If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume. –– Benjamin Graham

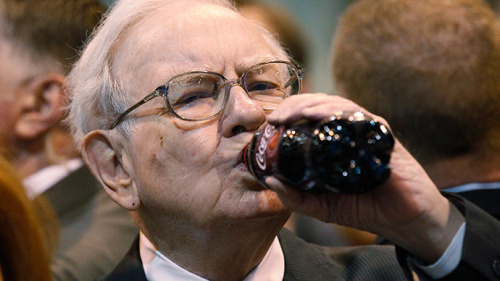

Following the Woodstock for Capitalists in Omaha, Neb. last weekend at the Berkshire Hathaway Annual Meeting, it is reasonable to consider whether there exists a reasonable margin of safety in the U.S. stock market.

The principle of a margin of safety was popularized by Warren Buffett’s mentor, Benjamin Graham, who is known as the father of value investing. The principle is based on the notion that one should purchase a security when the market price is significantly below its intrinsic value. This strategy provides room for error, but doesn’t necessarily ensure a successful investment.

The calculus of defining intrinsic value is subjective as it involves the estimate of a company’s earnings and different ways of calculating intrinsic value.

Add the accumulated intrinsic value of all companies and we get a view on the overall stock market’’s intrinsic value.

If people weren’t wrong so often, we wouldn’t be so rich. – Charlie Munger at Berkshire’s Annual Meeting

Despite protestations from certain market prognosticators and fast talkers, no one knows this answer for sure (I certainly don’t). Neither economic forecasts nor risk ranges, quantitative models nor any other economic or technical signpost guarantees investment success in the hunt for intrinsic value. As I have written, there is no secret market sauce.

We can just try be logical, rely somewhat on history, depend on the statistical flow of economic statistics and, from there, make an educated guess, as there are few certain truths in the investing and trading games.

So far, I have been wrong on interest rates … It is so hard for me to believe that you can drop money from a helicopter and not have inflation, but we haven’t. – Warren Buffett Saturday’s Berkshire Meeting

Buffett told CNBC’s Becky Quick yesterday that stocks are inexpensive if interest rates stay low for the next decade, but not so much if interest rates normalize. I can say with a high level of certainty that interest rates will normalize sometime in the next 10 years, perhaps sooner than later. (The yield on the 10-year note has already risen by almost 60 basis points to 2.14% in the last two months.)

As a consequence, I can say with a high level of certainty that there is limited margin of safety left in the U.S. stock market. That is, reward vs. risk is likely skewed negatively.

I can also say with a high level of certainty, as did Warren with Becky, that bonds (at a 45x P/E, inverse of 10-year U.S. note yield) are more overvalued than stocks (at 18x P/E, the price of the S&P Index divided by projected 2015 EPS).

As I have opined, the end of the 30-year bond bull market might take place this year. And since all asset classes (including stocks) are priced against an artificially-low-yielding 10-year U.S. note, isn’t there a threat to the current 18x P/E?

Moreover, as exquisitely presented by Wells Fargo’s Jim Paulsen, inflationary expectations are being buoyed by higher employment compensation and lower jobless claims, a reversal of U.S. dollar strength, rising rents and home prices, higher oil and non-energy commodities prices. As I wrote in yesterday’s opening missive, “My Tactical Investing Blueprint for 2015,” I have argued that many of these factors are conspiring to take bond yields higher over the last two months, despite anemic and subpar global economic growth.

We think any company that has an economist has one employee too many. – Buffett at Saturday’s Berkshire Meeting

Which raises the question: have the bond vigilantes emerged from hibernation after being absent for years/decades and, if they have returned, what is the impact on equities?

I can finally say with certainty that over almost any future timetable, the yield on the 10 -year U.S. note is overvalued and that, with almost every asset class being priced off of it, means that stocks are overvalued.

With interest rates rising, profit margins at a 60-year high and about 2.7 standard deviations above the average historical margin coupled with nearly every valuation metric (extended Shiller’s CAPE, Warren Buffett’s favorite valuation measure Equity Capitalization/GDP, etc.) there is limited margin of safety today.

Being rational is a moral imperative. You should never be stupider than you need to be. –– Charlie Munger on CNBC

Yesterday’s market advance was interpreted by many, including Jim “El Capitan” Cramer, as a halo effect that followed Berkshire Hathaway’s Annual Meeting in Omaha on Saturday and made investors more comfortable with stocks.

via There Is No Margin of Safety Left- Tumblr

From my perch, Warren should have been less of a cheerleader for equities at his Woodstock for Capitalists and he should have been more of a realist.

After all, according to The Oracle, “price is what you pay, value is what you get.”