When the media and most Wall Streeters talk about what drives the Treasury market they talk about silly things like inflation expectations, economic expectations, interest rate expectations. As if “expectations ever turn out to be right. They say that yields rise when “the market” expects a stronger economy and rising inflation. They say that yields fall when “the market” expects low inflation and a weak economy. Supposedly the two go hand in hand.

Funny, I remember a time back in the 1970s (yes, I was in the business then) that we had high inflation and a weak economy. They explained that by making up a word, “stagflation.”

Stagflation was both the result and the reason. Why were interest rates high? Inflation. Why was the economy weak? Inflation. Somehow, that became both cause and effect. Then somebody coined the term “stagflation.”

I actually don’t remember using the word back then. I think it’s something that economists came up with ex post facto, just like with everything else that goes wrong that wasn’t in their models. Economists are great at making excuses for what they got wrong after the fact. They’re not so good at understanding the present, let alone predicting the future.

So it is with why bond yields are rising and falling. When we don’t understand the real reason for something, let’s make up a bunch of BS and pretend that we do. That’s the Economists’ Credo.

Like right now. Yields have been rising in recent weeks. Why? Because the market thinks that the economy will be stronger and that we’ll have inflation as a result, so they say. Why will the economy be stronger? Because Donald Demento will spend a trillion doing this and that; because the Federal deficit will increase; and the economy will heat up. Ergo, we’ll have inflation. The bond market, they say, is discounting the future.

Ugh. Baloney.

Bond prices rise or fall, and yields move inversely to that, because of supply and demand (SAD). The “reasons” that people make up are just excuses for things that economists never bother to think about. Like what really drives supply and demand. It’s not expectations. It’s money. M-O-N-E-Y.

When central banks print money and jam it into the pockets of Primary Dealers the world over, it burns a hole in their pockets. Since they’re in the business of buying securities low, then marking them up and distributing them, that’s what they do. They’re constantly getting cashed out, whether by the Fed, or the ECB, or the BoJ. When they have cash, they buy. That’s the way it has rolled for decades as one major central bank or another, or all three, have rained money on Primary Dealers.

US Primary Dealers are those anointed ones like Goldman Sachs, JP Morgan, Bank of America, and 20 other big banks around the world, who get to act as exclusive counterparties for the the Fed. Most of them are also counterparties with the ECB and BoJ, and also as primary agents for governments around the world when they sell debt.

Of course, governments are only too happy to oblige, creating lots and lots of debt for them to buy. So there’s a delicate balancing act going on. Dealers have the cash to buy lots and lots of debt, but the amount isn’t unlimited. Governments want lower interest costs so while they create and sell lots of debt, they don’t want to sell too much. That would cause bond prices to fall, and yields to rise. That would raise government borrowing costs.

So in the course of this dance of the Sugar Plum Daddies, there’s this delicate balance between supply and demand. The central banks keep printing more money. That spurs demand. Everybody likes to buy stuff when they have more money. It’s especially true of securities dealers.

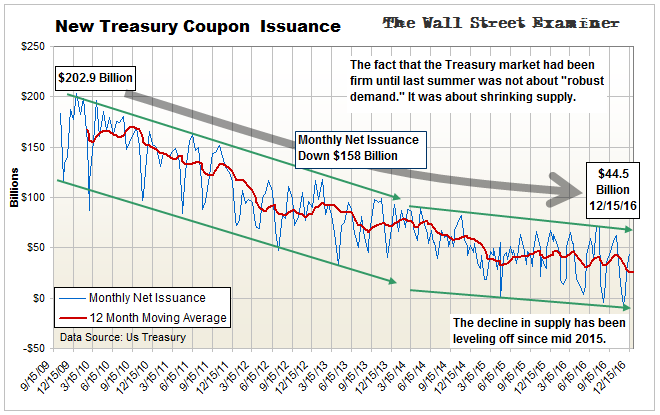

So why have bond prices been falling and yields rising since July? Notice I said July, not since the election. The rise started and continued gradually until the election when they blew the roof off. Were yields rising because dealers and investors were anticipating the election of Donald Demento? Hardly. They were rising because governments were still selling debt, but something was going on on the demand side that was a little more complicated and insidious.

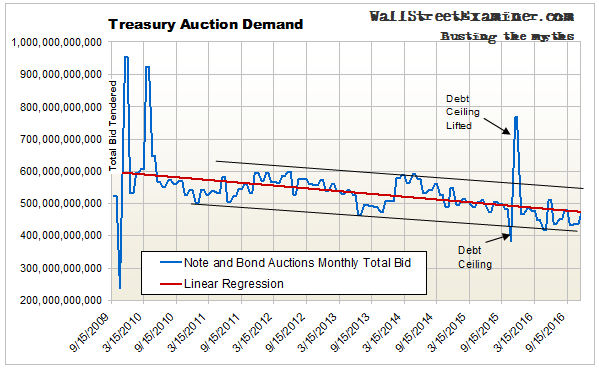

Yes, the BoJ and the ECB were still printing lots of money and showering it on Primary Dealers and assorted other bankers in the rest of the world. But demand fell anyway, because bank depositors, and especially the banks themselves, were destroying new money faster than the central banks could print it.

