By Tyler Durden at ZeroHedge

There is a fervent minority that claims gold and precious metals are manipulated to keep their asset prices from reaching a free market determined valuation. They claim that the measuring stick that is gold (& silver) against which all other assets are held constant, is being distorted.

First things first, what is manipulation and what forms does it take?

- Manipulation – Control or influence (a person or situation) cleverly, unfairly, or unscrupulously. Alter (data) or present (statistics) so as to mislead.

- synonyms – control, influence, exploit, maneuver, engineer, steer, direct, falsify, rig, distort, alter, doctor, massage, juggle, tamper, tinker, interfere, misrepresent, etc.

- Psychological Manipulation – social influence that aims to change the behavior or perception of others; typically through abusive, deceptive, or underhanded tactics. Social influence is generally perceived to be harmless when it respects the right of the influenced to accept or reject and is not unduly coercive.

- Market Manipulation – the deliberate attempt to interfere with the free and fair operation of the market and create artificial, false, or misleading appearances with respect to the price of, or market for, a security, commodity, or currency.

Federal Government Manipulations:

Had the federal government held a constant measuring stick rather than “tinkering, engineering, distorting” key government calculations such as the size of the economy (GDP), the rate of inflation, level of unemployment, or size of federal deficits and federal debt…the reality we face would be plain and honest choices needed. Instead, the responsibility of those working for “the people” has been breached via falsifying and distorting each of these (over decades). This consistently improves the output and does not allow a true means to quantify and qualify the nations health. Simply put, the government has continually tinkered, tampered, and distorted the accounting so as to mislead or create a falsely positive appearance. There is no GAAP* (generally accepted accounting principle) accounting or true measure of the nations liabilities despite all present and future liabilities plain existence on various agencies books. A quick perusal leads to a number easily in excess of $100 Trillion dollars in liabilities (money that would have to be there in todays dollars in order to pay for present and future liabilities). Further, money that is not there today would need to be collected via higher taxation rates in the future to fund these underfunded liabilities. The only other options are cancellation of liabilities (via bankruptcy / outright default) or monetization (digital “printing” of money to pay off the holders of these liabilities).

Federal Reserve and Central Bank Manipulations:

- Federal Reserve interest rate policy (FFR %) is simply a market manipulation with the intent to artificially slow or speed the economy via the cost of leverage. This is premised on the assumption the Fed knows better than the market what the cost of money should be.

