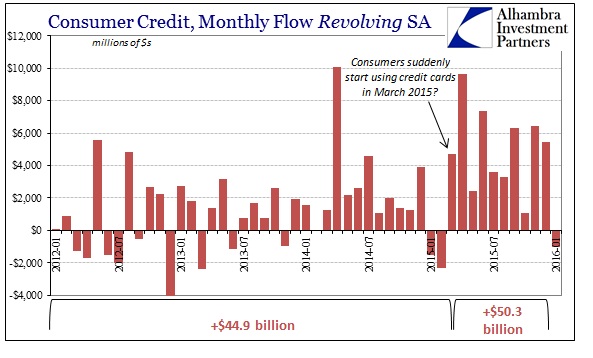

Revolving consumer credit turned upward in March last year, which signaled to economists that the true end of the Great Recession was at hand. The largest impediment to the monetary version of the recovery was the “debt hangover” from the mortgage surge during the housing mania. Consumers, rightfully cautious after that disastrous experience, spent the early years of the “recovery” eschewing debt beyond student and auto loans. Both mortgage growth and credit card growth (revolving) was historically weak.

The shift in revolving credit, then, seemed to suggest what Janet Yellen had been saying about the economic prospects in relation to the “best jobs market in decades.” From this view, jobs were turning to incomes which were turning to freer spending patterns and thus leading at least more closely toward “overheating.” It seemed like real confidence in borrowed dollars.

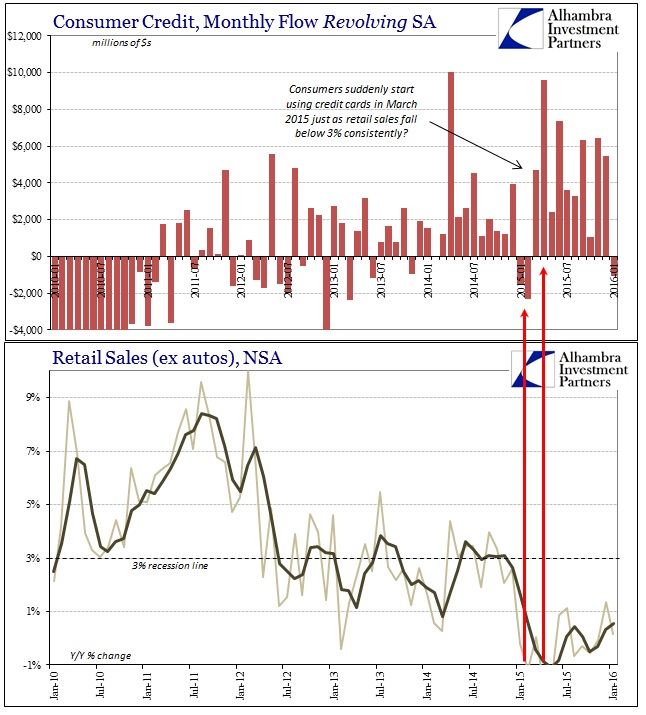

After only a few months it was clear that this had indeed been an inflection. The numbers over the past year leave no doubt; revolving consumer credit grew by just $44.9 billion from January 2012 through February 2015 but by $50.3 billion in just the 10 months March 2015 through December. With revolving credit falling again in January 2016, there is some immediacy to getting the prior interpretation right. During the worst of last year’s “financial turmoil”, the Wall Street Journal for one was firmly of the view that consumer credit was a hugely positive sign for not just skating out of that mess but for the full recovery/Yellen scenario:

Americans quickened their pace of borrowing in September, a sign of confidence in the economy amid low gas prices and a strong dollar.

Outstanding consumer credit, a reflection of nonmortgage debt, rose $28.9 billion, or at a 10% annual rate, in September, the Federal Reserve said Friday, the largest percentage increase since April 2014…

Revolving credit, mostly credit cards, rose at a 8.7% annual rate. In August, it rose at an annual rate of 5.3%.

There is, however, a very different interpretation as to especially revolving credit. In many circumstances heavy appeal and use of credit cards is as much a last resort as measure of sublime confidence in jobs and the solid nature of future income prospects. Historically speaking, a surge in credit card usage typically signals as much the end of an economic cycle as its beginning (or strengthening).

