Part 1 is here, the history of defining systemic operation since 1907.

The quest over equality or the “right” to impose optimal outcomes is one that cannot go backward. The inevitable failures lead no duty to re-assess overall, but only the means by which the results are to be commanded. That was the essence of Triffin’s Paradox, which was only a paradox if you follow that socialist outline. In short, the dollar, by holding a direct link to value expression, meant too much limitation on the extent to which fiscal socialism could execute its various means – the US gov’t wanted to spend but deficits disrupted the dollar as a global reserve currency. The threat of dollar upheaval was too severe of a rebuke, but instead of taking that to heart as a tangible economic element the discipline set about on how to overcome it yet further.

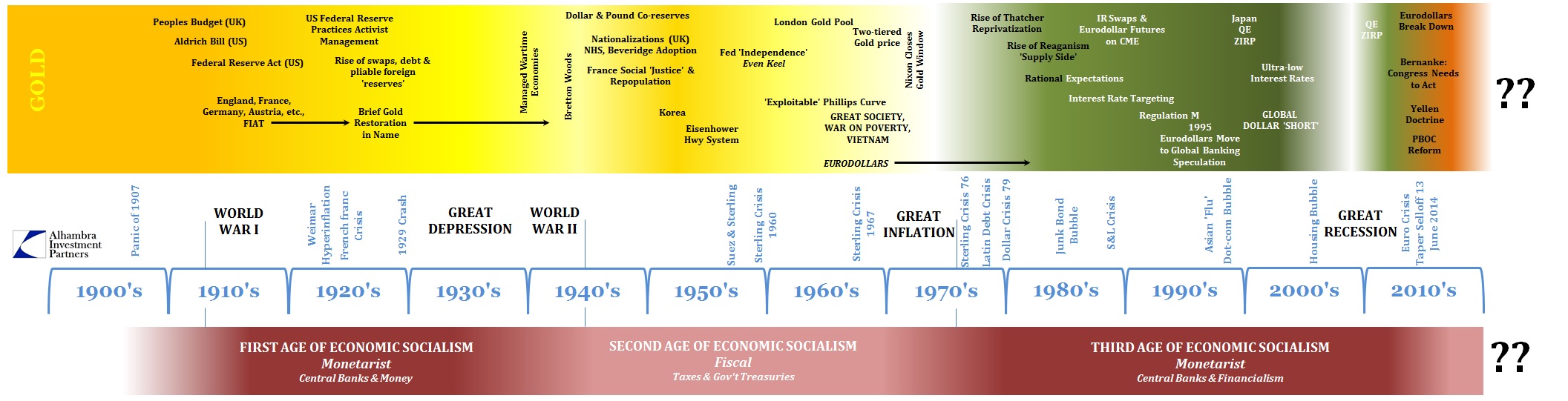

The turn into the third age is the most misunderstood for the reasons of that transition. Not only did the dollar disappear as the dollar, but fiscal retreat was taken as some kind of “rightward” or libertarian turn. Friedman’s counter-response for the origins of the Great Depression seemed to be mindful of that. What really took place was instead shifting marginal control, and the tools to wield it, back toward central banks and “money” once more. The Thatcher government reprivatized industry and cut government spending and deficits, as did Reaganism, all the while eurodollars and Federal Reserve activism simply supplanted those as they receded. As government treasuries fell back to sanity, central banks took up the slack of planning against capitalism.

That has caused inordinate confusion about how to describe the past forty years or so; many, especially those that yearn for the second age, look to this third age as “capitalism”, including the very central bank practitioners themselves. That was in great part a response to Milton Friedman’s influence, but he failed to see that he was not leading marginal systemic reality back to free markets but instead cultivating the conditions to transfer socialist economic command back from fiscal to monetary.

