Whether or not the Olympics in Brazil go off without any serious difficulties is actually an open question. There have been some athletes refusing to attend due to concerns over the Zika virus, while police and firefighters greeted travelers flying into the country through Rio’s airport with a sign that said “Welcome to Hell.” There are rumors reported in the Portuguese news that the public health system is close to collapse, with no money to pay doctors and nurses as well as police and firefighters. With the eyes of the world nearly upon it, the nation of Brazil seems ready to show off instead what happens in an acute “dollar” shortage.

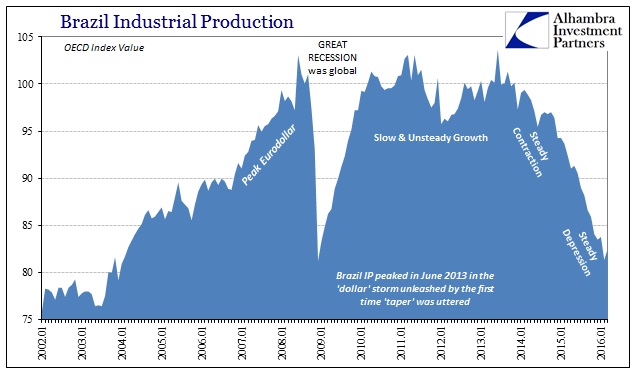

The devastation in the Brazilian economy is really unlike anything seen in its modern history, and Brazil is unfortunately no stranger to grand economic and financial difficulties. That tortured past had at one time not so long ago seemed an ancient memory, trouble for only historians. As recently as early 2012, Brazil appeared to be mending after its brush with the Great Recession. The mid-2000’s had built up what appeared to be the foundation for at last lasting prosperity no matter what the rest of the world was doing.

Yet, in 2016 we find instead some of the most extreme cases of malaise and contraction. This is no recession, as what is taking place would be categorized if it were a financial price or indication as a total unwinding. It really does seem as if all of the wealth created by Brazil’s 21st century expansion is coming apart and just vanishing into the political chaos of an unsettled social state.

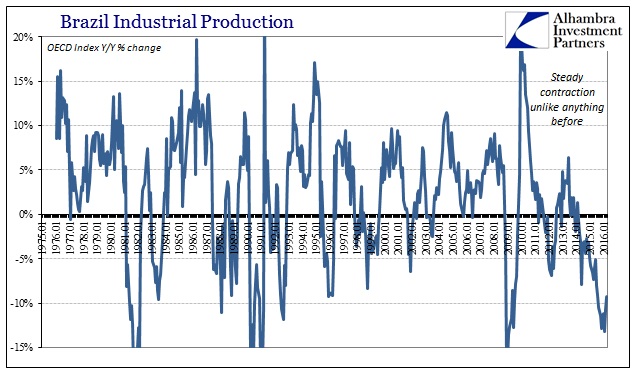

In the early 1980’s during what the US would experience as its own double-dip recession, Brazilian industrial production declined sharply but for a duration of just13 months. This was near the start of the country’s prolonged bout of currency instability. Nearly a decade later, toward the end of Brazil’s chaotic monetary run, IP would decline again for another 13 months starting in early 1990, and then yet again in 13 of the next 20 months. Top to bottom in what was some of the worst economic circumstances in its history, industrial production declined about 20% (OECD figures).

Starting in early 2014, just after a sudden and sharp brush with the currency disruptions of 2013, industrial production has now declined for 26 consecutive months (through April 2016). Dating back to September 2011 (and what was a very important month in eurodollar history for all the wrong reasons), Brazilian IP has been positive in just 14 of those 56 total months. Top to bottom, or at least to the current estimate, production has declined again by about 20%. Though that is similar in scale to the early 1990’s, there is as yet today no end in sight and no respite while the decline only wears on.