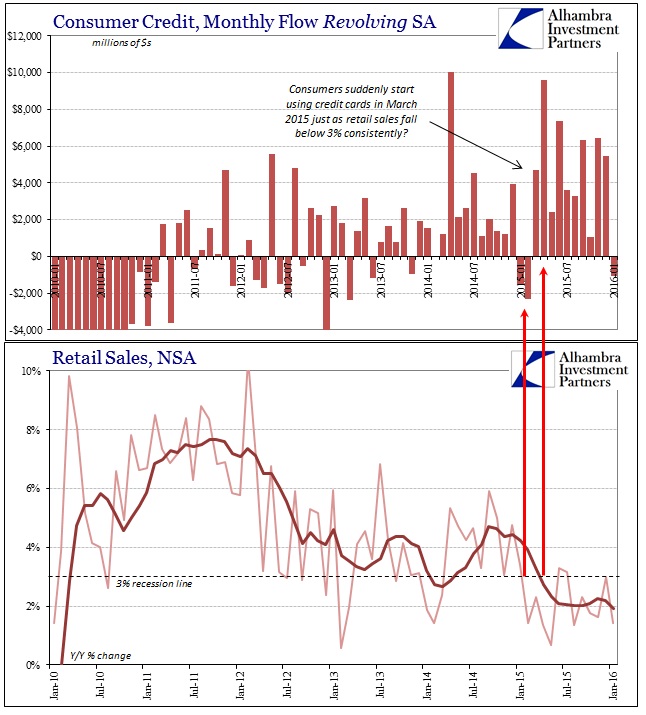

Comparing revolving credit against consumer spending, retail sales in this account, does not suggest as the Journal does; quite the contrary, the relationship is almost too perfect in indicating credit cards as a last resort, end-of-cycle correlation in 2015 into 2016.

Retail sales, including autos, grew by 6-8% consistent with a healthy(er) economy until 2012 without the “aid” of credit card debt. As retail sales slowed past 2012, revolving credit made its partial comeback – when retail sales dropped suddenly in early 2015, consumers responded with that large, sustained increase in revolving debt. That surge in borrowing, however, did not propel retail sales (or any sales) back toward growth levels at all, instead retail sales have continued on at recession levels in tandem with increased borrowing. That is classic end-of-cycle behavior, the ominous appearance of the “exhausted consumer” in multi-dimensional fashion.

Removing auto sales from retail sales shows this dynamic even more purposefully, as autos are related to their own class of debt. Again, the surge in revolving credit matches perfectly the sharp deceleration and even contraction in non-auto retail sales.

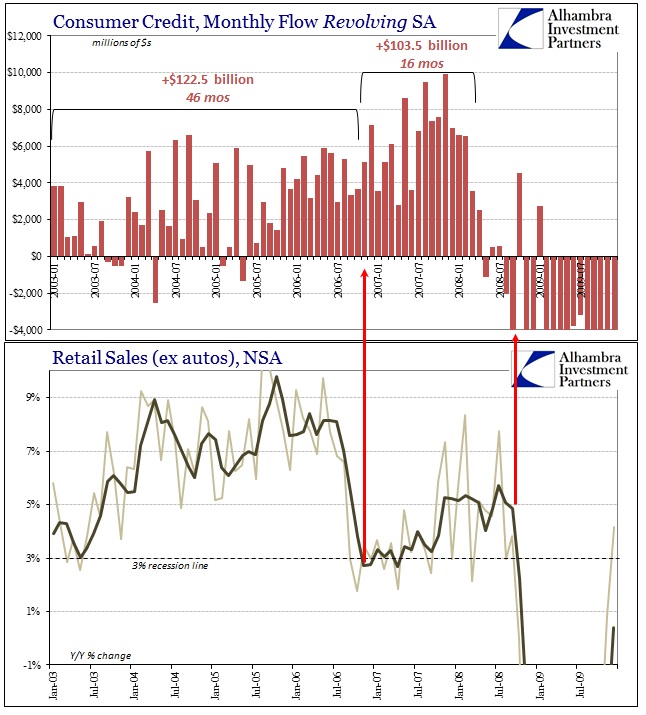

This behavior was last observed in 2007-08. Then, as now, revolving credit surged at the end of the housing bubble “cycle.” Consumer debt in this format had expanded by $122.5 billion from the start of 2003 until the end of Q3 2006 – just as the housing bubble began to burst. From the end of 2006 to the first months of 2008, revolving credit exploded by $103.5 billion in just 16 months (almost exactly the same pace as 2015) once housing no longer provided any more artificial lift and expansion.

Just as we have observed over the past year, as revolving credit accelerated sharply retail sales (ex autos) did the exact opposite. What was a healthy (though artificial) 7-9% growth month after month suddenly turned to just barely 3% (and then around 5% due to “inflation” toward the end). The increased pace in borrowing did not aid the consumer economy in navigating the post-bubble environment, instead it revealed “exhausted consumers” barely able to sustain minimal economic function.

