In looking at the “portfolio effect” of monetary policy, monetarists always see benefits without costs. The one exception in recent years has been Jeremy Stein of the FOMC, who is no longer a member. It was his statement in February 2013 about “reach for yield” that seems to have set off something odd in the policy apparatus. Some of that has to do with the idea of secular stagnation, in that people who believe in it think there is no choice but to create bubbles to gain any economic growth, but those same people cannot come to terms with how to manage those bubbles (which shows you one element of why the theory is ludicrous on its face, even though the stagnation is real, as are the bubbles).

In July, Janet Yellen remarked about what seems to be her preferred choice in that direction, a topic that has been central to her Chair.

In my remarks, I will argue that monetary policy faces significant limitations as a tool to promote financial stability: Its effects on financial vulnerabilities, such as excessive leverage and maturity transformation, are not well understood and are less direct than a regulatory or supervisory approach; in addition, efforts to promote financial stability through adjustments in interest rates would increase the volatility of inflation and employment. As a result, I believe a macroprudential approach to supervision and regulation needs to play the primary role. [emphasis added]

The first part of that remark is stunningly obtuse – of course monetary effects on “financial vulnerabilities” are “not well understood” at the Fed and other central banks because they still adhere to monetary neutrality which circumvents any attempt to understand. So the very organization charged with regulating the vast majority of banking and credit capacity is the very same mechanism by which central planning is initiated through credit policies, all at the same time these same “experts” fail to understand the actual connection between credit policies and that credit capacity. What a wonderful system; why are there serial bubbles again?

If we cannot expect the very mechanism that creates the impetus toward “financial vulnerabilities” then we are, as Yellen proclaims, in the capable hands of regulators and their “macroprudential” systems and arcana:

The Federal Reserve is stepping up its oversight of high-risk leveraged loans, shifting to a deal-by-deal review after its previous industry-wide guidelines were largely ignored by banks.

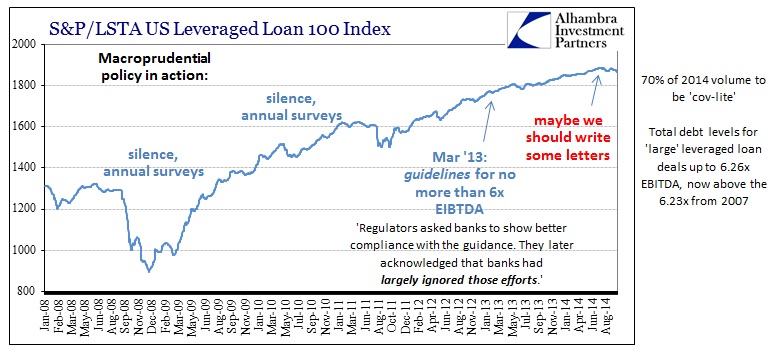

Truer words have never been written, as if you were observing the leveraged loan market from afar with little prior experience you would come to the conclusion that there was no such thing as “guidelines” in leveraged loans.

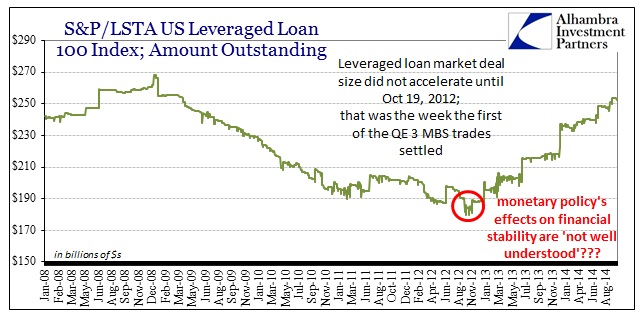

Until now, supervisors collected loan data in an annual survey, and last year told banks they needed better adherence to standards they put forth in guidelines in March 2013. Over the past several weeks, they have shifted tactics and are examining loans as they are made, showing a new urgency in avoiding the kind of overly risky lending that was blamed for igniting the financial crisis.

To sum up: the leverage lending market had prior guidelines that were supervised (using that term loosely) via an annual loan survey leading to a surge in the kind of “overly risky lending” usually reserved for the bitter ends of cycle peaks; and now, long after all that behavior has been entrenched and hundreds of billions of loans made, macroprudential policy wishes to step up regulatory pressure.

If the latest round of heightened scrutiny doesn’t work, regulators have other options. They can change supervisory ratings on banks, which could limit mergers. They could ask boards to sign agreements to make changes, or they could resort to fines.

This has to be theater of the absurd. Let’s not forget what Janet Yellen also said this year, that she believes that private “markets” should be so confident and comfortable with “resilience” and macroprudence and all of her academic knowledge as to simply ignore all of this.

…it is important for the central bank to make clear how it will adjust its policy stance in response to unforeseen economic developments in a manner that reduces or blunts potentially harmful consequences. If the public understands and expects policymakers to behave in this systematically stabilizing manner, it will tend to respond less to such developments.

Pay no attention to anything in leveraged lending because the letters have been written and all that awaits the stamps being affixed is byzantine bureaucratic approval? This is actually far worse than what I wrote about the reverse repo program – they have no idea what they are doing and want you to take absolutely no notice of any of it. So, on Chairman Yellen’s advice, do not look below because once more everything is contained.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com