During the course of its massive money printing campaign after the financial crisis of 2008, the Fed drove the 30-year mortgage financing rate down from 6.5% to 3.3% at its mid-2012 low. The ostensible purpose was revive the shattered housing market which had resulted from the crash of its previous exercise in bubble finance.

But what it really did was touch off another of those pointless “refi” booms which enable homeowners to swap an existing mortgage for a new one carrying a significantly lower interest rate and monthly service cost. Such debt churning exercises have been sponsored repeatedly by the Fed since the S&L debacle of the late 1980s.

This time the Fed really outdid itself. During some periods upwards of 80% of new originations were not money purchase mortgages to finance a new home, the declared purpose of interest rate repression, but just refis of existing debt. By resorting to this maneuver to leave more money in the pocket of borrowers each month, our monetary central planners undoubtedly hoped that America’s flagging consumers would buy another flat screen TV, dinner at Red Lobster or new pair of shoes.

Yet two obvious questions recur. First, why does the monetary politburo think that a zero-sum shuffling of shoe purchases into the spring of 2012 and out of 2014 makes any sense? That is the implicit assumption, however, because unless the Fed was prepared to permanently peg the 3.3% refi rate at its mid-2012 level, it was only a matter of time before mortgage rates would rise and household’s buying actual new homes with purchase money mortgages would be paying 4.5% as now, or 6.5% as before the panic, and thereby have far less discretionary cash left over for a trip to Red Lobster.

This cash flow shuffle sounds perfectly silly, of course, but it is essentially what our Keynesian paint-by-the-numbers central bankers are up to because they stubbornly refuse to acknowledge the reality of “peak debt”—especially in the household sector. Yet only a permanent gain in leverage can cause consumer spending to remain elevated in response to monetary stimulus. By contrast, yo-yo-ing the mortgage rate only swaps out cash flow from one arbitrary quarter to the next.

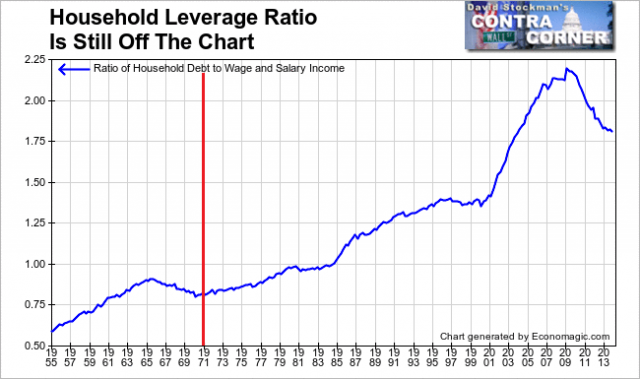

Thus, during the four decades leading up to the financial crisis, the Fed’s interest rate “easing” maneuvers worked because they caused a steady upward ratchet in household leverage ratios. That is, there was still balance sheet space left to hypothecate. And, as shown below, under the Fed’s post-1970 ministrations, the historically healthy ratio of about 80% debt/wage and salary income climbed parabolically until it peaked at 210% in 2008.

The above graph also highlights the reason why the Fed is now enmeshed in a pointless exercise of “yo-yo-ing” the economy in its endless pursuit of accommodation and consumer stimulus. Self-evidently, households have rolled back their leverage ratios to a still historically high and likely unsustainable level of about 180%. So by not permanently adding to their leverage ratio— but actually slowly retrenching it—households have thwarted the Fed’s maneuver to cause a permanent gain in the purchase of shoes and meals at the mall.

And properly so. A continuing rise in the household leverage ratio from the 2008 peak shown above would have led to an even more traumatic retrenchment than that which has already occurred.

But if the Fed’s arbitrary cycle of mortgage rate repression and eventual release—as metered into the financial system by the seers and forecasters resident in the Eccles Building– does not permanently levitate the Main Street economy, it nevertheless leaves an impact: namely, a huge and capricious reshuffling of wealth within both the real economy and the financial system, too. In fact, this wealth reshuffling is so massive and unaccountable that perhaps someday the question will arise as to why the Fed was ever empowered to operate a giant random wealth generator in the first place.

Within the household sector, it is obvious enough that the refi boom benefits only a tiny minority or households—most of which least need help from the state. Stated differently, of the nation’s 115 million households—perhaps 10-15 million have been the lucky recipients of the Fed’s refi maneuver. Clearly the 40 million renters didn’t benefit; nor did the 25-30 million who own their homes free and clear. And upwards of 20-25 million existing mortgage borrowers, who during most of the latest 5-year refi boom were “underwater” or did not have enough positive equity to cover transactions costs and more reasonable down-payment ratios, did not even qualify for the Fed’s lottery.

However, there was one sector that gorged itself on the “refi” lottery big time—namely, the giant mortgage originating banks on Wall Street who ended up controlling most of the home mortgage market after the Washington assisted mergers during the crisis. As summarized in the Fortune article below, the mortgage originators were booking up to $3,300 of up front profit per refi.

And that was just the fee on the transaction—before booking the embedded “gain-on-sale” (often thousands more) when most of this booming mortgage volume was subsequently shuffled off to Freddie and Fannie to be packaged and resold as an MBS. Yes, and at that point, such newly minted “mortgage bonds” did flow back to Wall Street where they were doubtless churned many times over by the dealer side of the banking houses in their endless and remunerative chore of supplying “liquidity” to the homeowners of America.