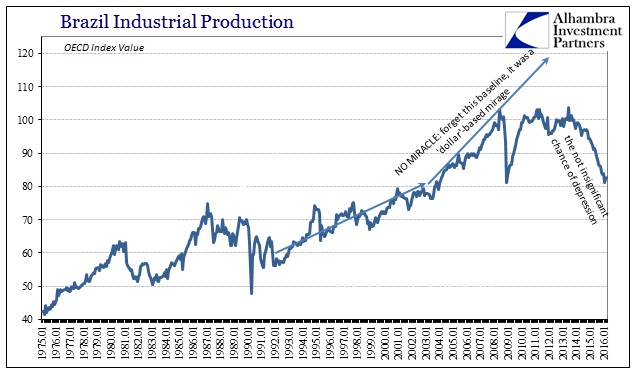

Monetary reform by the mid-1990’s had paved the way for much steadier growth for the Brazilian base economy. By around 2003, however, it appeared as if the Brazilian system had found another level of prosperity to which the mainstream assigned “proper” policies as the cause. This meant all the criteria that were supposedly met imposed by orthodox economists and their assumptions of “capital flexibility.” But none of that answers how it could all just disappear so suddenly and drastically – especially after being cut short around 2011 in recovery from the Great Recession.

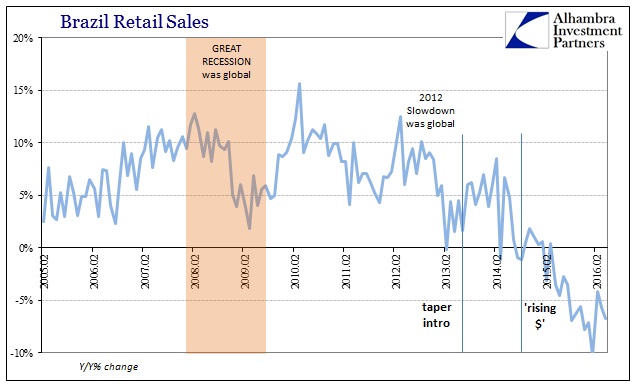

As Brazilian industry has fallen into alarmingly steady contraction, the rest of the economy has only followed. Retail sales, which had barely noticed the Great Recession at all (adding one more fallacy to the idea of permanently-achieved prosperity in the mid-2000’s), have now fallen in 13 consecutive months (through April) and 17 of the last 26 dating back to early 2014. The 6-month average “growth” rate is -7% compared to +4.4% at the worst in 2009.

