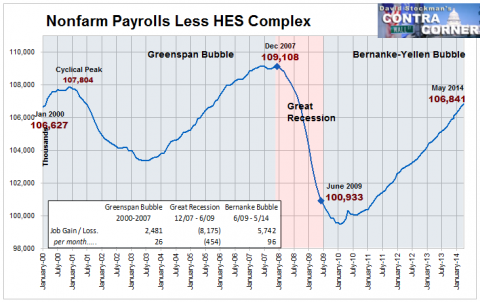

Yes, the nonfarm payroll clocked in at 138.5 million jobs and thereby retraced for the first time the point at which it stood 77 months ago in December 2007. This predictably elicited another “milestone of progress” squeal from the mainstream media.

So you have to wonder. Did these people skip history class? Do they understand the vital idea of “context”? Are they so mesmerized by paint-by-the-numbers agit prop from Wall Street and Washington that they have come to mindlessly embrace the notion that any number that is better than the last “print” is all that it takes—regardless of composition, quality or longer-term trend?

Thus, consider the ancient days of the Reagan era. Back then there were actually 15.0 million new jobs by the time that 77 months had elapsed after the June 1982 bottom. And these were honest-to-goodness new jobs that had never before existed, not born again jobs of the type that CNBC has made a “jobs Friday” fetish out of ever since the Great Recession was officially declared over in June 2009.

So if you want to try a little “context” absurdity recall this. So far we have created a trifling 100k “new” jobs since the last cyclical peak. During the equivalent 77 months in the Reagan era the US economy actually generated 150 times more jobs!

And, no, that wasn’t due to a demographic windfall of new employable bodies. During that 77 month period the civilian population age 16 and over increased by 8% or 13.3 million. This means that 113% of the growth in the pool of employable adults was converted into job-holders.

This time around, the pool of working age adults grew by quite respectable 14.4 million; and that amounted to a not shabby gain of 6% from December 2007. But self-evidently, during the 77 months since then virtually zero percent of the labor pool growth was converted into job holders. So the yawning difference between the Reagan era and now is not a surfeit of demography, but a dearth of job creation.

And this has nothing to do with Ronald Reagan hagiography—since the jobs gains of the 1980s were purchased in part with grotesque peacetime deficits of a magnitude never seen previously. Nor would they be seen again until the Bush-Obama era showed what real fiscal profligacy looks like.

But the larger point is that each cycle since the 1980s has generated net new jobs, albeit at a steadily declining rate. The truth of the matter is that we have now reached the point where no new payroll jobs have appeared for 77 months—which is to say, over the entire span of a historically ordinary peak-to-peak business cycle. Rather than a cause for celebration, therefore, the Friday jobs print ought to stand out as a wake-up call.

Surely, the CNBC revelers do not believe the business cycle has been abolished. And if not, why should it be assumed to have a indefinite remaining lease on life when everywhere around the world governments are at the end of their fiscal rope and central banks have painted themselves into an impossible monetary corner of ZIRP and QE. Is it not probable that something will go bump-in-the-night owing to these vast experiments in fiscal and monetary largesse?

Stated differently, 6-years of ZIRP have left the world’s financial system booby-trapped with tottering pyramids of debt and rampant carry trades and financial speculations. Why would this be assumed to comprise the kind of stable and productive financial environment that would enable the current business cycle expansion to go on for years into the future, thereby eclipsing every record from far more stable times of decades past?

So a 77 month jobs drought is a big deal, yet search the financial press and you will find no mention. And not just because of the benchmark set in the Reagan era. During the 77 months after the 1990 peak nearly 10 million net jobs were created; the working age population expanded by 12.2 million; and the conversion rate was not zero, as during the recent go round, but actually more than 80%.

Even after the dotcom bust and well into the second Greenspan money pumping spree the US economy did manage to eke-out 5 million net nonfarm job gains during the 77 month interval after the 2001 peak. And that amounted to a 28% conversion rate from the 18 million gain in the working age population pool.

Taken in broader context, however, the two most recent cycles of first middling job growth during the Greenspan housing bubble and then zero growth during the entire duration of Bernanke’s ZIRP experiment constitute an alarm bell of secular import. After all, since January 2000—when Bill Clinton was enjoying his last days in the Oval Office—the US economy has created only 7.5 million net nonfarm payroll jobs. That amounts to less than 45,000 per month or not even 30 percent of the monthly growth in the pool of the working age population.

That comparison alone points to a up-coming crisis, but not one of the type imagined by the stock market cheerleaders on bubblevision. The crisis that we are drifting into owing to the failure of meaningful economic growth and job creation during this century is one of fiscal dependency.