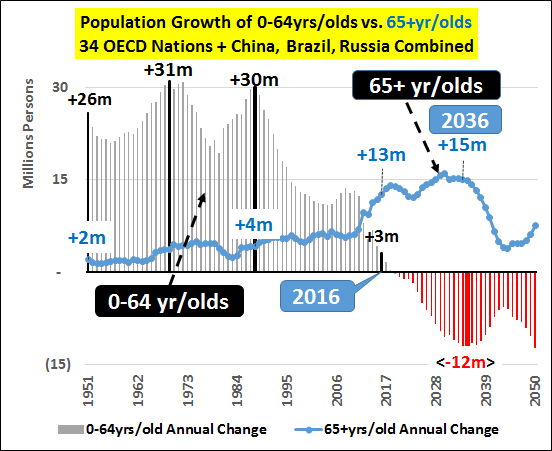

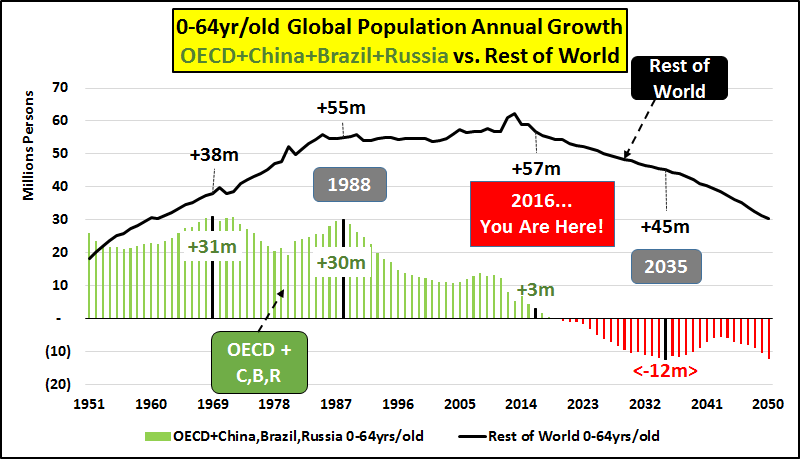

- Key central banks have lowered interest rates for the past 3 1/2 decades. The proximal cause of the CB actions appears to be decelerating demand due to decelerating population growth. First, population growth among rich nations waned, then among developing, and now it’s even waning among many poor nations with only the poorest in Africa still growing. However, many simply don’t recognize this watershed event due to the lengthening of lifespans masking the collapsed population growth of the under 65yr/old population of the world. ZIRP & NIRP are simply attempts to substitute credit for decelerating demand to maintain goal-seeked growth targets.

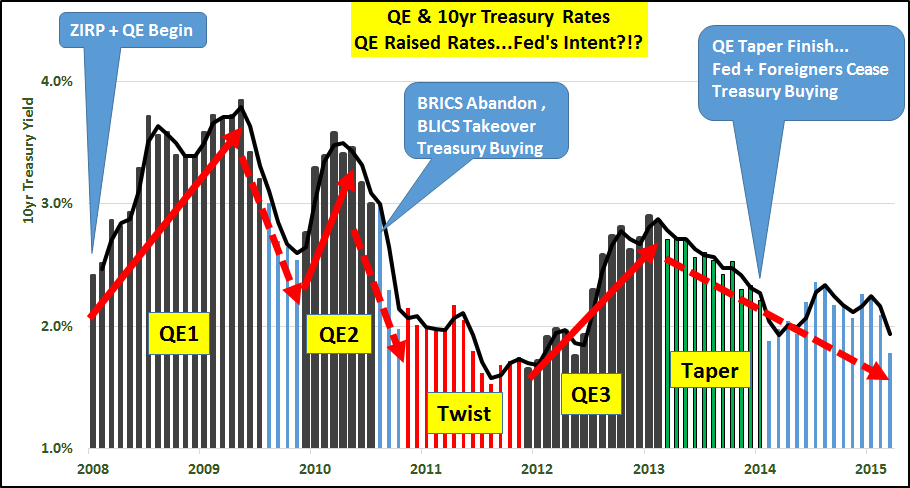

- QE & “CB balance sheets” – The digital printing of money with which to buy assets and remove them from the marketplace with the intent of pushing the remaining outstanding asset prices higher…aka, manipulation. The chart below highlights the 10yr Treasury bonds monthly yield during different periods.

Treasury and Bond Market Manipulations:

- Once upon a time, the Fed’s balance sheet and banks Excess Reserves were used as a means to artificially manage (manipulate) interest rates. The Fed would typically hold short term bills and notes (though relatively little long term bonds) and use this capability to remove or introduce more or less excess reserves…in this manner, banks overnight lending rates were affected and the whole chain of interest rates whipped up or down.

- When ’08-’09 came along, first the Fed jumped in with $10+ trillion of interest free loans to the greatest entities among us to incent them to buy, buy, buy and stem the selling that was taking place. After this initial manipulation was achieved and poor sold trillions of assets for pennies on the dollar to wealthy who paid no interest on the loans (and had Fed guarantees on any potential losses…Hello Warren) this was not enough. To further hike these asset prices and ensure their consistent appreciation, QE was initiated. On a daily and weekly basis, the Fed purchased billions of Treasury’s and MBS’s. And then in Operation Twist sold all it’s holdings of Bills and shorter duration Notes and used those proceeds to buy longer duration Notes and Bonds. And then more QE until record market valuations were set. To ensure the maintenance of those asset values, the Fed has maintained it’s balance sheet size and composition by continuing to buy new Treasury’s and MBS as maturity of existing Treasury’s / MBS occurs.