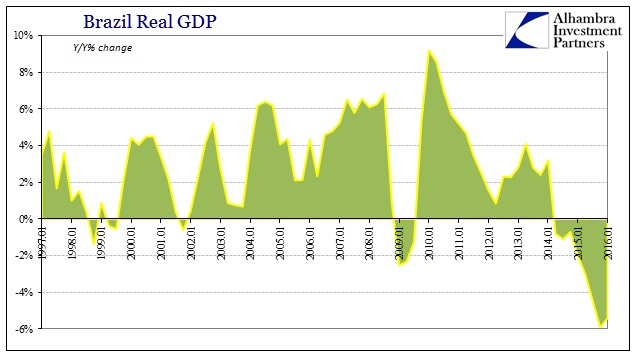

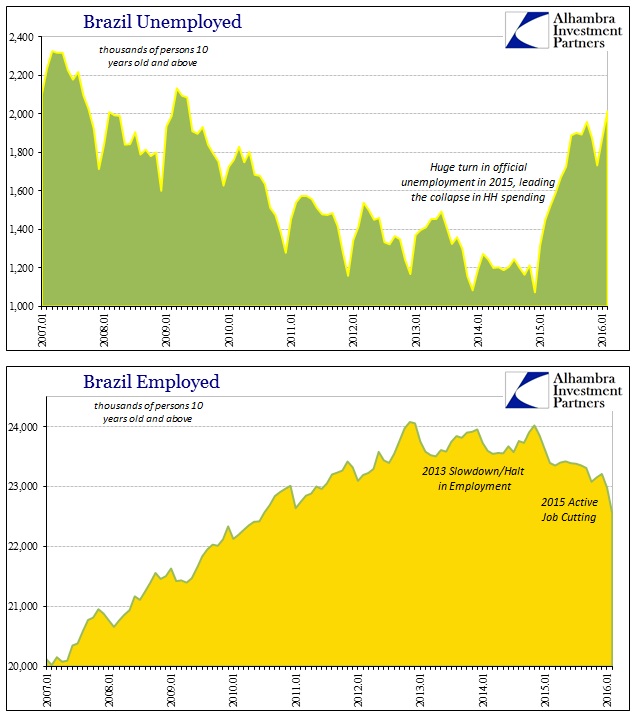

GDP has now fallen year-over-year in each of the past eight quarters at an overall increasing rate. Though Q1 GDP was “only” -5.4% and thus slightly better than the -5.9% in Q4, it was still by far the second worst quarter since the early 1990’s. Even employment in Brazil has been affected, with official measures of payrolls falling while the tally of jobless rose sharply in 2015.

That means the industrial basis for the Brazilian economy, which includes its vast resource sector, has been so seriously degraded that it has pulled down the rest of the economy in a way not seen in at least twenty-five years. And, as noted above, since there is yet no end in sight, there is the non-trivial chance that Brazil has found itself gripped by extended depression perhaps unlike anything in any of its modern history.

It wasn’t supposed to be this way, not after the “miracle” of the late 1990’s and mid-2000’s.

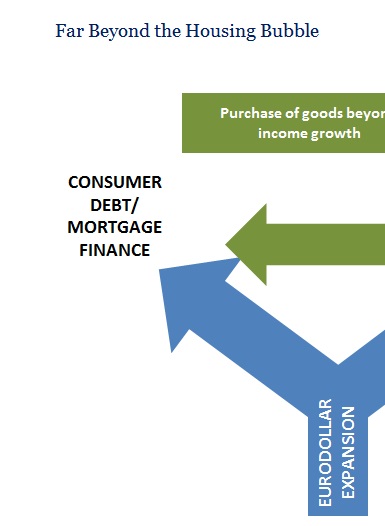

Our own US-centric view has perhaps obscured too much of the full nature and extent of the asset bubbles. We know very well the housing bubble even to the point of its European infection and manifestation – smaller German banks, for example, being almost routinely nationalized during the crisis because of US real estate exposure. But in reality, the housing bubble and the securitization mess were only one part of the asset bubbles of that time, and arguably the smaller part.

