By Tyler Durden at ZeroHedge

You know it’s bad when… Following a dismal October, Swiss watch exports continued to collapse in November. As we noted previously, not only are luxury jet values dropping for the first time since 2009, London mansion prices plunging, San Francisco home sales collapsing, and Sotheby’s laying people off, but, despite desperate major price cuts, Swiss watch exports tumbled 11% YoY (in USD terms), the worst November since 2008.

In Swiss Francs, this is the biggest November plunge in Swiss watches since 2009…

And in USD, the largest collapse since 2008…

As RBC’s Rogerio Rujimori reports, it appears driven by the collapsing Chinese wealth bubble outflows via Hong Kong…

By region, the focus is likely to be on Hong Kong which registered declines of -28% despite the comparative easing by 19ppt (vs. -39% in Hong Kong, -18% in September and -18% in August), which suggests an underlying deceleration of 11 ppt. China expanded by 17% given the comparative also eased by 19ppt (vs. +5% in October, -13% in September and -39% in August), whilst USA declined by 5% and the UK expanded by 14% and Japan expanded by 9%.

All major regions experienced value and volume decline: Asia exports declined by 6.8% by value and 2.3% by volume implying ASP declines of c5%, whilst Americas value declined by 5.5% and volume declined by 7.9% implying ASP declines of 2-3%. Europe value declined by 4.5% and volume by 1.6% implying ASP declines of 3%.

All price points declined with CHF 200-500 and CHF 3000+ registering the most significant contraction (~10%).

Stock implications: We were expecting some improvement in export trends largely owing to easing comparatives, however the deceleration in Hong Kong comes as a surprise, illustrating continued pressure on the luxury watch segment in Asia and read-across to Swatch Group and Richemont is negative.

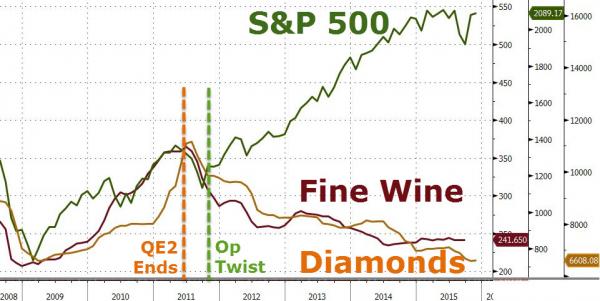

But, as we recently pointed out, aside from Swiss Watches, it appears only one thing has really benefited from The Fed’s largesse (as demand for Diamonds and Fine Wine has crashed)…

The rich appear to be cinching up the purse strings, and as we concluded previously, that is not a good sign…

So the rich are becoming less rich? To an extent, yes. Recent declines in commodity prices and emerging market debt have no doubt taken a bite out of some big portfolios. Meanwhile hedge funds, the preferred investment management vehicle of the uber-wealthy, have done badly for the past couple of years, with some high-profile implosions generating headlines.

These disappointments have lowered the net worth of some big players and made others more cautious. Hence the lessened demand for the most pretentious assets.

The impact on the global economy? Almost certainly bad, since the 1% are the marginal buyers of so many reference assets like blue-chip stocks and government bonds. To the extent that they grow cautious, the bid for a lot of things will be lower, cutting corporate profits, equity valuations and high-end asset prices.

Put another way, when the only healthy part of an already-impaired system turns negative, everyone will feel the resulting pain.