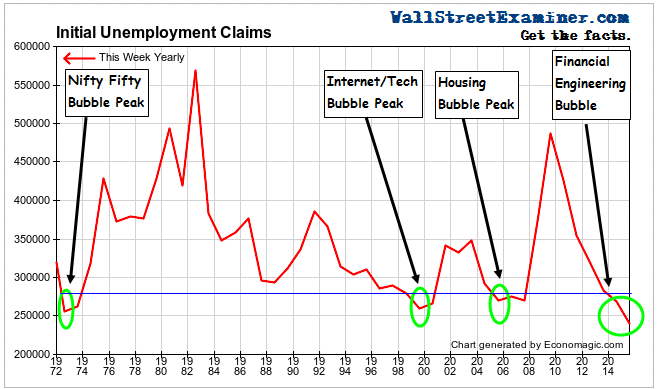

First time claims for unemployment compensation hit a 41 year record low last week at just over 198,000. This was the actual number, not subject to any seasonal hocus pocus. 41 years ago the labor force was only 60% as large as it is today, so on a workforce size adjusted basis this number was even more extreme.

There were just 1,400 claims per million employed workers last week. That compares with 1,905 in the Labor day week at the top of the housing bubble in 2006 and 1,785 in the Labor Day week at the top of the Internet Bubble in 1999. The Labor Day week always sees the annual low in claims, but the current week is remarkable in terms of how much lower it is than previous records. In stock market terms we think of a move like this as a “blowoff.” Was this the final “blowoff” in initial claims?

Almost certainly it is not good news, considering that previous records were also associated with bubble peaks and peak economic activity resulting from those bubbles.

In the previous week, the trend had appeared to go flat. A 2 year string of record lows in initial unemployment claims finally appeared to be ending. This week reversed that.

The stock market recently had a break. Historically, as bubbles start to deflate, employers usually seem to be the last to get the news. But the very fact of their record long term ebullience should be warning enough, as chronicled here in these reports over the past year. Employers still haven’t wisened up. The real job cuts are still to come.

The Department of Labor (DoL) reports the unmanipulated numbers that state unemployment offices actually count and report each week. This week it said, “The advance number of actual initial claims under state programs, unadjusted, totaled 198,597 in the week ending September 12, a decrease of 33,910 (or -14.6 percent) from the previous week. The seasonal factors had expected a decrease of 25,314 (or -10.9 percent) from the previous week. There were 242,318 initial claims in the comparable week in 2014.”

The comparison to the comparable calendar week in 2014 is not apples to apples. With Labor Day on September 7 this year there was one fewer day in which claimants could Labor Day fell in the prior week in 2014. However, in the comparison of the current week with past years, we can see that this week beat the record low September week for each year, which is normally the Labor Day week.

Below is a 10 year chart of the actual data.

Click here to view chart if viewing in email

We use actual data, as opposed to the seasonally finagled headline numbers which Big Media shovels out for mass consumption. We want to see from the actual numbers if there’s any evidence of trend change. So we look at how the current week compares with this week in prior years and whether there’s any sign of change in the trend. The actual change for the current week versus the prior week was a decrease of 33,900 (rounded). Given that the only other time that Labor Day was on September 7 in the 21st century was in 2009, we compared this week with the past 10 weeks in which Labor Day fell each year from 2005 to 2014.

The 10 year average for actual data for that week was a decrease of -26,200. This year was stronger than that average and stronger than 2014 which had a decline of -15,000. The record decline for this week was, -55,000 set in 2009 when Labor Day was also on the 7th, and when the US economy was beginning its bungee rebound from the crash that ended that year in March.

Week to week changes are noisy. The trend is the thing we must watch. The annual rate of decline in claims surged to the low end of the normal range this year with a drop of 18% compared to the same calendar week. The drop was 15% compared to the Labor Day week last year. Since 2010 the annual change rate each week has mostly fluctuated between -5% and -15%. The annual rate of of decline had been steadily moving toward zero since April. This week reversed that trend.

A shift to a year to year increase in claims would be a sign that the US economy could be headed for recession. The stock market is a key. When it weakens, employers will take their cues from that. The Fed knows that businesspeople watch the stock market and often base hiring and firing decisions on its direction. A weakening market would make the Fed even more cautious to make significant changes in policy. The FOMC today again refused to attempt to raise interest rates in part due to the stock market. It shows that everybody watches the markets and makes decisions accordingly.

Click here to view chart if viewing in email

The real time Federal withholding tax data which I track was consistent with the claims data until mid August. It was very strong in July and through mid August but began to tumble late in the month and since then through September 15. The year to year growth rate, adjusted for wage inflation, has now dropped to zero. That has happened twice before in the past year, but each time collections recovered within a couple of weeks. The current weakening may be part of the normal short term cycle or it could be something more serious. This is where the rubber meets the road. We will continue to track this in the weekly Wall Street Examiner Pro Trader- Federal Revenues report.

Don’t be surprised to see the claims data begin to reflect the weakening in tax collections soon.

Below is a review of the implications of the extreme readings on initial claims from a post n August 13, 2015.

“However, it is absolutely normal for employers to completely miss the signs of impending doom.

“In recent weeks, Big Media and others have noted the fact that claims were recently lower than the record low of 1973. What they failed to mention was that that low came well after the Dow reached an all time high in January of that year. The devastating 1973-74 bear market, which cut the value of stocks by 50%, was in its early stages. This was an early example of employers being late to the funeral.

“Similar employer hoarding of workers has been associated with bubbles in the more recent past and has led to massive retrenchment, usually within 18 months or so. In the housing bubble, employer hoarding behavior continued well beyond the peak of that bubble in 2005-06.

“It’s worth noting that there was an institutional stock market bubble in 1972-73. It was the Nifty Fifty bubble, where the biggest best known stocks kept soaring while everything else in the market went nowhere. A bubble does not require mass public participation. Institutional bubbles are just as insidious, even more so.

“The current string of record lows in claims is now 6 months beyond the point at which other major bubbles have begun to deflate. Based on the fact that previous records were attained at and for some time after the peaks of massive bubbles, by that standard, the current financial engineering, central bank bubble finance bubble, which is very much a big money, institutional bubble, may be the bubble to end all bubbles!

Click here to view chart if viewing in email

“As a result of the fact that employers apparently tend to take their cues from stock prices, we cannot depend on the next downturn in the claims data to give us advance warning of a decline in stock prices, although there should at least be concurrent confirmation. However, history shows that the fact that claims are at record lows is warning enough! In this case, the warning has lasted far longer than ever before.