The relevant issue about January 2016’s estimated decline, the first in nearly a year, is what came next the last time debt usage abruptly shifted. Consumer borrowing of all forms obviously collapsed starting in the middle of 2008, as did the whole US and then global economy. Exhausted consumers that suddenly stopped borrowing became ghost consumers – the actual and violent end of the “cycle.” January’s revolving decline (as well as a lower-than-expected increase in non-revolving) is only one-month, so there are no conclusions yet to be drawn, only wariness about potential implications should it continue in the months ahead.

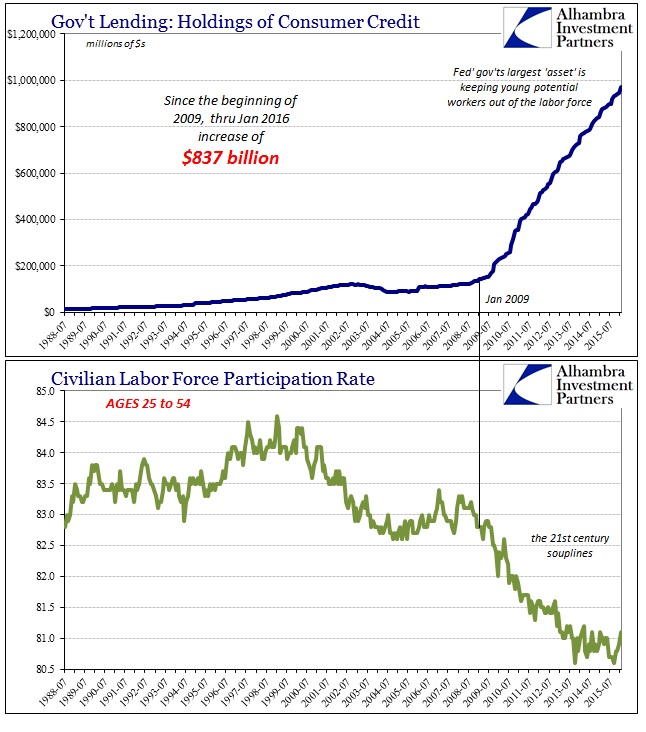

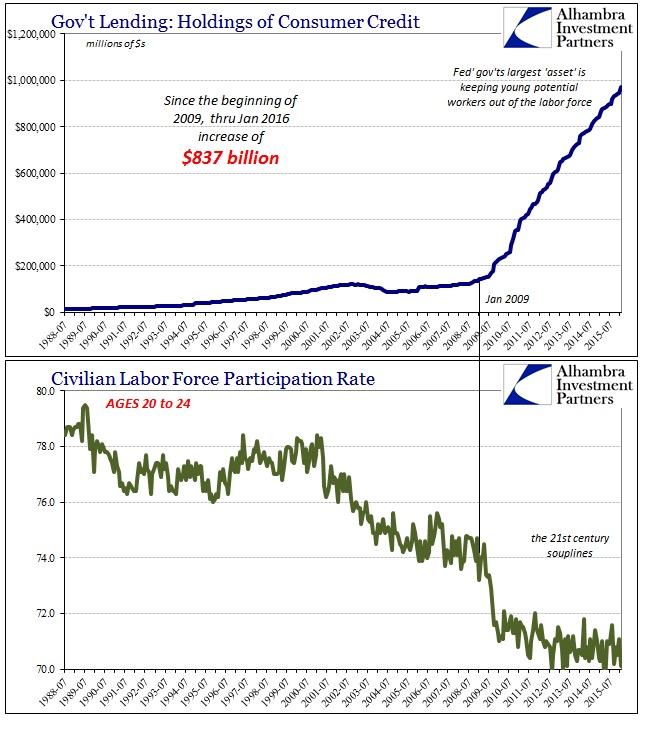

Consumer credit figures also provide at least a partial explanation as to the “slope” (“slowdown that won’t stop slowing down” rather than the usual “V” shaped recession) of this current economic decline as potentially different from past recessions. Student loans, in particular, have acted as an ongoing and heavy fiscal “stimulus” cushioning the disastrous lack of full labor deployment past the Great Recession. The participation rates of those in their prime working ages suggest the same as the nearly $1 trillion in “consumer credit” “owned” by the Federal Government. Take away those loans and lingering college stays, and those in their 20’s suddenly enter the workforce and drastically alter not just the calculated unemployment rate but undoubtedly the whole economic trajectory and slope – especially here in what increasingly looks like the end of the “cycle.”