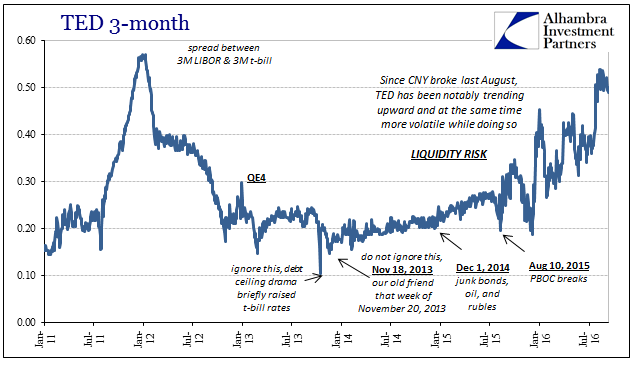

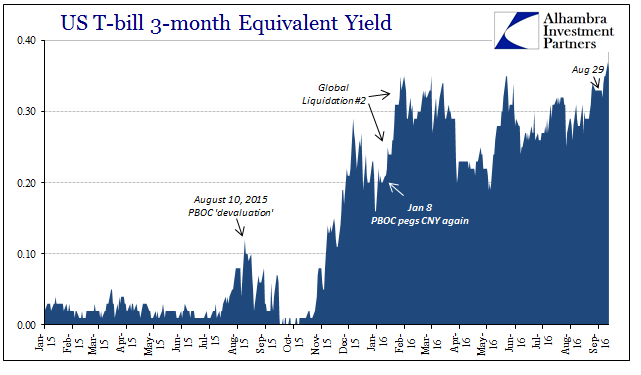

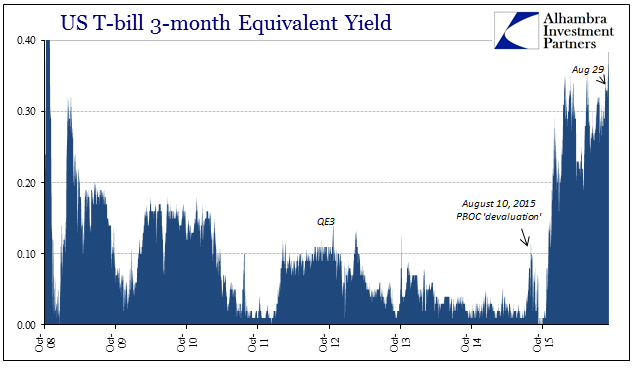

Treasury bill rates have been trading notably higher of late, with the 3-month bill equivalent yield as much as 37 bps this week. Though it was the highest rate since November 2008, a true reading of bill history shows that it is not a matter of Fedearl Reserve policy “normalization.” Trading in bills, especially the 3-month, makes indications of risk somewhat more obscured. For example, though “dollar” liquidity was clearly problematic and getting worse from mid-July 2015 all the way through the liquidations late in August, the TED spread was actually falling during that time. The reason was not that interbank markets were being restored and acting robustly, rather it was the curious nature of T-bill trading leading up to what was a Chinese-led “dollar” event.

It happened again to start this year, where through almost the whole month of January the TED spread fell back sharply. From about 45 bps to end 2015, by January 28 the spread had shrunk to just 26.5 bps. As August, this occurred as the worst liquidations since 2011 were taking place wherever the “dollar” connected (which is almost everywhere).

In both of those instances, the responsible party narrowing the TED spread was the T-bill part. There is an established tendency for bill rates to rise whenever the Chinese are in “dollar” trouble; expressed usually as either a peg or perhaps, as now, a “line in the sand” for CNY depreciation. So we have indications, as now, that when the TED spread is declining as a matter of a noticeable rise in T-bill rates it is likely Chinese “dollar” transformations that are reactive to the troubling nature of “dollars” and China.

Of course, there is no shortage of indications in Chinese money markets that Chinese money is as US T-bill rates once more indicate. As I wrote this morning (subscription required):

Together with HIBOR, we have all the indications back together that repeat the pattern of summer 2015. What changed for the Chinese can only be “dollar” pressures that for most of the middle of 2016 appeared relatively manageable (that doesn’t mean without great effort, as in May and early June when CNY fell precipitously such that even LIBOR rates “noticed”). That might be the most important inference from all of this, that “dollar” pressure may have changed from difficult but manageable to not. That would seem quite consistent with days like yesterday and Friday where there was a clear tendency across global markets to sell everything.

There is quite little like an increase in the “risk-free” rate indicating global risk. Welcome to Keynes’ long run where we aren’t dead but money just might be.