With the Chinese manufacturing indications “unexpectedly” disappointing over the weekend it was absolutely no surprise that US estimates of income and especially spending would as well. These overall, broader figures align closely with other indications of a dangerously weak household sector, very much explaining why the rest of the world is screaming about impending contraction.

For all that intuitive sense and logical consistency, the media and their appointed credentialed economists are talking about a totally different world. While there was acknowledgement of a “less-than-stellar” December, somehow there remains a preponderance of “tailwinds” in all commentary.

Despite ending 2014 on a weak note, lower gasoline prices and a firming labor market are expected to provide a huge tailwind to consumer spending in the first quarter.

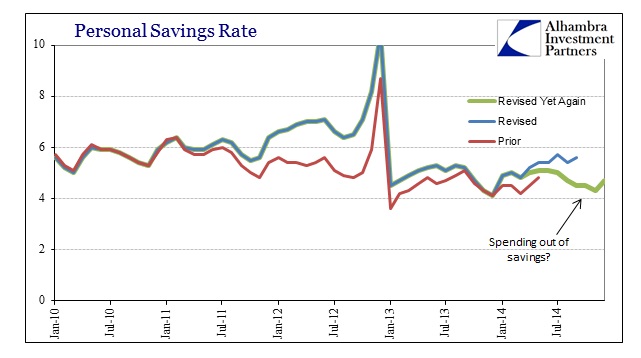

Households have so far used much of the extra income from cheap gasoline to pay down debt and boost savings, according to economists. Gasoline prices have plunged 43 percent since June, according to U.S. government data.

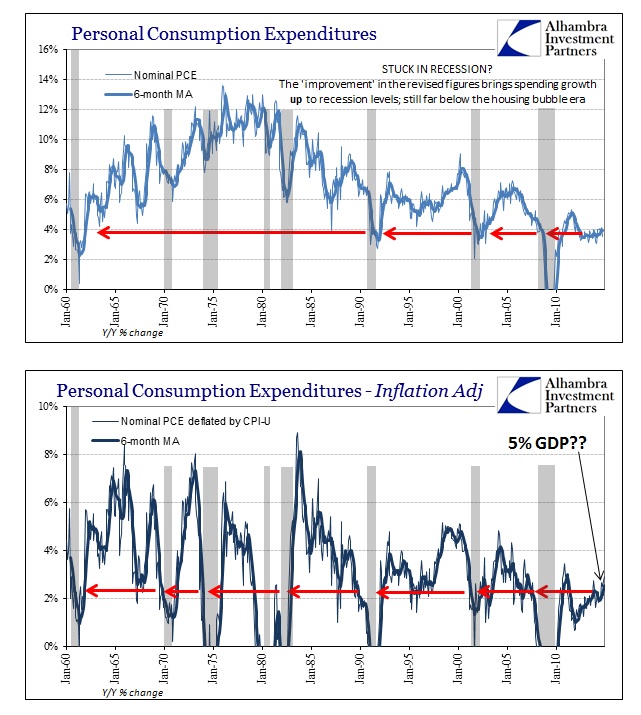

The second paragraph quoted above directly contradicts the first’s blatant cheerleading, as lower gas prices have not been used for spending yet so it is completely unclear (aside from ideology) as to why that would suddenly and sharply change. As it is, any increase in spending is due in no small part to healthcare, which is clearly crowding out other more efficient activity. The major revisions to the savings rate demonstrated this zero sum existence, and now in December does no favors to those looking for a gas price “boost.”

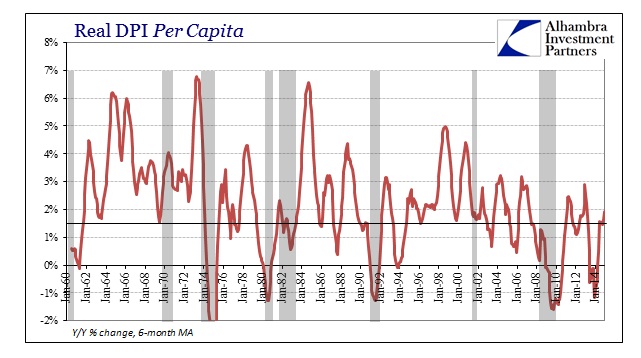

The other part about the “firming labor market” providing another and even more potent lift I just don’t get. I understand that the Establishment Survey says that jobs have become plentiful, exciting economists, but every other broad economic account about income and spending are more than suggesting the opposite conclusion. The context is unambiguous, meaning that any analysis of “tailwinds” is far too exclusive to be even slightly useful.

