St. Louis Fed President James Bullard has become something of a spectacle in the past year or so. As the FOMC claims to be data dependent upon its on schedule for ending ZIRP, Bullard’s interjecting media appearances seem to straddle either side, the exact which he takes being dependent on maybe not data but at least markets. While stocks seem to have figured prominently via his seeming tipping point back and forth, there can’t be any denying market-based inflation trading and measures as an equivalent piece.

The recovery story itself is down to almost that point exclusively. There is nothing left of the current economic story by which to suggest that mainstream view of data dependence. What the FOMC has tried to do is replace current conditions with an “anchored” future, so certain because, they claim, inflation expectations are only there. Everything else is supposed to follow that one last assumption.

A top Federal Reserve official stuck to his forecast of raising interest rates in the first quarter of next year, with rebounding inflation, strong jobs data and lower oil prices propelling a strengthening U.S. economy.

The problem with going “all in” on long-term inflation expectations is revealed in the quote above, not for the paraphrased words from President Bullard but rather how they were expressed in November 2014. Yes, “transitory” and all that falling apart, but there is deeper and more significant erosion here that is really conditional in tearing asunder the “transitory” fantasy.

It starts with TIPS trading and how that view of “inflation expectations” has been altered, or at the very least evolved. This is a greatly underappreciated facet of this period, so much so that I’m almost certain it is wholly unappreciated. This change is obvious when viewed, like most economic and market accounts, in longer term context.

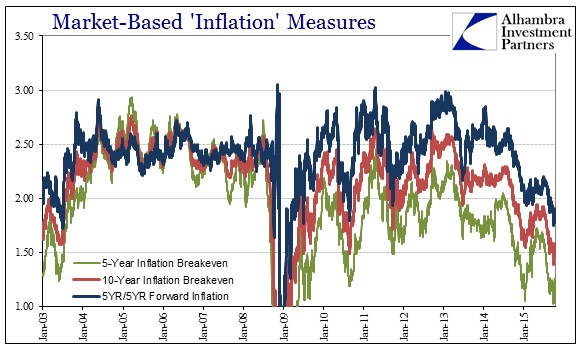

You see plainly in the chart above, consisting of 5-year inflation breakevens derived from 5-year TIPS, 10-year breakevens and the calculated “forward” inflation expectation rate, the massive imprint of the Panic of 2008; it dominates the chart as it did in reality. Right about the middle, everything suddenly and sharply depresses as the panic was really and truly the nexus of financial irregularity bleeding into economic collapse. The relevant portions, however, to our current condition is to both the right and the left of that; specifically, how the right (recovery) looks very different from the left (pre-crisis).

Starting chronologically, during the later housing bubble period all three of those inflation expectations measures were in very close proximity; often remarkably so. They fell out of line around June or July 2007, with a good jolt between them in, where else, August of that year. This is a market-based indication of what Yellen has been trying to use as proof of long run fixation; namely, with the varying maturities (and the forward rate essentially measuring that) closely clustered that suggests a very stable inflationary environment (as far as, again, market-based expectations) in both the near and longer terms.

Clearly, “something” changed in the aftermath of the Great Recession. Here, too, the spacing of the expectations measures tells the story. With the 5-year maturity often trading significantly below the 10-year, that spread denotes the monetary fantasy against hard luck reality. In other words, the short-term view being depressed is the market-based expectation about shorter term economic deficiency in the lackluster, at best, recovery. However, the longer-term 10-year maturity trading well above suggests that while the current period might be underwhelming there trades an expected correction at some point in the more distant future. Monetarism is thus defined by the market in the “recovery” period as not particularly convincing closer to time zero but investors are also not willing to fully bet against it in the long run. It is, as you can imagine, a precarious arrangement.

The 5-year/5-year forward rate is thus like the steepness of the yield curve – highly artificial owing not to an expected recovery but rather this same disparity between what is occurring and the “don’t fight the Fed” mentality that has existed, inappropriately, for far too long. I make that claim based upon QE itself, because in very general terms the panic and immediate aftermath was really a direct challenge to that monetary myth. The Fed was forced to respond in kind; to demonstrate the Fed’s power where legend was no longer anywhere close to sufficient. The staggering totals about the size of the QE’s were, apparently, enough to maintain it – for a while. But the continuing spread between inflation expectations, and the artificial rise in the forward rate, as the yield curve steepening, was thus highly susceptible to the market “waking up” and appreciating the great disparity.

If the market were to see that QE was more (all) fluff than substance, the precariousness of the arrangement becomes not just potentially dangerous but paramount.

And that is what we see since the middle of last year, coincident, of course, with the “dollar.” The falling forward rate measuring, again, the spread between the maturities of breakevens shows that the market is no longer so enthralled by that QE-inspired myth of monetary power as a sort of upper bound marking what Yellen hopes of that anchor. If it had worked, inflation breakevens would be instead converging to the 10-year upward, but because they are instead hurtling toward a meeting far downward we can only conclude the magic is gone in the bond market. If the myth of QE was the mainstay in keeping that spread apart despite underwhelming reality, and thus hope and Yellen’s future inflation anchor, then its demise recently is the final nail in that coffin.

The fact that inflation trading in the past two months has been more so aligned with global “dollar” liquidity than strictly oil or commodities I believe leaves little other interpretation. Unfortunately for President Bullard and Chairman Yellen, that also suggests the death of their so-called inflation anchor. They can continue to point to surveys of “professional forecasters” all they want, in the end fixed income and money markets just aren’t buying it. Without that force, they are doomed; which is why what Bullard said in late 2014 is practically indistinguishable from what he might say now. Talk has never been cheaper in this “cycle.”