By Tyler Durden at ZeroHedge

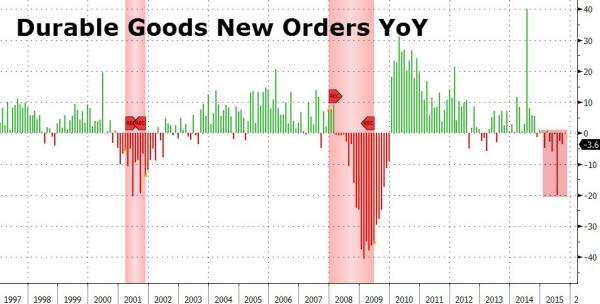

After a significant downward revsision to August’s data (to -2.3% MoM), September Durable Goods New Orders dropped 1.2% (better than the expected 1.5% drop only due to historical revisions) for the 5th monthly drop this year. Year-over-Year, Durable Goods orders tumbled 3.6%, accelerating weakness from August amid major revisions. This is the 6th consecutive YoY drop, something not experienced outside a recession. Under the covers it was just as ugly with Non-defense, ex-aircraft orders dropping 0.3% (notably missing expectations) after a huge downward revision for August. What is most worrisome, however, is the collapse in Core Capex YoY down 7.9% NSA – the worst since 2009.

Chart: Bloomberg

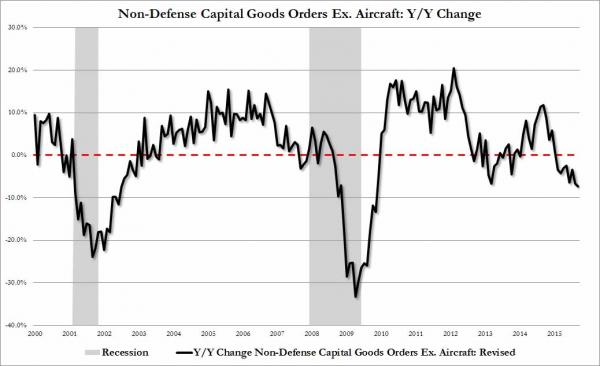

As Core Capex (NSA) collapses

Chart: Bloomberg

And even after the magical seasonal adjustments, Core Capex is the worst since 2009:

Not a pretty picture to hike rates into: simply put, we’re gonna need “moar” war, because The US is either in or entering a recesssion.