Whatever her other faults, and they are legion, Janet Yellen has impeccable timing. On the day the FOMC actually voted to raise the irrelevant federal funds rate, thus signifying to the world the soundness of the economic circumstances, the Federal Reserve calculated that industrial production had contracted for the first time (for the month of November). It was a significant shift, as IP is one of the longest and most reliable economic accounts in existence. The appearance of a negative number at the headline is reserved almost exclusively for recession; leaving the Fed to declare both recession and recovery on the very same day.

If that set up something of a debate or battle between competing narratives, it has only gotten worse for Yellen’s side. IP has since been revised lower such that the start of the steady contraction is now set two months earlier at September, and by the time the Fed “raised” rates (RHINO) industrial production had actually declined by more than 2%; a level in the historical data that has precluded any other cyclical condition but recession.

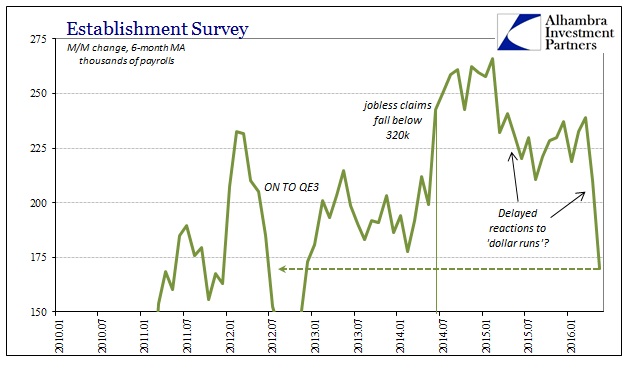

Time and again with each new and “unexpected” appearance of the negative sign, the refrain from policymakers and economists alike has been in unison, “but the labor market.” With only an increasing degree of emphasis, the monthly chained variation of the Establishment Survey has been wielded over the past year and a half as if it was the actual stimulus itself (and there is a great deal to the accusation, rational expectations theory and all). The Fed is data dependent whereupon the “data” is their own speechmaking.

My colleague Joe Calhoun put it best:

And so once again, the Fed finds itself with egg on its face, hoisted by its own petard of forward guidance. As I’ve said numerous times over the last few years, forward guidance – what other kind of guidance is there by the way? – is only as good as the Fed’s forecasting ability. Which is, sad to say, not very good. Forward guidance has itself become the destabilizing force, a source of volatility rather than a dampener, creating uncertainty rather than providing the opposite. It is hard to believe markets would have had to adjust so sharply Friday if the members of the Fed had just been silent the last few weeks.

Building on Joe’s central point, they can’t be silent because their unhinged howling at the moon is all there is. With the Friday’s payroll report, even the unemployment rate takes on very different connotations. To which Chairman Yellen, unsurprisingly, replies today as if it never happened:

I see good reasons to expect that the positive forces supporting employment growth and higher inflation will continue to outweigh the negative ones. As a result, I expect the economic expansion to continue, with the labor market improving further and GDP growing moderately.

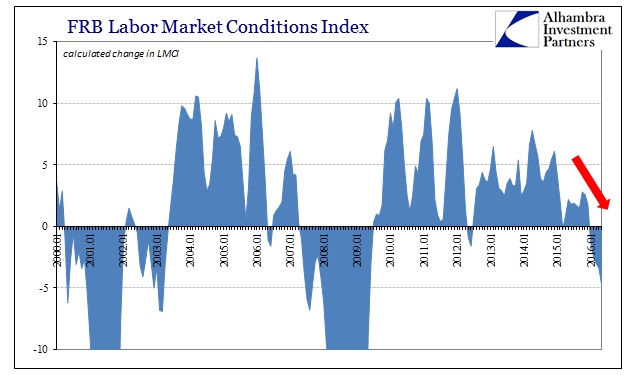

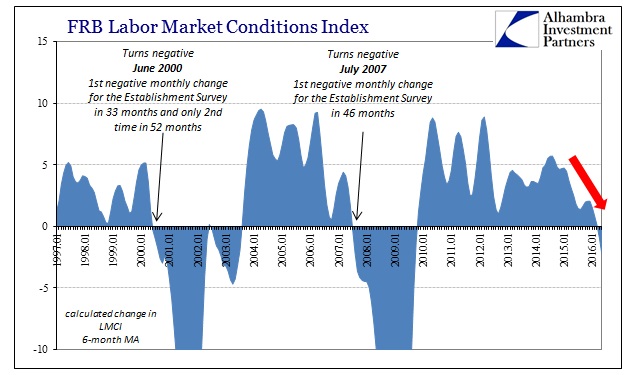

Her comedic timing is just flawless. Just in time for “labor market improving further” the Federal Reserve also today released its May 2016 update to the Labor Market Conditions Index. The LMCI is a factor model expressly produced so that monetary policy and policymakers would not be reliant upon just one metric for their analysis of the labor market; recognizing, as anyone with common sense, that the unemployment rate in this condition is very flawed. The latest release is, as IP in December, the opposite of what Yellen says.

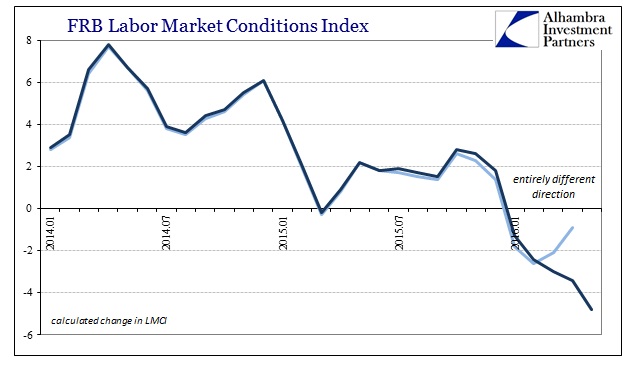

The index change for May was nearly -5, a further deceleration from April’s heavily revised -3.4. That suggests from the Fed’s own crafted labor quantification attempt the jobs market not only got worse but did so at an increasing rate. And you have to in at least this one instance hand it to the regressions of the factor model, as in the past two cycles whenever the 6-month average turns negative the Establishment Survey does too. In the current case, though we don’t have a negative headline payroll print to match, this most recent decline in the LMCI certainly seems to match up with the trend in the monthly variation, almost predicting not just Friday’s disappointment but perhaps finally a negative sign in the very near future, as well (likely unleashing still future downward revisions to all of it).

Again, even the latest revisions (non-benchmark) were more egg to Yellen’s already spattered face. She still says the labor market is more improving than not, but now both the index and revisions to it are aligned squarely against her. Janet Yellen all but has to say the economy is improving because without her shaky, narrative voice there is truly nothing left to her economy. If she doesn’t say the word “overheating”, and all the obfuscating mush that goes with it, then the media can’t report it as if it were the only fact of this economy. She should think about suing Ben Bernanke (and Alan Greenspan) for leaving her no choice but to dutifully play the idiot.