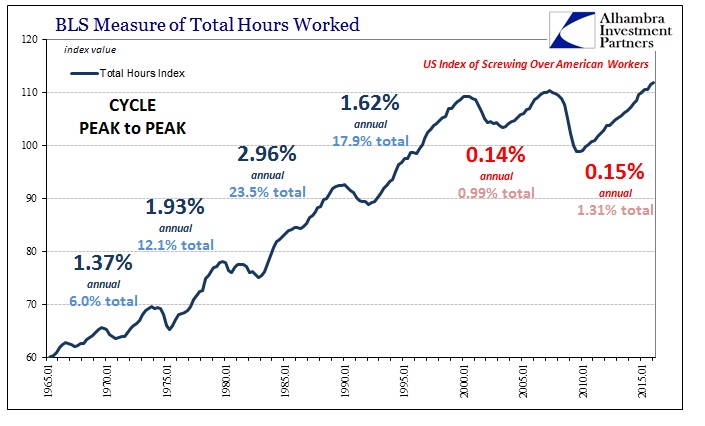

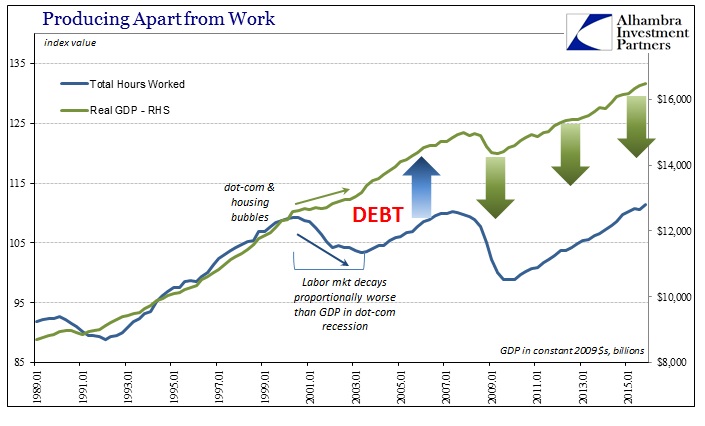

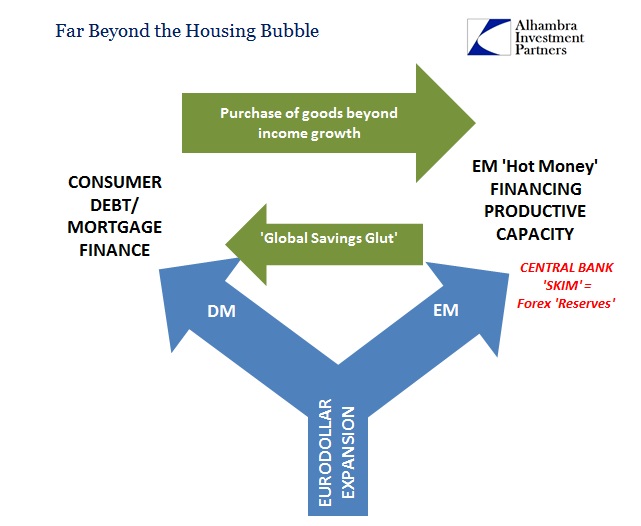

The effect of this avenue of eurodollar expansion was to “supplement” growing weakness in earned income and overall labor utilization. In other words, debt expansion essentially financed continued consumption at the (wide) margins, offering steady consumption as production jobs moved offshore and were only partially (and temporarily) offset via other industries like FIRE and construction. For EM’s like China that were seemingly the greatest beneficiaries of this productive migration, the consumer “half” of the eurodollar bubbles meant what seemed like a steady baseline of customers (and it was not just US consumers) that was extrapolated far into the future.

To meet both the growth in consumption as well as the greater market share of it, EM economies needed an influx of “capital” to finance productive capacity to keep up. This was the other part of the eurodollar bubble that remains poorly (if at all) understood in mainstream commentary. As it was, contemporary to its implementation, central bankers around the world could not grasp either the nature or extent of its processes. At the Federal Reserve, both Alan Greenspan and Ben Bernanke continued to refer to a mysterious “global savings glut” as if demographic-driven retirement savings had out of nowhere crystalized into foreign buying of US treasury bonds (among other asset classes).

In reality, the “global savings glut” was just one process by which foreign participants in this eurodollar expansion attempted to control or at least influence it and its nature. Foreign central banks had often pegged their currencies or manipulated them to some degree, which then became part of their official foreign “reserves.” In effect, however, the greater the level of foreign “reserves” the more it only indicated the further penetration of the eurodollar expansion via what is really a “global dollar short.” Brazil, as is well-known, amassed a huge pile of seemingly incontrovertible “dollar” reserves.