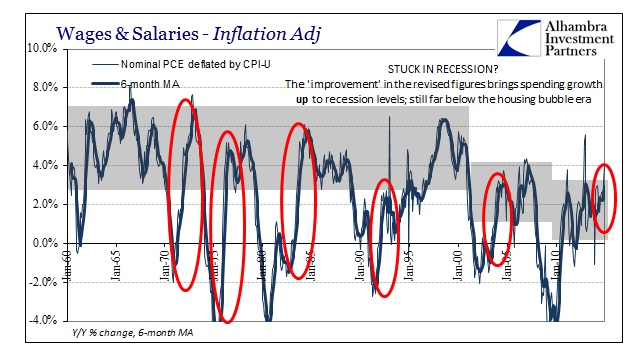

Even wages and salaries, which have been marginally better in 2014 than 2013, show nothing of the tremendous acceleration that typically (without fail, except in this cycle) accompanies a true recovery. Again, relativity in a narrow context is impractical, and in this case very much misleading.

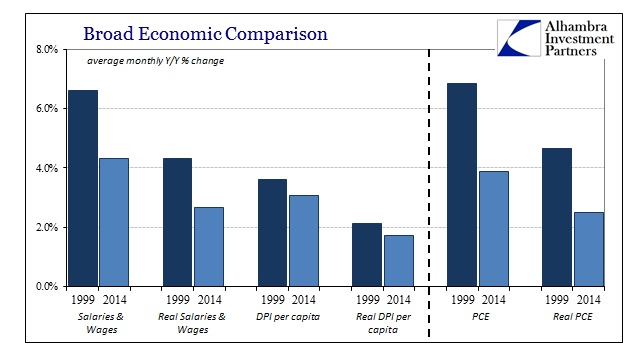

Even setting all that aside, if 2014 was the best year for payroll expansion since 1999 then the household economy in 2014 should have at least a passing resemblance to 1999. As you can probably guess by just the charts above, it doesn’t – not even close.

By every major measure of income and spending, both nominal and adjusted (badly) for some calculated level of “inflation”, the economy of 2014 is absolutely nothing like that of 1999. The numerical count of job gains in the Establishment Survey last year might be of similar magnitude (not counting for population), but so what? If there are jobs in this “cycle” they are nothing like previous jobs and Americans are acting that out in actual and diminished economic activity (as China will tell you).

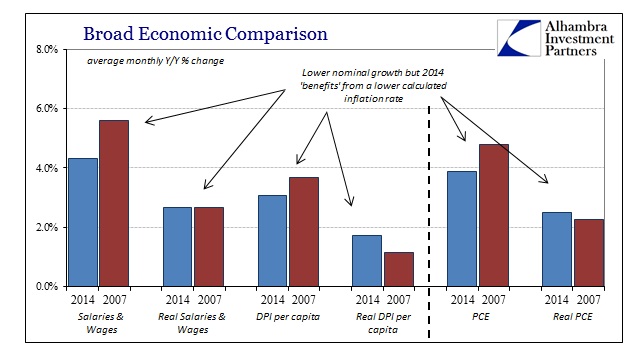

But what should really obliterate this talk of “tailwinds” is where 2014’s household economy does actually relate – uncomfortably so.

Rather than suggest an economy like that in 1999, everything shown above resembles far too closely the pre-recession year of 2007. In fact, in nominal terms, 2014’s results were actually worse than 2007, and it was only a smaller calculated inflation rate that kept these measures equal. If actual and experienced price changes in 2014 were similar to those in 2007, which there is anecdotal evidence for, then in every case 2014 wasn’t just a little more than half of 2009 it was worse than even 2007.

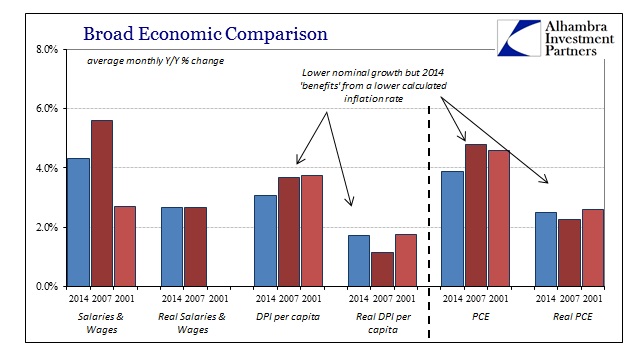

We can also include 2001 as a close comparison. Apart from wages and salaries, the level of DPI, real and nominal, as well as spending levels are far too equitable with the year 2001 to be of much help toward the optimistic outlook.

That means that the economy in 2014 was not in any meaningful manner even close to that of 1999, instead an almost exact copy of what we saw in the pre-recession year of 2007 (which included one month inside the Great Recession itself) and the fully recessionary year of 2001 (the dot-com recession lay entirely within that calendar year). It bears repeating that the Chinese (and the rest of the global supply chain as central banks everywhere are suddenly turning to “stimulus” through new rounds of rate cuts) would wholly agree with that assessment.

The economy being talked about in the media just doesn’t exist, no matter how you view the unemployment rate. There is no spending because there is no income(marginally deficient). Instead, what we see is instability where these low levels of activity and true wealth creation persist. There are no “tailwinds” to be found here, only confusion about the relative state of progress. Going from really bad to less bad is not recovery, just another fact of an unstable economy plodding its way toward the next, and eventual, dislocation. This is very much consistent instead with a smaller overall economy conspicuously absent of sufficient wealth creation; i.e., replete with redistribution instead.