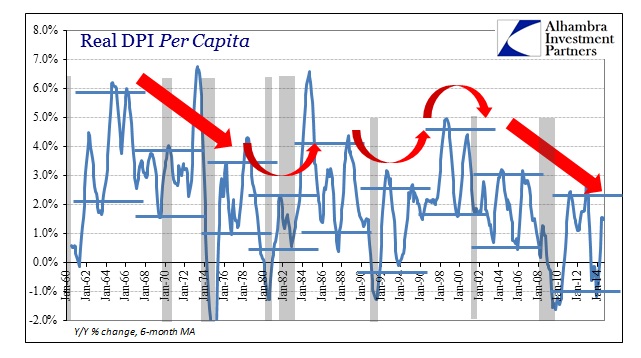

I’m not sure what basis there is for expecting a robust holiday season. Even factoring the move in the unemployment rate and upward revisions to GDP in the past two quarters, none of that has done anything toward correlating with rising income. In fact, 2014 is conspicuous in that aspect more than at any time during this “recovery.”

The latest estimates, released quietly last week just prior to Thanksgiving, show not just that continued lack of income growth but significantly less upon recent revision. Personal income after June has been estimated lower to a level not usually associated with anything bright and healthy.

More than that, the straight and steady growth rate post-revision belies any apparent equilibrium as such an appearance is usually associated with statistical anomalies. Regardless of validity, income growth at 1.5% is about a half to a third of what it “should” be for the stage in the cycle that monetary proponents claim this economy resides at. With incomes in 2013 and early 2014 contracting in real terms, you can forgive consumers for not spending with abandon at a supposedly steady 1.5% for all of 6 months. To get to where economists suggest would “need” something like 3-4% income growth, or levels not seen in a long time (so far in the past that they have forgotten this easy correlation of income and spending?).

In fact, such reduced income growth has been reserved for times more closely resembling economic decay and turmoil.

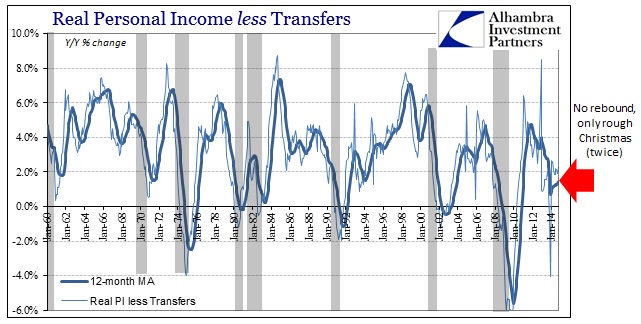

When we look strictly at the changes in the private sector generation of income, stripping out transfer payments (which should be more favorable to the “narrative”) there is a clear lack of anything that looks like actual progress.

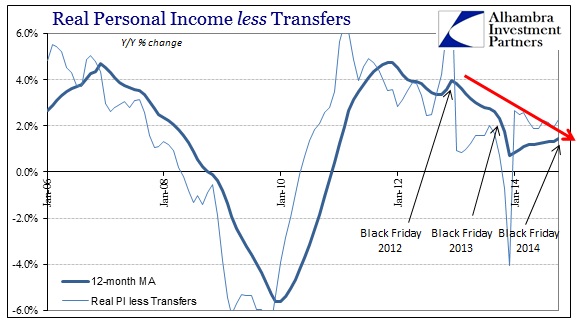

To offer a compelling explanation for the pared results of Black Friday sales is to simply view the trend in income since 2012.

Each November has seen a reduced growth rate in private incomes starting with November 2012 (which was roughly even with November 2011). The continued lack of income growth, now at least two full years, is far more consistent with reduced spending activity than a supposedly robust economy so full of promise.

Again, incomes at this paltry level of growth are almost always reserved for recession (the sole exception dating back to 1960 was late 1993). In the latest chapter, it is clear that income growth peaked in 2011 and perhaps 2012, and has only slowed since then with heavy variation month-to-month. The latest revised figures suggest (again, setting aside statistical validity in such a straight line) that there is a much lower ceiling on growth in this slowdown environment than otherwise might appear from more remote views on economic status.

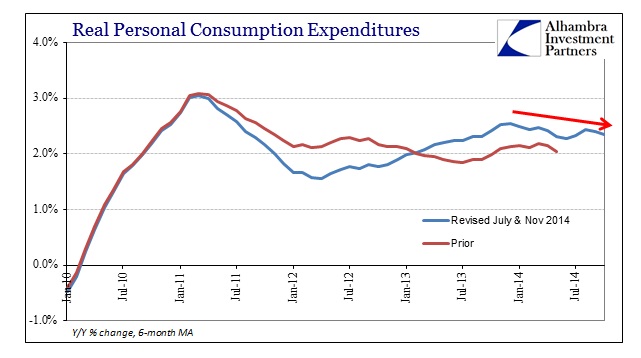

That view is confirmed, to a high degree, by spending levels that almost look like an advance but only in a very narrow context of the past two years. In historical context, personal spending (despite upward revisions to correspond with GDP) continues to be mildly recessionary at best.

Not only that, the trend more recently, even in the latest upward revisions, has been in the wrong direction. There is and has been a peak in perhaps the latest mini-cycle that shows up after last year’s Christmas disappointment, taking full account of Q1 2014.

There is no need to search and grope for alternate explanations for “unexpected” sales declines, as spending is so surely linked to income. The lack of income growth compels everything we have seen for the past eight years, dating back to the housing bubble burst, which connects the artificial growth of “aggregate demand” to the obvious lack of recovery. Contrary to orthodox belief, spending does not lead to income as it is wealth that drives labor utilization. However, lack of spending does tend to foster the “wrong” sorts of tendencies, which is why the Fed is getting more and more uncomfortable with its own lack of apparent influence.