So the banking side of the Fed’s refi churn did well too—–enjoying a triple profit dip along the way. But there were two untoward effects of these giant windfalls. First, they self-evidently were not a permanent source of bank earnings, as documented by the Fortune article below. JPMorgan’s fee profit per mortgage has now plummeted to a loss of $1,500 each; its mortgage volume has collapsed by upwards of 80%, meaning that fat quarterly profits from “gain-on-sale” into the GSE mills has also evaporated; and its massive trading inventories have been generating losses as often as gains—since bond prices are no longer on a one-way escalator upwards.

The point here is not to lament the resulting sharp decline in the bank earnings from their triple-dipping mortgage businesses. The windfalls there were no more arbitrary than those captured by households fortunate enough to board the Fed’s refi train while it lasted.

The far more important point is that these were not real economic profits that added permanent value to the American economy. They were simply central bank enabled “rents” that permitted the big banks to artificially and temporarily repair their balance sheets. The big bank mortgage operations have booked at least $50-$75 billion of this kind of bottled air since the crisis.

And that is were the evil-doing comes in. Based heavily on the windfall of mortgage and fixed income trading profits, the Fed has permitted the Wall Street banks to plunge right back into the business of paying generous dividends and undertaking heavy stock repurchases. In a word, the very monetary politburo that now says that the solution to financial instability is tougher “prudential” regulation and supervision—rather than the honest thing of slowing down its printing presses—-has engaged in flat-out regulatory folly: It has permitted Wall Street to re-cycle vast unearned rents to the gamblers and fast money traders who have piled into bank stocks since the crisis.

Instead, it should have been recognized that the giant Wall Street banks are wards of the state. Without access to seven years of deposit funding pegged at zero, the Fed’s discount window privilege in the event of a crisis, and trillions of taxpayer guaranteed deposits, the Wall Street conglomerate banks would not even exist in their current form. So every dime of profit booked—-genuine or windfalls like these—should have been sequestered on their balance sheets until it was truly evident that the “all clear” condition had been reached. Based on first quarter banks results this far, that hardly seems the case.

There was a government anti-drug propaganda movie in the late 1930s called “Reefer Madness”. It would appear that our monetary politburo has been smoking the same.

By Stephen Gandel, senior editor April 11, 2014: 3:37 PM ET

FORTUNE — If you are wondering why you can’t get a mortgage, here’s an answer: Every time JPMorgan Chase makes a home loan, it loses money, $1,500 on average. That might not make JPMorgan want to make so many loans.

That helps explain why banks are lending so little, and why the housing recovery, which seemed to be zooming along just a few months ago, has begun to falter. It also may say something about the sluggish economic recovery.

On Friday, JPMorgan (JPM) reported its first-quarter earnings. They were less impressive than analysts were expecting, in part because loan growth at the nation’s largest bank in the country has evaporated. JPMorgan had $730 billion in loans a year ago. It has the same now. Deposits are still rolling in. Typically, a bank makes money lending out the money it takes in from depositors and pocketing the difference. But JPMorgan is now lending out just 57% of its deposits. It used to be more like 80% a few years ago.

MORE: JPMorgan’s Jamie Dimon says Fed exit will be easy

Signing up borrowers was never the most profitable part of the mortgage business. The bigger profits came from collecting the interest on the loans, or selling those loans off to others. But it was never a loss leader, either.

A year ago, for instance, JPMorgan made about $750 per loan. The year before that, it booked $3,300 of profits for every new loan.

But then, about a year ago, interest rates began to rise for the first time since the financial crisis. It wasn’t much, around one percentage point, but it was enough to crater one of the few businesses for the banks that had come roaring back. And the housing market remains fragile. All of a sudden, all those people who were rushing into refinance their mortgages every time rates dropped stopped coming in.

JPMorgan funded $53 billion in mortgage loans in the first three months of 2013. That shrank to $17 billion in the first three months of this year. And JPMorgan is based on being big. The result is that you don’t just make less when you make fewer loans. You make nothing. A year ago, JPMorgan earned $500 million in the first quarter from originating home loans. In the first three months of 2014, it lost $200 million.

That might not be all that bad if JPMorgan were still making good money on the other parts of the mortgage process, like collecting interest or selling off loans. But it’s not. Interest rates are still near lows. What’s more, the rise in interest rates has squeezed the difference between what banks can charge mortgage borrowers and the interest they have to promise the purchasers of those loans. That difference a year or so ago accounted for a huge source of profits.

MORE: Greece’s economy is a huge mess

Put it all together and JPMorgan made just $114 million in income from its entire mortgage operations in the first quarter. That was down from nearly $700 million a year ago and $1.1 billion the quarter after that. But bankers like to talk about their businesses not in total profits but the returns they generate. Three quarters ago, JPMorgan’s mortgage business had a return on investment of 23%. Last quarter, it was 3%. JPMorgan could have almost done just as well by putting all of its money in a 10-year Treasury bond and calling it a day.

And it’s not just the mortgage business. Over the past few years, consumers and businesses — some not so great — have been able to secure loans at historically low interest rates. Expectations adjust. Now, interest rates are rising, and borrowers don’t want to pay higher prices. How long will it be before borrowers adjust? If you have just refinanced your 30-year mortgage, it might be a while.

If you want to know what higher interest rates might mean for the banks, take a look at JPMorgan’s mortgage business. It’s not good.