A perfect example of this confusion is Paul Krugman. Dr. Krugman makes it very plain that he wishes to exercise the role of social scientist in generating both optimal economic conditions and fairness, which he believes are linked (as do most socialists these days, the fusion occurred a long time ago). Thus, he sees very well the transition from the second age to the third, in the abstract construction of each, but is perplexed by what actually constitutes the third. From 1999:

I grew up in a planned economy. Bureaucrats didn’t run everything: Small-business men were more or less free to buy and sell as they saw fit. But those who controlled the economy’s “commanding heights,” its key industries, were administrators rather than entrepreneurs, conformists who were valued less for their productivity than for their loyalty, whose career advancement depended on their political skill. For ordinary workers, the system had some benefits: It was hard to get ahead, but once you had a good job, your life was secure. Still, the economy was often appallingly inefficient and consistently unresponsive to consumer needs. No, I am not an immigrant from Eastern Europe. I’m talking about the U.S. economy of the ’50s and ’60s, when General Motors was the very model of a modern major company…

The retreat of business bureaucracy in the face of the market was brought home to me recently when I joined the advisory board at Enron–a company formed in the ’80s by the merger of two pipeline operators. In the old days energy companies tried to be as vertically integrated as possible: to own the hydrocarbons in the ground, the gas pump, and everything in between. And Enron does own gas fields, pipelines, and utilities. But it is not, and does not try to be, vertically integrated: It buys and sells gas both at the wellhead and the destination, leases pipeline (and electrical-transmission) capacity both to and from other companies, buys and sells electricity, and in general acts more like a broker and market maker than a traditional corporation. It’s sort of like the difference between your father’s bank, which took money from its regular depositors and lent it out to its regular customers, and Goldman Sachs. Sure enough, the company’s pride and joy is a room filled with hundreds of casually dressed men and women staring at computer screens and barking into telephones, where cubic feet and megawatts are traded and packaged as if they were financial derivatives. (Instead of CNBC, though, the television screens on the floor show the Weather Channel.) The whole scene looks as if it had been constructed to illustrate the end of the corporation as we knew it.

Krugman again in 2002:

But then why weren’t executives paid lavishly 30 years ago? Again, it’s a matter of corporate culture. For a generation after World War II, fear of outrage kept executive salaries in check. Now the outrage is gone. That is, the explosion of executive pay represents a social change rather than the purely economic forces of supply and demand. We should think of it not as a market trend like the rising value of waterfront property, but as something more like the sexual revolution of the 1960’s — a relaxation of old strictures, a new permissiveness, but in this case the permissiveness is financial rather than sexual. Sure enough, John Kenneth Galbraith described the honest executive of 1967 as being one who ”eschews the lovely, available and even naked woman by whom he is intimately surrounded.” By the end of the 1990’s, the executive motto might as well have been ”If it feels good, do it.”

How did this change in corporate culture happen? Economists and management theorists are only beginning to explore that question, but it’s easy to suggest a few factors. One was the changing structure of financial markets. In his new book, ”Searching for a Corporate Savior,” Rakesh Khurana of Harvard Business School suggests that during the 1980’s and 1990’s, ”managerial capitalism” — the world of the man in the gray flannel suit — was replaced by ”investor capitalism.”

