The concept of a tipping point is remarkably easy to relate in the physical world that we actually experience day-to-day. We all have intuitive sense of it owing from that concision and familiarity. In more complex systems analysis, that innate “feel” is no less applicable, particularly where it is transparent, thus making it more confounding that it goes so unnoticed by “experts.”

In post-tsunami Japan, there is widespread recognition that the sudden introduction of merchandise trade deficits would be a significant hurdle to restore vitality in the economic system. A good deal of that analysis, however, has had no more than a cursory focus on the dearth of indigenous energy sources, including the now-evident lack of nuclear generation capacity and usage. Following that line of thinking, turning on the nuclear reactors is believed to assuage so much of the “need” to import, therefore restoring trade order.

Restoration of trade balance is supposed to unleash one of the primary factors of Abenomics: the Japanese export machine. These are nice theories in academic settings, though even there they are far less robust than is talked about publicly. As with the US, however, there is no shortage of faith in these theories and models about theories, a pertinent fact to the unending malaise besetting the global economy.

The real world is just too complex to fit inside the subjective assumptions that create these economic models upon which all monetary interjection, and thus all “markets”, rest. It is not energy that is pushing the Japanese trade deficit, but rather currency instability itself – an outcome not even modeled by monetary “experts.”

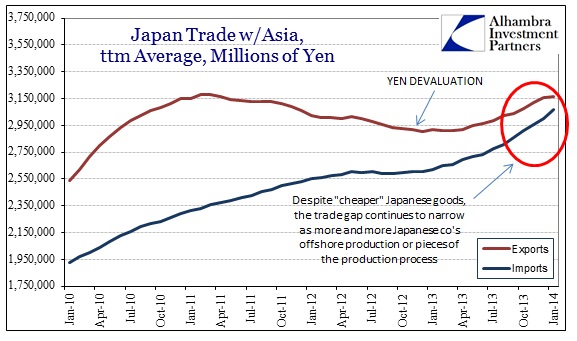

Japanese businesses are doing what they see fit under the circumstances, and given both the scale of currency instability and the persistent and overriding threat of even more (as inevitably it will be viewed as “not enough”), they simply move production capacity offshore. Where once Japan was an export powerhouse, the instability that is supposed to guide this assumed renaissance is instead the very agent of destruction. Just as it is practiced elsewhere, monetary intrusion on a massive scale is only fit to hollow out the economic system.

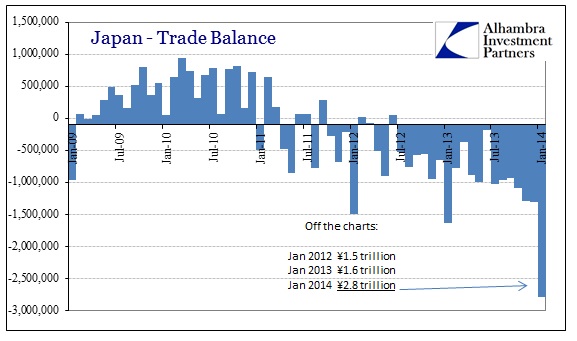

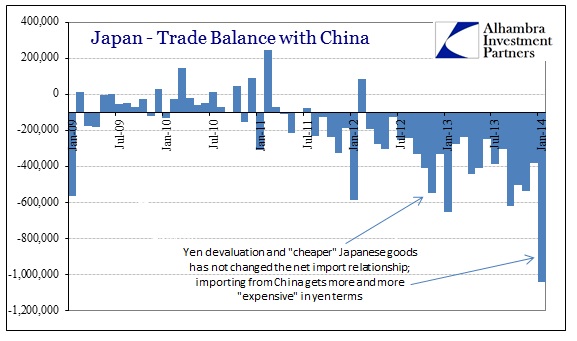

One cannot adequately describe the trade deficit from January. It is clear, or should be but likely isn’t, that monetary practitioners have got “something” very wrong in their theories or the applications of them. It is an axiom of economic “science” that devaluing a currency increases exports and decreases imports (one becomes cheaper, the latter more expensive). What we see here is precisely the opposite, thus rendering that “axiom” more suitable as uneducated or unsophisticated conjecture – and the whole of such monetary science more like faith-based ideology.

And it is far more than just energy here. Again, turning on all the nuclear reactors in Japan tomorrow would not arrest this decay. The sudden abundance of energy in January would have only rebalanced the trade equation by a relatively small amount, the record deficit would still have remained, meaning that there is some other primary factor driving merchandise trade so far in the “wrong” direction. It is an unambiguous rebuke of one of the pillars of recent QE. The massive deterioration in January (indeed all of 2013) was not energy importation, but rather offshoring.

That brings into the discussion the idea of the “tipping point.” In this context, has Japanese theory eroded the real world system so far as to be irreparable now? Has Japan arrived at the point in which offshoring is now self-sustaining?

Self-sustaining is probably too strong a word, but given the primary impulse about currency instability it has to be part of the discussion. Japanese corporations have now seen the up-close impact of yen devaluation on offshore-driven profits. The die has been cast, and profitability becomes more and more remote from the domestic Japanese system. It is the drastic erosion of the very elements monetary theory wishes (expects) to work in its favor.

Imports of machinery into Japan rose 37% Y/Y in January. That’s not all due to yen devaluation (not even close as the chart directly below demonstrates), and it directly contradicts that monetary “axiom” of the appeal of devaluation. That would include, in what has to be a bitter blow to the idea of Japan Inc. 2.0, a 41% Y/Y increase in imports of transportation equipment, a sector that was once the sole province of the first incarnation of Japan Inc.

That was most evident in the export/import balance to the rest of Asia. Where once it was believed to be an eternal export-driven surplus, the gap has almost fully closed in a near-deficit fit entirely within the scope of Abenomics and devaluation.

As industry so clearly moves away from the growing artificial instability, profitability increases, particularly for the financial sector. That leads to an increase in the amount of resources dedicated to financial management of all this instability, set against the profit motives and operational constraints that favor offshoring. At the margins of the Japanese economy, then, we see where the system becomes so hollow – dedicated increasingly to finance in the place of losses in true production. That all sectors appear more profitable is the illusion, because the means required to achieve that fact are very different and ultimately scale well past detrimental.

Beyond some point, this theoretical tipping point, lies a condition whereby Japanese firms will derive too much profitability from offshoring and the accounting “boosts” from devaluation to be irreversible – in the parlance of the orthodoxy, it gets more and more “sticky” as more overseas investments are made. That will tend to operate as a positive feedback loop whereby the only “solution” palatable to both authorities and multi-nationals is doing more of that which is hollowing out the economy in the first place – intervention through instability.

Given January’s dire trade results, you have to wonder how close to the tipping point the Japanese have become – or even whether it has been crossed. It is far too early to tell at this point, only through further analysis and study will it be revealed (and only to those not captured by the orthodox ideology). It is very clear, however, that January (as if 2013 alone didn’t) should completely refute the mainstream “axiom” about which so much of Abenomics depends. As if this wasn’t all revealed in the Federal Reserve’s 2008 discussions, we have ongoing empiricism here (and nearly everywhere) of just how little understanding and competence is yielded by orthodox economics.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com