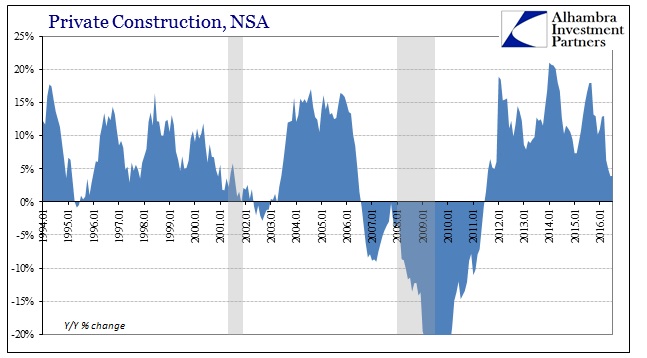

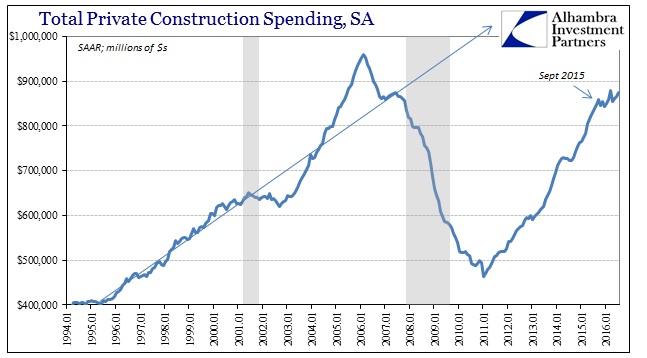

Total construction spending was essentially flat year-over-year in July 2016. Public construction at both the state and local and also the federal government levels declined more than 3% Y/Y. Excluding the public sector, private construction spending (NSA) was up just 3.9% in July for the second month in a row. That was the lowest increase since the housing rebound started in the summer of 2011.

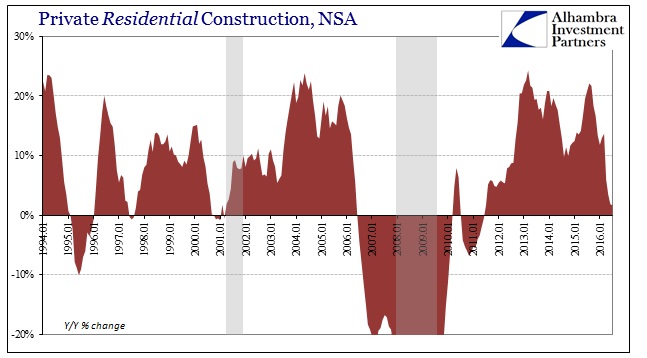

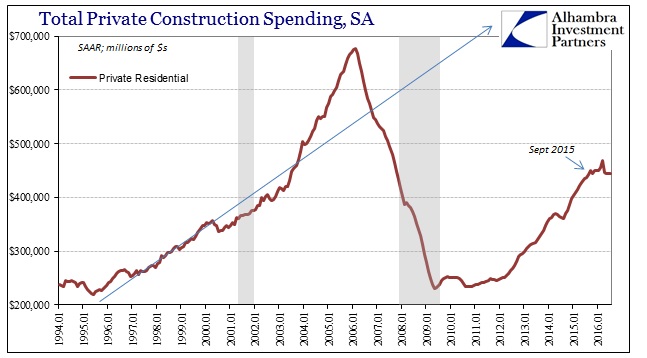

While total private construction includes both residential and non-residential activity, it has been the residential side that is responsible for the dramatic slowdown this year. Year-over-year growth (NSA) was almost 21% in July 2015, but just 1.7% in July 2016, following a revised 1.8% in June. Like overall construction, those were the lowest gains by far during this housing rebound.

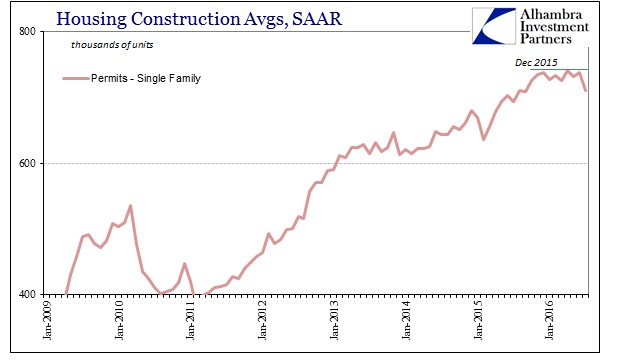

In seasonally-adjusted terms, construction of and on (spending includes remodeling activity) single-family homes declined for the fifth straight month in July, matching the pattern observed in forward real estate construction estimates (permits and starts). Multi-family construction spending was down 1.7% year-over-year in July.

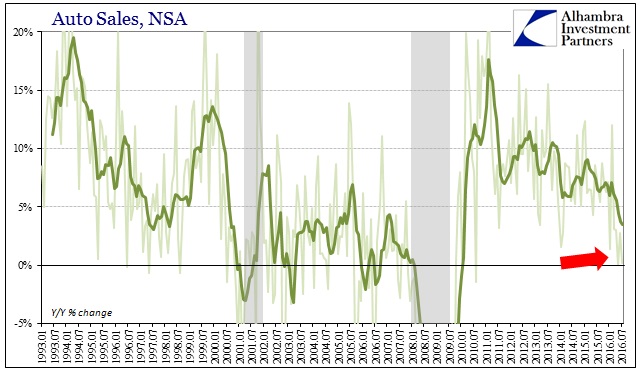

It does appear as if “something” has changed in 2016 with regard to the real estate market, a possibility raised not just by permits and starts but also resales, and with weakness coming from the residential end of that market it suggests consumer confidence and/or ability to spend on new homes or the remodeling existing ones. It is also consistent with the growing sense of trouble in the auto sector, as more weakness is indicated across more data points in the two largest consumer purchase items.

The shift or drag in residential construction dates back to last September, an unsurprising development given both what occurred then and how many other economic accounts show the same inflection point. Further, while it isn’t yet consistent with recession or full contraction, it does suggest that the arrival of “global turmoil” did create a broad negative effect nonetheless. The construction estimates add additional evidence to the sense that such negative pressure was a more-than-temporary strain in one of the two areas of consumer spending (the other being autos) that have been the majority of the margins in this anemic economy.