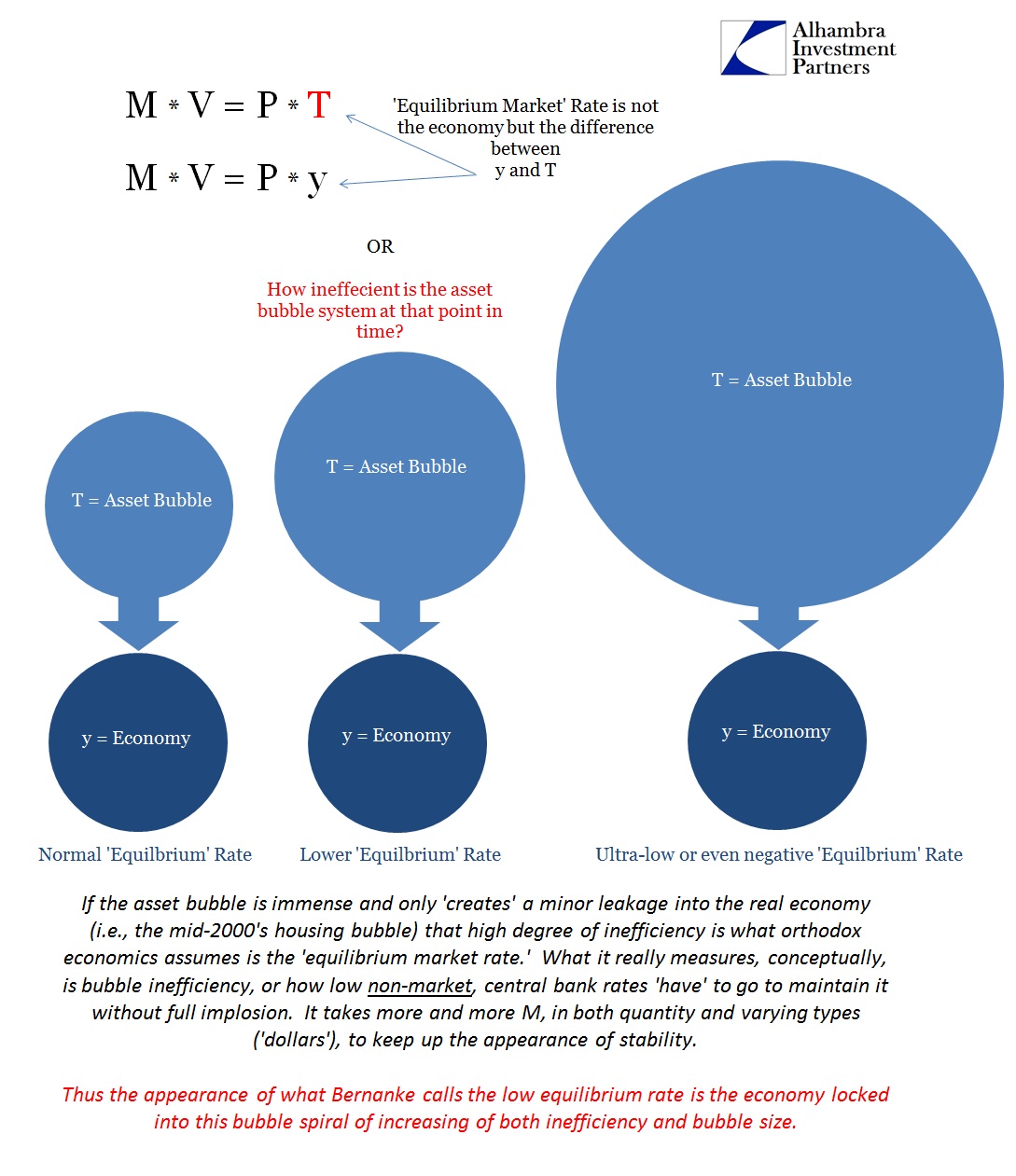

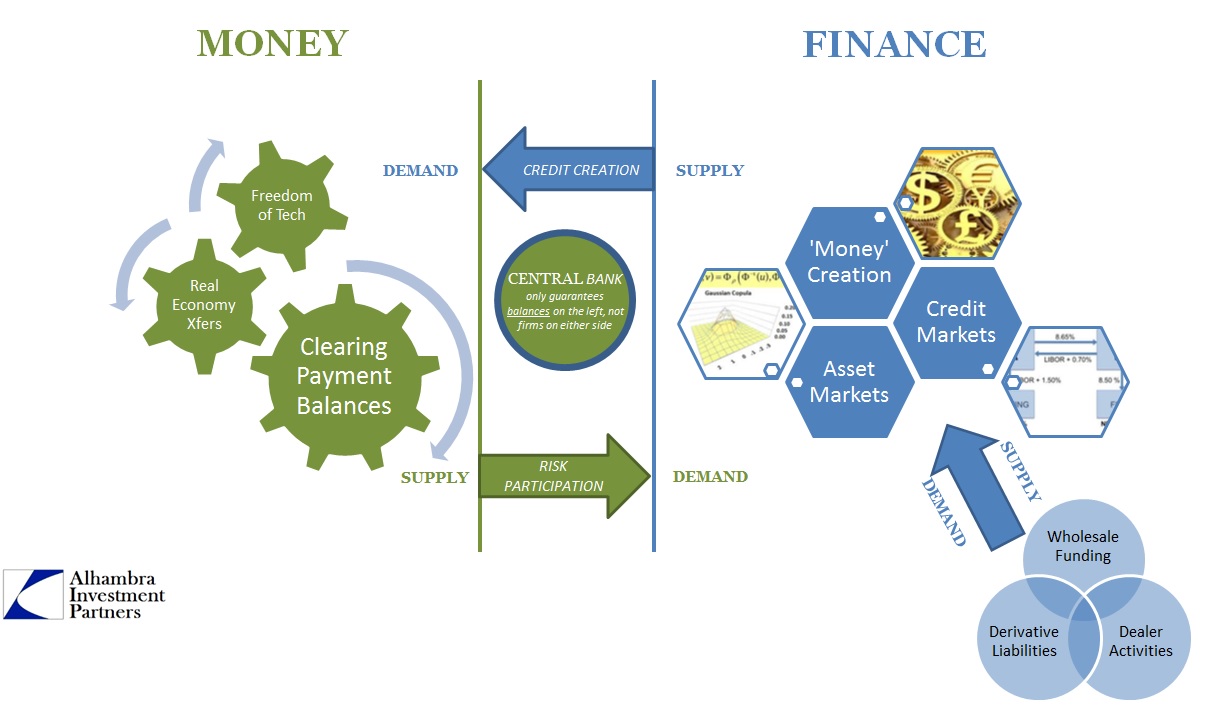

But all that didn’t just “happen”, springing up out of nowhere; “investor capitalism” was not an organic process that needs soul-searching levels of inquest. It’s much easier to see now having the serial asset bubble period to guide even the unwilling. The influence of the shift from the second age to the third age was still a socialist program of using macro ends to circumvent individual needs and perceptions, but exchanging government budgets that sought to borrow without restraint for monetary “stimulus” which cajoled private institutions and individuals to do the same. In order for that to happen, debt had to be created financially which meant “money” as well. The eurodollar system was only too obliging, which begins to account for “investor capitalism” properly categorized as “eurodollar socialism.” The banks stopped being the tool for private capitalism and overran all of it as an indirect agent of the government through various central banks.

The serial bubbles of the 2000’s are nothing more than what was wrought of the 1920’s, in general. The monetary character of both is not coincidence, as the failures that bookend each of these ages induces the transformation: from monetary to fiscal and back to monetary again. That looks like progress and accountability, but in each it only leads to more extreme measures (relative to the last) to still achieve what Robert Owen and Karl Marx conceived more than a century and a half ago.

