is heading.

With Europe on the edge of another contractionary part of its ongoing depression, the uniformity of that “cycle” with US proclivities in capex does not suggest ignoring “overseas” results. Again, just like this morning’s durable goods report, there is an obvious artificial rebound that gets extrapolated, wrongly, into this expectation of an actual economic advance. Instead, the fact that the rest of the world is struggling under the weight of the “dollar” more than recommends that this idea of “decoupling” is at least backwards, though more so fully inappropriate to the modern concept of globally financialized systems.

Mainstream commentary assures us that the “rising dollar” is a very good sign about US growth prospects, but that observation applies less and less to anything that actually exists. Ask Latin America about economic reality in terms of the “dollar” as opposed to the dollar of old.

The missed earnings and revised expectations are due in part to a rapidly appreciating dollar, which is being driven up by the relative strength of the U.S. economy as well as the announcement of central bank bond buying in Europe. A more expensive dollar means that U.S. companies are less competitive abroad.

There is nothing in that quoted passage that I would agree with, as US companies are not less competitive but simply unable to sell products in economies that are clearly falling apart. A full part of the reason they are doing so is that central banks have destroyed the innate ability of the global economy to allocate resources based on anything other than skewed financialism. Thus, “tightening” in the “dollar” acts as a massive restraint at a time when growth prospects have dimmed since 2012. If the “dollar” were “rising” as a result of US recovery strength, I highly doubt the credit markets, which are conspicuously absent from every one of these kinds of excuses, would be so bearish. Instead, credit markets and the “dollar” are highly complementary, as are these earnings reports, of a broad-based breakdown.

The “rising dollar” actually tells us a lot about the state of global affairs, US included, at the same time most analysis is proclaiming it unimportant and entirely irrelevant.

The Cincinnati company, which sells products ranging from Tide detergent to Crest toothpaste, said Tuesday that exchange rates will remain a challenge well into fiscal 2015, especially in the second half of its year. Overall, it expects foreign exchange to chop its core, fiscal 2015 earnings by 12 percent and reduce its revenue by 5 percent…

A stronger dollar can hurt companies that do a large share of their business overseas because sales in other countries translate back into fewer dollars. Health care products maker Johnson & Johnson and drugmaker Pfizer Inc. also recently reported a hit from foreign exchange rates.

Procter & Gamble is blaming the “dollar” for its current and now expected woes, but the sad fact of its operations is that revenue declined 4% to $20.16 billion, well below the expected $20.7 billion. While the currency impact is included in that, if things were actually better in the economy, globally, revenues would be expanding at something far greater than what currency adjustments could totally undo. Again, the dollar is not responsible for these “unexpected” disappointments, only revealing the depth and scale of how that is not just one part of the global economy or another – it all stinks and is getting worse.

US stock markets are starting to see that in broader earnings numbers, but again rationalizations cloud, intentionally, interpretations.

What’s unusual is that stocks have gotten more expensive in terms of valuation, even as the market itself has been relatively stagnant: The S&P has logged only mild losses on the year through Friday’s close.

That’s because earnings estimates have fallen dramatically of late. In fact, from the end of the year until now, analysts have decreased their estimate for what S&P 500 companies will earn over the next year by nearly $3, or 2.2 percent. So even as the price/earnings (P/E) equation’s numerator has stagnated, earnings have fallen.

Unsurprisingly, much of the decline in earnings expectations comes from energy sector analysts, who are still reeling over oil’s 50 percent plunge from its 2014 highs. From the end of the year, earnings per share estimates for the energy sector have swooned 27 percent.

Energy, the dollar, overseas economies. It seems as if the only thing in the world going in the right direction right now is the parts of the US economy that best advocate buying more stocks. But even in this respect, there is too much contradiction for it to survive the times. The “dollar” will assure that earnings decline in more than just the energy sector, meaning that even that excuse will have to be inconveniently set aside in the very near future.

That’s because the global economy truly runs not on a “rising” or “falling” dollar, but is desperate for a stable currency regime. That is where the global recovery is hiding, somewhere waiting out the endless monetarism and its deleterious effects on actual business everywhere. The Treasury Secretary proclaims adherence to a “strong dollar” when instead that very result is causing all this trouble; that is simply because nobody seems to remember what a “strong dollar” actually means anymore – fluctuations up and down are financialisms, and thus the direction does not matter as it is all “bad.” What it used to mean is exactly the kind of stability that fosters true economic recovery and advance, with full wages, wealth and all.

Until that becomes a reality, the global economy will shift from artificial advance to decline in near-unison, a threat and reality that is being taken very seriously by credit markets even if stock commentary lives in a stylized, skewed existence that is shrinking with the pool of pretexts and stretched justifications.