- Interest on Excess Reserves – As the banking system was imploding in ’08-’09, the Fed created trillions of dollars and stuffed them into the banks accounts to ensure their “solvency”. All along, banks held a minimal amount of excess reserves and as noted, the Fed actions to raise or lower these reserves (via selling into or buying from banks) set interest rates. But another manipulation occurred along the way…Interest on Excess Reserves. The Fed paying interest to banks for not lending trillions in capital?!? And since the excess reserves of banks were so large that a simple increase or decrease of a few billion (as per previous rate hike / cuts) would have no impact on rates…the Fed determined to pay banks more not to lend those trillions. Up rom a .25% up to a .50% (or up from $62.5 billion year to $125 billion year) to take no risk and lend no money.

- Treasury purchasing…inquiring minds should be wondering who it is that is pushing the Treasury market to the century’s lowest rates? Since China ceased accumulating Treasury’s in July of 2011, the buying has come from the strangest sources. First, the BLICS and then the US public. When the sources of 80% of Treasury buying over the past 15yrs have entirely ceased buying (net) and yet rates keep falling, that should raise some alarms. BLICSHERE Treasury Buying Mystery HERE.

Mortgage Rate & resultant Real Estate Manipulations:

- A 100% reduction in the Fed’s lending rate (Federal Funds Rate) from the 1981 peak at 18%+ to zero (presently at 0.4%) reduced the cost of financing residential and commercial real estate by 80%+. All that money saved on mortgage service was passed through to higher property valuations. It also encouraged serial mortgage equity withdrawals as homeowners were refinancing at lower rates and simultaneously withdrawing the equity to fund generally non-productive (financially) activity’s.

- Once the reduction of interest rates was no longer an option (absent moving to NIRP), the Federal Reserve moved to further control the housing market via buying the bundled mortgages known as MBS or mortgage backed securities (to avoid a market based pricing).

- Of course, one could also argue that the mortgage interest write offs incenting borrowers to take greater leverage over sound skin in the game is an attempt to steer or interfere with borrowers.

Stock Market (direct and indirect) Manipulations:

- The removal of large swaths of assets ($4.5 trillion of treasury’s & MBS’s), that would have been bidding for these assets (likely at record high interest rates given the risk/reward ratio) must go elsewhere…hello equities.

- Likewise, the interest rate manipulation means cheap borrowing directly or issuing bonds to interest starved investors. These corporate loans at record low rates are particularly taken with the intent to buy back outstanding shares (rather than capital expenditures)…reducing the number of outstanding shares results in a shrinking total outstanding # of shares plus a smaller divisor against which earnings are compared…improving PE’s absent improved business.

Currency Manipulation:

In ’71, Nixon severed the Bretton Woods agreement (and the primary means to maintain balance in US budgets and check the creation of dollars). Subsequently, Nixon initiated a deal with the devil otherwise known as the Petro Dollar (whereby all OPEC nations would only accept US dollars for their oil regardless the parties involved…and the US military was turned into mercenary’s to protect America’s “middle Eastern allies” and punish those who suggested accepting anything other than dollars)…the US had the means to flood the world with dollars absent the typical hyperinflation that would ensue. The US ran increasingly large trade deficits but an even greater quantity of dollars were needed by exporting nations to allow dollar denominated trade…particularly those in need of oil imports (Taiwan, Japan, China, S. Korea). Oil exporting nations gathered up all those dollars from the Asian exporting corporations (who in turn were exchanged massively increasing quantities of local currency…aka, importing inflation) recycled all those dollars into oil and commodity purchases (denominated and executed solely in dollars), stocks, real estate, and obviously US treasury debt.

It is in this environment whereby the US forces nations worldwide to transact in US dollars and dollars alone to purchase energy that America claims China and others to be currency manipulators.

Gold / Silver / Precious Metal Manipulation:

Given all this, shall we accept that the gold and silver markets are not manipulated? That the inert and generally static metal that is gold which is in its simplest form a fixed measuring stick or focal point against which all else moves…that this alone is not controlled, engineered, distorted, rigged??? As currencies and liabilities (absent means to meet those liabilities except creation of even more currency) are multiplying annually while the total supply of gold advances around 1% annually?

If it’s all Manipulated…Why?

