By Tyler Durden at ZeroHedge

Yeah but it’s junk credit… who cares! I am invested in solid megacaps and even solider FANGs – what can go wrong?”

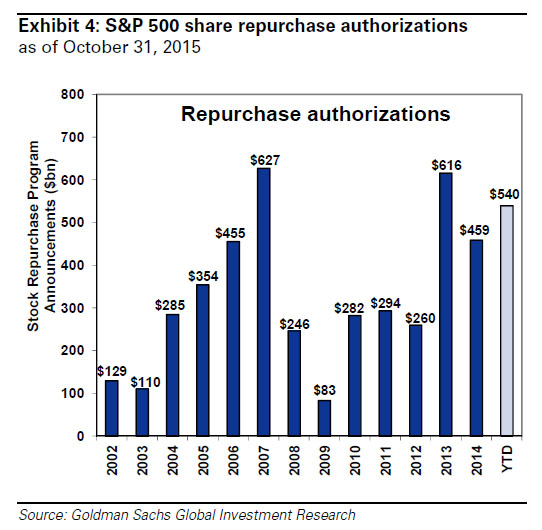

The biggest buyer of stocks in 2016, will be, according to Goldman Sachs, the same as it was in 2015 – corporate management teams buying back their own stock in near record quantities. But there is a problem with this thesis… the cost of funding these epic buybacks is surging, making the un-economic actions of the CFO (if very economical for their own bank accounts as they sell record amounts of their own personal stock to their company) even more irrational.

Here is Goldman’s David Kostin explaining who the biggest buyer of stocks is (and will be) – as a reminder, it’s not “mom(o) and pop”.

We expect corporations will continue to be the largest source of demand for stocks, with net purchases by US companies totaling $450 billion, equal to about 2% of public equity cap. We forecast equity inflows from equity-related ETFs ($225 billion), equity mutual funds ($200 billion), life insurance ($50 billion), and foreign investors ($25 billion). We forecast net outflows from households ($25 billion) and pensions ($150 billion).

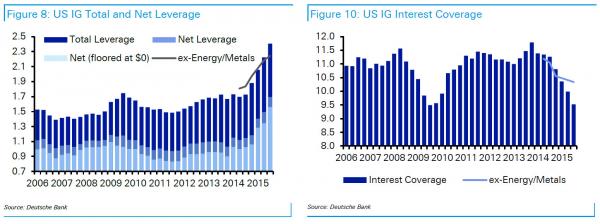

Well, the cost of funding that carnival of financial engineering and artifice (just ask Nordstrom, Macy’s, IBM and so on) is soaring, as high-yield decompression pukes over into investment grade markets, spiking the cost of funding and crushing the ‘economic feasibility’ of debt-funded shareholder-friendliness:

And, in case you thought “well, cost of funding has only gone up 30-40bps in IG, they can handle that,” you are wrong! To all those who claim US corporate balance sheets are in great shape – they are not! Leverage is at record highs and interest coverage near record lows for the IG universe. And judging by today’s collapse in Investment Grade bond prices, the market just woke up to this reality.

Simply put, the Fed’s policies enabled massive releveraging and now corporations are stuck with few options to escape a vicious circle – which by the way, is why it’s called the credit ‘cycle’.

And this is why the contagion to IG matters: the biggest buyer of stocks of the last few years is about to priced away as its (cheap debt) funding dries up, removing the biggest pillar of delusion from current equity valuations.

Source: This is How the Credit Crisis Spreads to Stocks – ZeroHedge