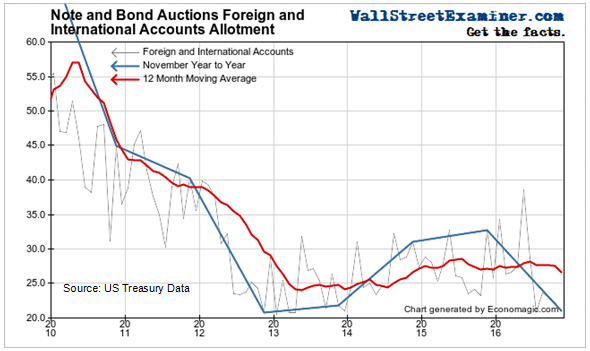

European banks are largely insolvent. The money that the ECB is pumping into their accounts has been a stopgap to keep them afloat. It has worked up to a point. But the crisis reached a flashpoint this fall. The banks and other borrowers in Europe then began to use the ECBs cash to pay down their own debts. Before, they would use the cash to buy sovereign debt, both of their own countries, but more often than not, of the US Treasury. So for years, US Treasury prices kept rising, and yields kept falling.

That reversed last summer when the banks started to need to raise cash. Instead of buying more Treasuries, they started to use their Treasury holdings as a ready source of cash with which they could pay down debt. When debts are paid down, deposits are extinguished. When deposits are extinguished there’s less money available to buy more debt.

So the Treasury market has a double whammy. European banks are selling Treasuries to raise cash to pay down debt. When they pay down debt they use cash on deposits to pay for it. The money is thus extinguished, so there’s less of it available to buy Treasuries. Prices fall and yields rise. That pressures the market. Some traders get hit with margin calls. And so it goes, leading to a downward price spiral and mirroring rise in yields.

Eventually, yields reach a level where they start to look attractive to “investors” who are lucky enough to be sitting on some of the cash that’s still floating around. This is particularly true of the US. While Europe is undergoing cash destruction, the US banking system still has tons of excess cash. Those banks start to like the looks of that 2.5% 10 year yield. Especially considering that they were only yielding 1.4% 6 months ago.

So we’re starting to see some nibbling around here. Will it be sufficient to overcome the steady flow of liquidation rolling out of Europe? Maybe in the short run. Maybe not. The forces of monetary contraction in Europe are strong. That’s not like to change any time soon. Any counter trend buying in the bond market is likely to be shortlived.

Meanwhile the Fed is making at least a tactical error by merely pretending to want to raise short term interest rates. It’s pretending that that’s because the US economy is” strengthening.” It’s pretending that the strength they perceive will cause inflation to heat up. Those are its excuses.

But the truth is that nothing has changed. Weighed down by massive excess debt, and technological change that is rendering work workers irrelevant and worthless, the US is on the same path of puny growth it has been on. That’s not changing. If inflation does heat up, it won’t because the economy is strengthening.

And if bond yields resume their rise, which the technical charts suggest is only a matter of time, it won’t be because the “market” expects a stronger economy and more inflation. It will be because there’s less money around. Europe has always been a huge buyer of Treasuries. Europe is now really broke. Even its brokers are broke. Broker than ever before. Deutshce Bank? Dead! Monti di Paschi? Dead! Spain’s banks? Dead? Bank deposits? Plunging. Banks holding deposits in other banks? Fleeing like rats from a sinking ship.

It’s over for Europe. Finished. Kaput. Now, as Rome burns, the ECB has decided it’s time to cut back on its weekly cash drip to the Eurozone banking system. The process of central bank long term serial blunders just goes on and on. They’ve made a mess they can’t undo. Well, they could undo it, but their house of cards collapses on the process.

So if bonds do rally here, take it as a gift. If you’re holding long term bonds that have big profits, use that next rally to skim the piggy bank. If you hold on to your long term paper, those profits will shrivel away. By the same token, short term bills are likely to increasingly reward you for being on the sidelines as the liquidity crisis deepens.

This report is derived from Lee Adler’s Wall Street Examiner Pro Trader Monthly Treasury Supply and Demand Report.

Lee first reported in 2002 that Fed actions were driving US stock prices. He has tracked and reported on that relationship for his subscribers ever since. Try Lee’s groundbreaking reports on the Fed and the Monetary forces that drive market trends for 3 months risk free, with a full money back guarantee. Be in the know. Subscribe now, risk free!