So, manipulation reigns and, although I haven’t even tried to prove it in gold/silver, a reasonable person can make a reasonable assumption what is true for nearly everything else is also true for PM’s. You nor I may fully understand the machinations which likely lead to todays precious metals rigged prices but below I explain the ongoing and accelerating avalanche of monetization to come. Absent a fixed focal point, there is no means to know how far the monetary orbit has changed…but why the avalanche?

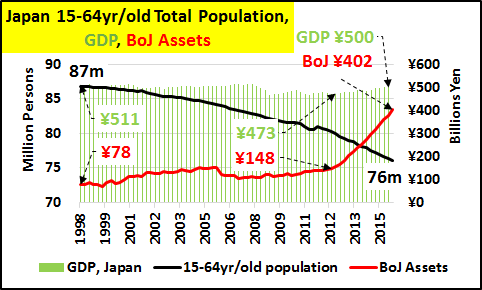

First, the case study that is Japan…the chart below shows Japan’s declining 15-64yr/old population (consumer base) vs. GDP and BoJ held assets. A declining base of consumers means fewer home buyers, fewer car buyers, fewer tax payers, etc. and general declines in demand in a highly leveraged economy. The deleveraging, if it were allowed, would create a price spiral and systemic economic collapse. Quite simply, the BoJ has determined to remove assets from the “market” to maintain asset prices and avoid the deleveraging. This is known as monetization or digitally printing money to reduce the outstanding float of assets, pushing up the value of the remaining assets.

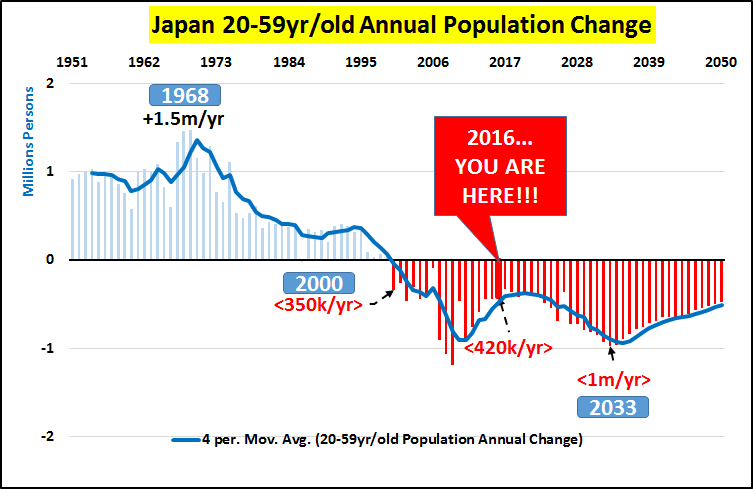

To understand why this policy is lunacy…just look at the Japanese population data provided by the OECD. The history and likely overly optimistic future estimates for Japan show clearly the BoJ will have an awful lot of “printing” to do for an awful long time!

The BoJ has gone down a road that has no end in sight…monetization & balance sheet growth to infinity.

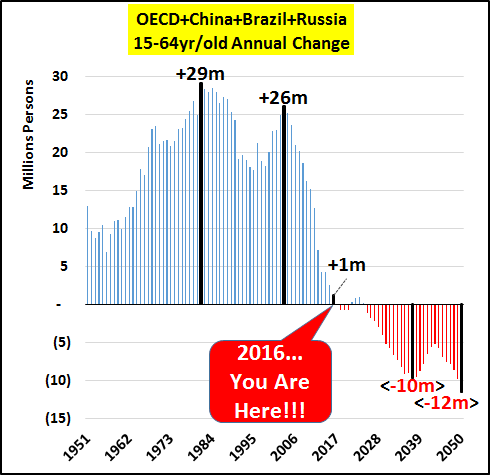

But unfortunately, the demographics facing the BoJ are not unique to Japan and the responses from central banks worldwide are the same. Balance sheet expansion to remove ever more assets to maintain existing asset valuations. The chart below shows the combined 34 OECD nations (OECD Members), plus China, Brazil, and Russia annual change in the 15-64yr/old total population. Together, these nations represent in excess of 3 billion people and likely 80%+ of the worlds wealth and consumption power.

Source: What Manipulation Does to the Free Market – ZeroHedge