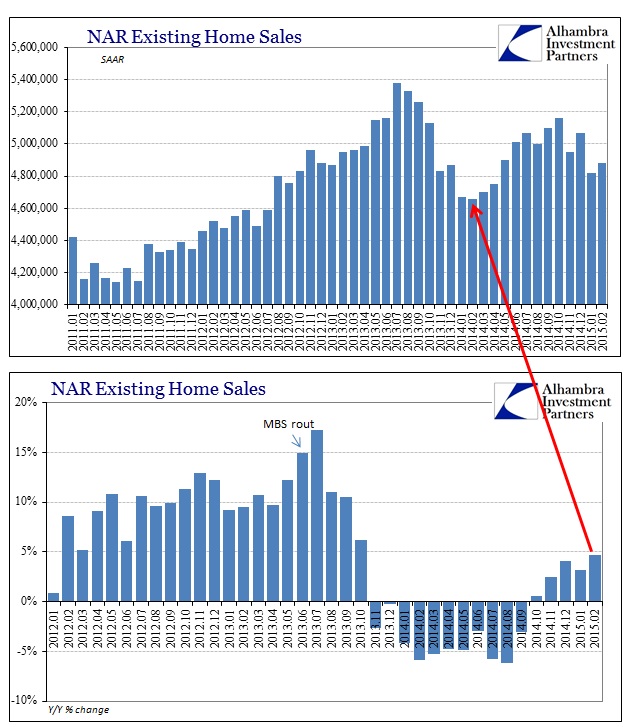

There really isn’t much to say about the housing market in the US right now except that economists clearly don’t know what to do with it. Having signed up wholeheartedly for the “booming” economy, or at least the narrative thereof, flagging sales in both new homes and resales doesn’t compute. Instead of recognizing why that may be, especially as it relates to the clear, obvious and unambiguous monetary influence in it all, the best they can come up with is something like this:

Lawrence Yun, NAR chief economist, says although February sales showed modest improvement, there’s been some stagnation in the market in recent months. “Insufficient supply appears to be hampering prospective buyers in several areas of the country and is hiking prices to near unsuitable levels,” he said. “Stronger price growth is a boon for homeowners looking to build additional equity, but it continues to be an obstacle for current buyers looking to close before rates rise.”

I’m at a total loss to understand what that statement actually means in anything like a real economic circumstance. According to basic supply and demand, “strong price growth” should not in any way be a constraint upon supply of houses for sale; quite the opposite. Mr. Yun takes this to an extreme whereby he actually supposes that lack of supply is restraining buyers!

Again, there is no way that makes any sense whatsoever. The only way that rising prices would lead to restrained supply is if potential sellers realize they can no longer sell at those rising prices. In that sense, rising prices aren’t really rising prices indicative of a healthy market but rather, unsurprisingly, unsustainable bubble mechanics. Further, it isn’t, then, supply that is restraining but demand for resales. The economy isn’t booming at all except for a small section most adorned by asset inflation that is skewing pretty much any economic account and factor.

All that would seem to indicate, very strongly, that home sellers have a much better understanding economically than economists (which is not at all surprising given economics is the study of regressions and stochastic estimations rather than actual economic function and factors).

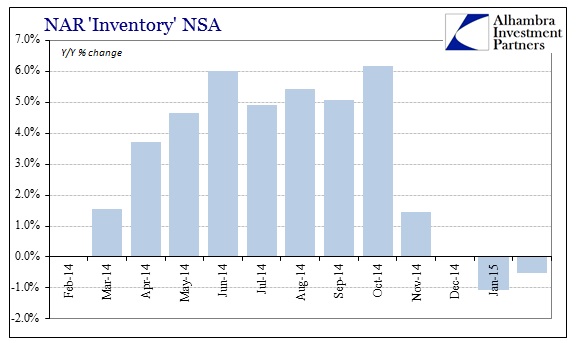

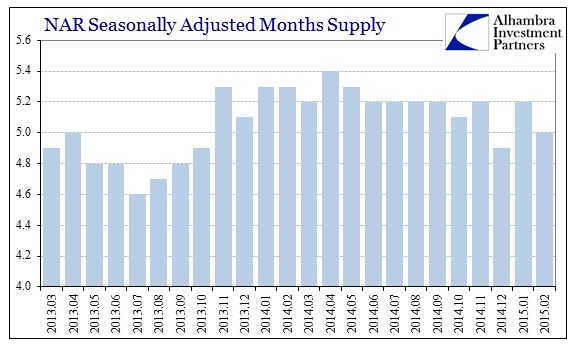

That is the only way to reconcile how rising prices could lead to what you see above, shrinking supply of homes for sale. In fact, the inventory of homes is slightly less in February 2015 than it was in both February 2014 and even February 2013. According to the NAR, the average home price was just shy of $250k in February, an increase of 5% year-over-year and 12% more than two years prior. The median home price was estimated at $203k, a one-year gain of 7.5% and nearly 17% more than February 2013.

There will be, of course, an attempt to use the weather to “explain” this basic economic inconvenience, but the worst housing results were not from the Northeast but the West and Midwest. And by comparing only to previous February data, all of which have apparently fallen under the category “winter”, the amount of snowfall is relatively constant.

The only way to be consistent is to recognize the obvious deficiency in true economic function. In other words, wages and incomes are not even close to keeping up with home prices while credit to only certain distinctions is. The economy is not booming, only the third try at monetarism running its inevitable course.