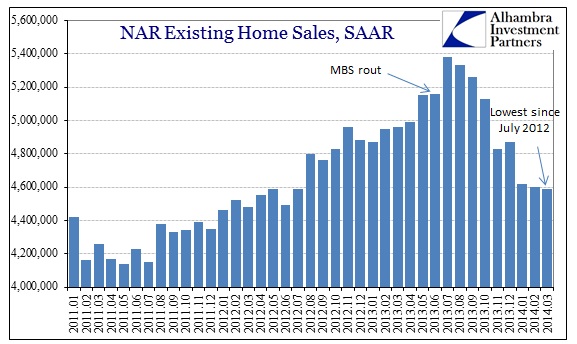

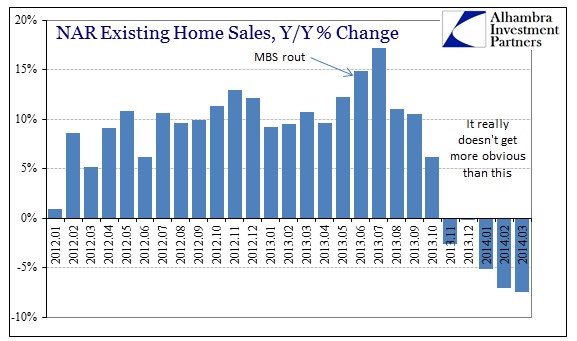

I mentioned earlier today that pretty much the only sector of the economy (outside of government run lending for university waste) acting favorably toward interest rate “stimulus” was autos. Prior to the historic credit selloff and MBS rout in the middle of last year, you could add housing to the list. The latest figures for March 2014 from the National Association of Realtors leave no doubt that housing has disengaged over the interim.

The obsession with temperature continues, even though March was free and clear of the kind of “unusual” storms plaguing January and February. Again, such pandering is indicative of the kind of groping and pleading for something that can explain what is otherwise obvious while still preserving the monetarist view and paradigm. To accept what is obvious means either total refutation or more experimentation with the limits of rational expectations theory.

The change in trend clearly predated the change in season, but aligns exactly with the inflection in mortgage finance and credit. This should be much more alarming to mainstream observers, as I have noted repeatedly that a relatively minor increase in interest rates should not have provoked something so dazzling in its contrast. How can 80 or so basis points lead to these results, absent any artificial market factors? Once more, the tide of asset inflation.

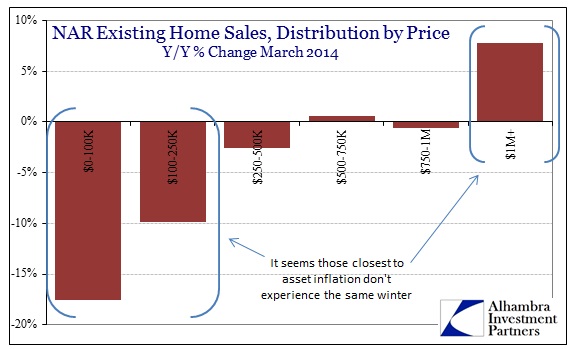

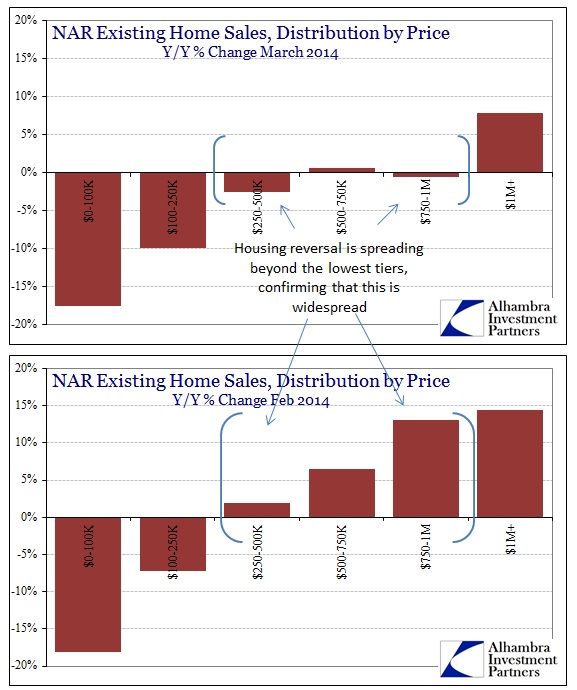

Furthermore, this change or inflection appears to be gaining a wider berth. Whereas previous months have seen such contraction more or less limited to the lower tiers of the pricing environment, the data for March shows no such limitation except now only the extreme upper level.

The comparison of March with February is very much conspicuous on that account.

This asserts not just a macro problem, particularly as we see persistent economic detachment, but also as another and further warning of artificial markets in general. Once they lose their assumed paradigm, the artificial factor, the results tend to be just so incongruous and asymmetric.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com