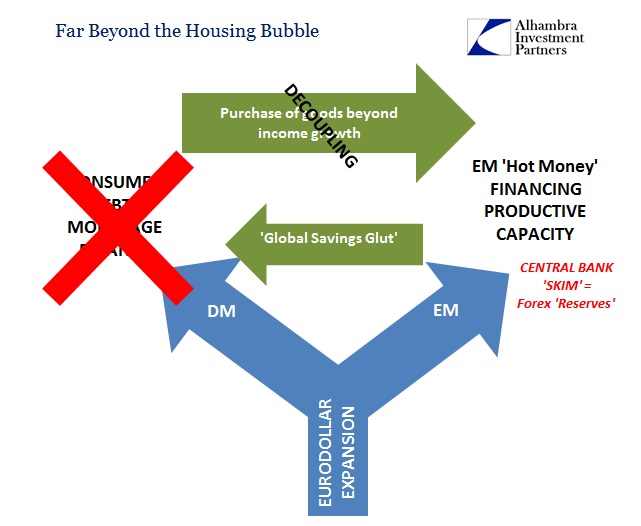

From this view, both the EM rise and fall makes perfect sense within the context of the eurodollar system’s variable conditions. The 2007-08 crisis and Great Recession were a temporary, it seemed, interruption in “dollar” flow, which had the effect at first of altering only perceptions of the DM part of the eurodollar bubbles. Called the “new normal”, the weaker-than-expected recovery placed a greater financial emphasis on EM’s in “decoupling” as their mid-2000’s “prosperity” supposedly provided a platform for relative economic outperformance via maturing economic foundations (consumer-led rather than export-led).

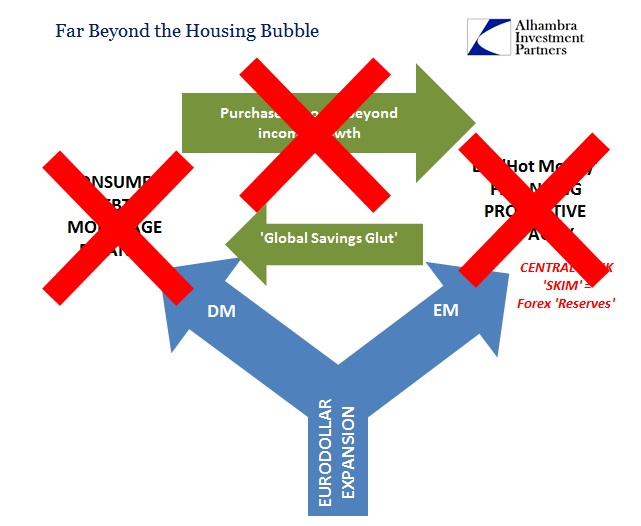

But this was another false assumption predicated on global monetary misunderstanding, as by 2011 overall eurodollar expansion began to erode into not just a “new normal” in DM economies but in increasingly disruptive fashion to EM financial flows (and really assumptions about conditions like volatility).

Since prosperity was all along nothing more than a eurodollar illusion, the widespread eurodollar retreat left EM economies increasingly vulnerable to financial-driven irregularity. Thus, Brazil’s economy in the last few years acts as if it has reverted to the worst forms of monetary irregularity in its modern past. The amount of economic chaos is really proportional to the level of growth that was “allowed” to condition the overall economy to the eurodollar itself. That suggests we really have no idea just how far and how long this depression might last in Brazil because the eurodollar expansion had been at work for more than a decade to 2007, and then another four or so years after that.

What we find in Brazil is, however, only just the most extreme example of what we find all over the world – not just China and other EM’s but also the US and its own “manufacturing recession” that is already itself nearly two years old likewise without visibility as to its potential end (and therefore increasingly expressive of depression). These are all variable forms of the same condition – monetary strangulation on a global scale. Unfortunately, unlike textbook currency elasticity there is no money supply “cure.” As I wrote last week in identifying bond yields that go only further and further down (the warning of the interest rate fallacy):

The resulting paradigm shift in eurodollar money has been an equivalent paradigm shift in the economy. No matter what central banks attempt or propose, they cannot possibly succeed. That is what bond markets and interest rates have actually been declaring this entire time outside of a few discrete periods of euphoric, emotional mania (the last being the middle of 2013). Monetary conditions in the real economy are exceedingly “tight” and getting more so all the time. This has nothing to do with the business cycle, real or assumed. It’s not about recession, it is about depression; a more than temporary deviation from health…

Unfortunately, the answer is not to increase the eurodollar supply because there is simply no way to do so. The eurodollar must be replaced, but our central bank “heroes” are busy instead coming up with ways to explain why QE didn’t fail (it was the economy’s fault). The end result is thus the familiar social and political upheaval that accompanied the earlier extremes in monetary imbalance.

The end result is “Welcome to Hell”, an increasingly familiar global condition. Brazil is not an isolated case of idiosyncratic factors, it is the worst example of the “dollar” decay that has yet to identify its own worst case. It is the economic side of the bond market’s warning.