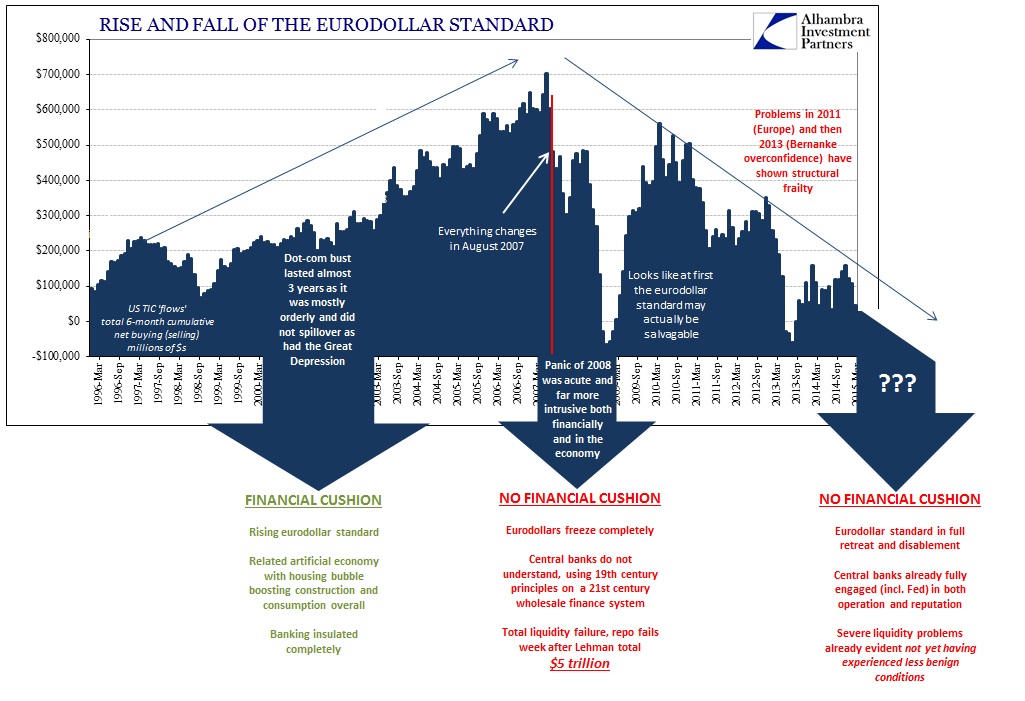

That leads us to 2015 and what is certainly the ragged end of the eurodollar standard. The third socialist age was undone by August 2007, but that did not stop its proprietors of “eurodollar socialism” under the name “investor capitalism” from trying to rebuild and restore it to full capacity. There were some words exchanged about TBTF and some minor attention to banks overall, some spiffiness about “risk”, but in the end nothing much has changed; except actual function. That leaves us with perhaps another forming transition, from a third age to a fourth.

The groundwork has already been laid, and it is exactly what you would expect given the history since 1907. There are no widespread details about a return to capitalism and sound money practices, only how to overcome the third installation of that timeless barrier thrown down in the collapse of each of the asset bubbles so far – value. Paul Krugman himself is already playing a leading role, which more than suggests that the fiscal rebirth is already in its infancy. What seems to be lacking at this point is a final resolution where the Panic of 2008 apparently wasn’t but really should have been – perhaps the next failure.

That does not have to be a great financial panic or crash, and may be more attuned to social upheaval (which may actually be worse). However, given that “investor capitalism” has found new depths of debasement, there is a good chance this transition follows all the rest.

What isn’t as clear, or with much visibility yet, is how the eurodollar system might be replaced. If the next transition is simply to be a fourth age of socialist economics, then the choices are quite restrained. The opportunity, however, is to make it the first age of free market restoration. That, however, is a political question but one that might be enhanced in the market direction by the failure of the eurodollar standard itself. If gold defined money at the outset of the first age, quasi-gold at the start of the second, and eurodollars the third, there really is no definition of a dollar heading through the fourth; a problem and, again, opportunity.

To achieve that is even straightforward, to do what those arguing against prior shifts had not – to discredit. The shift to the second age was enthusiastically embraced, as shown by Churchill’s defeat, because it was generally believed capitalism had failed in the Great Depression (as if capitalism links call money to payment systems, and then advances call money through foreign “reserves”). The same is being setup right now, as Krugman and the rest would just as much like everyone to believe that capitalism built the asset bubbles, those greedy CEO’s and derisive shareholders who just want to screw everyone and use Wall Street to do it. But they are not the true perversions here, just manifestations of the real governing dynamic, and certainly not the one making Wall Street dance. The maestro directing the tune is the world of central bank socialism and activist economics using banks to go beyond everything imagined in either the first or second ages.

What keeps thwarting these perfect plans of growing central planning is value. No matter how much money is changed, altered and even completely banished, there is still some sense of it somewhere at all times. It may be harder to define and recognize, a purposeful deflection of money by proxy, but it is there – in the dot-coms when it all went wrong; in housing as sanity proved the balance to monetary-driven mania; and again as all the world’s QE’s and ZIRP’s cannot conjure even a meek economic drive for more than a few months at a time. That is to discredit, but it also suggests to those who believe their crusade never wrong, like the Robert Owen’s, Paul Krugman’s and Ben Bernanke’s, that a fourth age will have to be even more “creative” toward command ability. None of the “isms” are ever wrong, according to their zealous proponents, just never enough.

While so far most publicly available discussion surrounds still further intrusions against currency and money (including banning currency outright), at some point it may yet dawn that the true enemy of socialism this past century has been value; and it will remain so. In that respect, narrowly and in limited interpretation, Karl Marx has been proved right; so long as value remains, socialism has limitations. Those limitations may be somewhat pliable and vulnerable to intentional changes in money and currency, but it has survived and continues to provide at least some marginal anchor to true capitalist foundations. The challenge, as I see it, is to strengthen the anchor not try more devious and statist means to severe it.