By Tyler Durden at ZeroHedge

Long before negative interest rates shifted from the monetary twilight zone into the mainstream (with some 30% of global government bonds now trading with a subzero yield), one organization wrote a report warning about the dangers of NIRP. The NY Fed. Back in 2012, NY Fed staffers wrote “If Interest Rates Go Negative . . . Or, Be Careful What You Wish For” it warned “if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printingwill likely be called upon to print a lot more currency as individuals and small businesses substitute cash for at least some of their bank balances.”

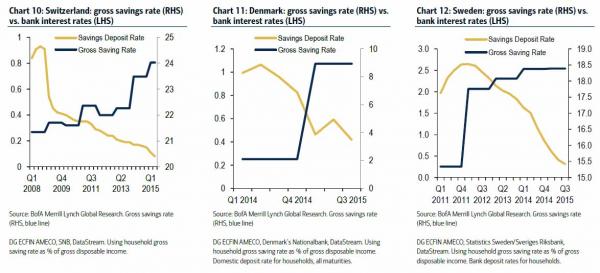

Then, last October, Bank of America looked at the savings rates across European nations which had implemented NIRP and found something disturbing: instead of achieving what what central banks had expected, it was leading to precisely the opposite outcome: “household savings rates have also risen. For Switzerland and Sweden this appears to have happened at the tail end of 2013 (before the oil price decline). As the BIS have highlighted, ultra-low rates may perversely be driving a greater propensity for consumers to save as retirement income becomes more uncertain.”

The evidence:

Which was to be expected by most people exhibiting common sense: NIRP by definition is deflationary, and as such as prompts consumers to delay consumption, and as a result to save as much as possible, if not in the banks where their savings may soon be taxed under NIRP regimes, then in cash.

And nowhere if the failure of NIRP – and unconventional monetary policy in general – more evident than what just happened in Japan, where according to Japan Times, the Finance Ministry plans to increase the number of ¥10,000 bills in circulation, amid signs that more people are hoarding cash.

It will print 1.23 billion such notes in fiscal 2016, 180 million more than a year earlier. The number of ¥10,000 bills issued annually leveled off at around 1.05 billion in the fiscal years from 2011 to 2015.

The paper adds that some financial market sources believe it is because more people are keeping their money at home rather than in banks, because interest rates on deposits have fallen to almost zero after the Bank of Japan introduced a negative interest rate in February.

Actually make that most market sources, because the failure of NIRP is now too staggering for even tenured economists to deny. As for Japan, Kuroda appears to have made the country’s chronic over-saving problem even worse.

The total amount of cash stashed at home is estimated to have surged by nearly ¥5 trillion to some ¥40 trillion in the past year, Hideo Kumano, chief economist at Dai-ichi Life Research Institute, said.

He attributed the sharp increase to people not wanting their wealth to become known to authorities following the introduction of the My Number common identification system for tax and social security.

In addition, the BOJ’s negative rate policy “may have fueled concerns among the public about depositing their money in banks,” Kumano said.

There will be 200 million ¥5,000 bills issued in fiscal 2016, down by 80 million, and 1.57 billion ¥1,000 bills, down by 100 million.

Recent BOJ data show daily averages for currency in circulation rose 6.7 percent from a year before to ¥90.3 trillion at the end of February, the sharpest growth in 13 years.

The number of ¥10,000, ¥5,000 and ¥1,000 bills in circulation increased 6.9 percent, 0.2 percent and 1.9 percent, respectively.

The punchline: not only has the Japan’s aggressive attempt to escalate QE now been unwound, with all USDJPY gains since the October 2014 expansion of the BOJ’s QE been lost, leading to a comparable collapse in the Nikkei.

As for the BOJ printing more cash, that is merely a case study for what will soon happen in other NIRP-friendly regimes at least until cash is banned, of course.

Source: Japan Prints Additional ¥10,000 Bills As People Scramble To Stash Away Cash – ZeroHedge