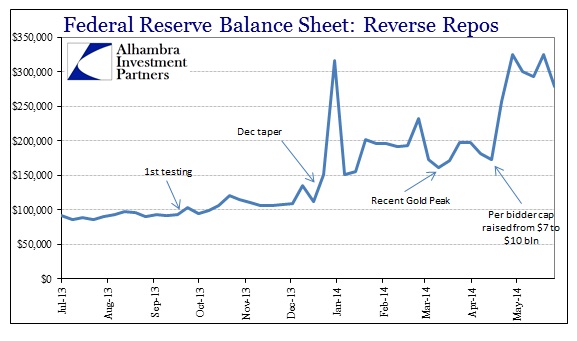

The explanation given for the increase in participation at the reverse repo “window” in mid-April was taxes. In other words, the payment of quarterly and annual estimates and billings reduced the need for the federal government to borrow. Since the variability in borrowing amounts is taken up in t-bills, the relative scarcity of on-the-run t-bills has left the market somewhat short of them for collateral.

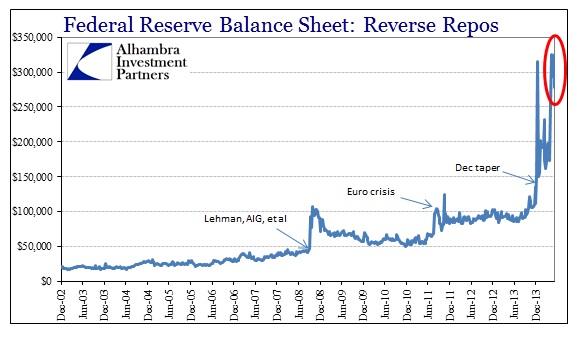

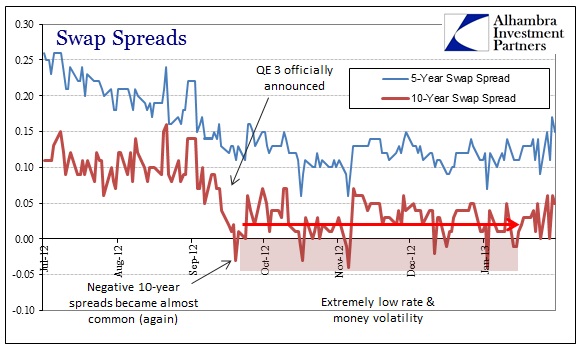

This is entirely predictable and is a seasonal occurrence that is fairly evenly managed by financial participants. Last year was an outlier, clearly, in that repo rates suddenly persisted at or below 0% and repo markets began exhibiting odd behavior. QE was having a persistently negative effect on collateral availability, though it was directed toward notes and bonds on-the-run rather than bills. The Fed first adjusted its POMO out of on-the-runs entirely, but that didn’t seem to have the intended effect as collateral strains persisted.

With t-bills out this year, at least the Fed has opened another channel for collateral flow with its reverse repo program. As you might expect, given tax season and government cash levels, there was a spike in reverse repo usage into the prime tax collection weeks. But it did not abate, and has remained elevated for nearly two months now.

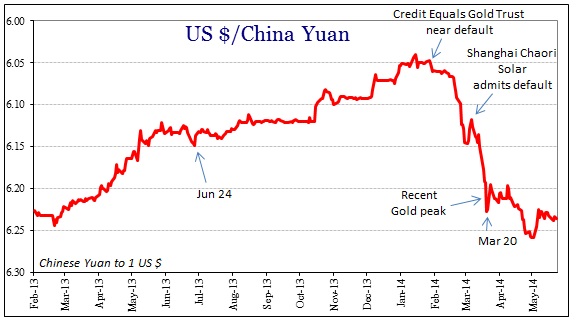

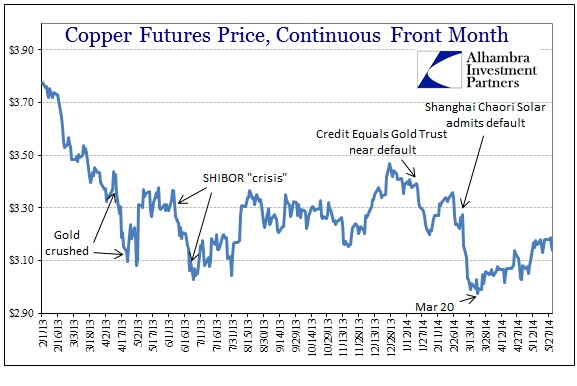

While I think it is obvious that last year’s problems created the crater in gold prices, it isn’t so nearly neat this year. Something is depressing gold, however, particularly after March 17. That date stands out but in the context of China and dollars, rather than treasury collateral.

Conditions with China have been very quiet these recent weeks, an ebb in the otherwise loud property bubble burst on the other side of the Pacific. Both the yuan and copper have been taken off the front pages, though neither has returned to even close to pre-episodic peaks/troughs.

I think that shows that China isn’t done yet roiling dollar markets but that there is no particularly immediate problem right now. Maybe that is the reason gold prices are gently descending rather than cascading.

Even though volatility is slight, gold prices have moved out of the recent trading range to the downside. If there was a safety bid after the actual taper in December, it has either diminished or has been slightly imbalanced by selling/collateral pressure. It could very well be that the lack of volatility in credit, more than anywhere else, has cooled the demand for tail risk insurance (gold). However, given the reverse repos, I still think collateral is strained but without an obvious culprit.

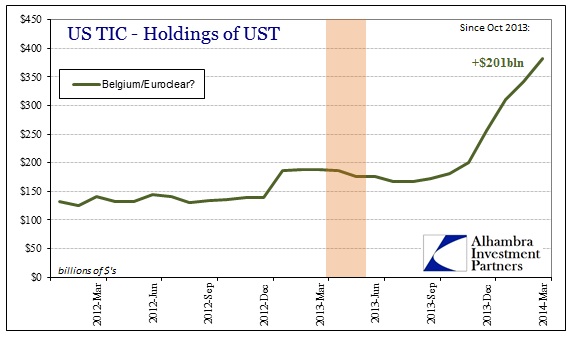

Besides the scarcity of t-bills, there has also been the curious flow of UST to Belgium and Euroclear. Despite the name it is not at all clear why Europe is such dire need of UST to settle trades. It could very well be, given the persistence of lower revenue news out of banking recently, that derivatives trades are being recollateralized.

The timing certainly lines up to where you would expect collateral calls to be made after last year’s selloff. Given eurodollars and swaps, as I have stated for some time, I think the major banks were extremely heavy swap writers (receiving fixed, paying floating) since the middle of 2012 (and even before as swap spreads were compressing throughout that year; and the negative swap spreads that started in the first days of QE3 pretty much confirm trade positioning).

The systemic rate reset after the first taper selloff would no doubt have triggered more collateral, and I believe it was driven by banks being on the “wrong” side of that trade. That would potentially explain the need or flow of UST to Euroclear as European banks are among the largest derivatives dealers and writers – all in dollar denominations.

None of this provides a comprehensive or even really all that satisfying theory about collateral. My intent here is to investigate the collateral side as a possible explanation for the recent inflection in gold, particularly as gold prices are again exhibiting that kind of pattern. I think this is at least a partial account for recent weakness, though nothing matches up exactly or stands out unambiguously like this time last year.

There is enough collateral disturbance here to make this reasonable conjecture. More observation is obviously needed, including entertaining thoughts about a potentially diminished safety bid.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com