It implies a crisis of public finance that will either lead to continued bond-buying by the Fed and an eventual monetary collapse, or, in the alternative, decades of steadily rising taxes–likely of the wealth destroying populist kind—that will shutdown the American economy and render Washington even more paralyzed, ineffectual and rent with partisan conflict than it is today.

The numbers behind that proposition are dispositive. Owing to the lack of job creation since the turn of the century, the number of Americans over 16-years who are not employed has soared, rising from 75 million to 102 million. And that massive gain in the ranks of non-workers is not because the entire baby-boom up and retired. In fact, there are only about 7 million more “retired” Americans on OASI today than there were 14 years ago.

So upwards of 20 million have tumbled into public and private safety nets. As to the former, the number of combined food stamp and social security disability recipients(DI)—the first line of the public safety net—has surged from 23 million in 2000 to in excess of 60 million today. So one-in-five citizens are already in the public safety net, and millions more have fallen on private support by moving in with mom and day, into public shelters or onto the streets.

And yet the clueless CNBC revelers apparently think that this is some kind of societal misfortune, but nothing which could cloud the perpetually bullish skies ahead. In the Keynesian world of 30 days at a time, in fact, the predicate is just the opposite. That is, don’t even begin to address the implied fiscal crisis of jobless dependency because the resulting “fiscal drag” might shave a tenths off the quarterly GDP print.

In short, never in modern times has the financial press had its head buried so deeply in the sand. Counting “jobs” as if the principle of “one man, one vote” applied in the realm of economics should be indictment enough. It is not even possible that the revelers are aware of the following cardinal fact—a fact which belies part and parcel the farce known as jobs Friday.

During 2013 the private business sector—which once upon a time was thought of as the foundation of growth and wealth in the US economy—utilized 194 billion labor hours. What is salient about that fact is that it is the same number of labor hours as were utilized by the private business sector way back in the days of Bill Clinton’s blue dress period—that is, 1998.

So it is entirely fair to call people clueless who revel in 217,000 “new” jobs last month, while completely ignoring that this cyclical blip occurred in a context in which there has been no gain in the true metric of employment—-labor hours in the business sector—for 16 years running.

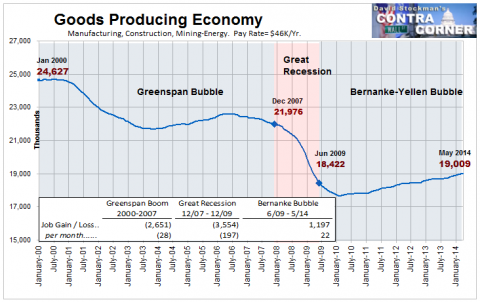

So this means that as the job count has crept upwards, the actually utilization of labor has gone nowhere during this entire century. Well, actually, utilization of the most productive and high paying labor has actually gone south. As shown below, the number of goods producing jobs—construction, manufacturing and mining/energy—has actually shrunk big time.

Notwithstanding the Friday cross-over into aggregate job growth after 77 months, the number of goods producing jobs reported last Friday was 19.0 million or 3 million and nearly 15% fewer than in December 2007; and even more starkly, 4.6 million or 23% fewer than existed at the turn of the century.

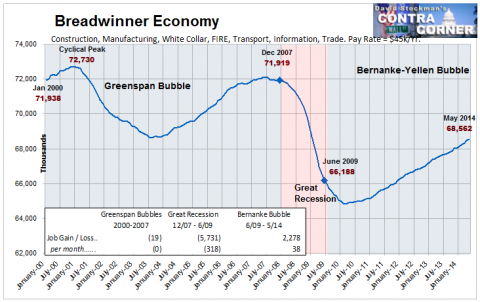

While the fall has been less dramatic, the pattern is also true for what we have called core private sector services jobs—- distribution and transportation, FIRE (finance, insurance and real estate), information technology, the white collar professions, and business management and support services. At a posting of 38.6 million jobs on Friday, the print had still not reached its December 2007 level.

In fact, while these are the highest paying jobs in the US economy—with annualized pay rates around $50k—- the monthly rate of growth since January 2000 is just 9k jobs.

Likewise, the very highest paying jobs in the US economy—core government employment outside of education and the post office—where average pay rates exceed $60k per year, is also still below is 11.2 million level of December 2007.

To be sure, from a fiscal policy viewpoint, this is more than welcome, and there are millions more of these taxpayer funded jobs—especially the 800,000 in the Pentagon—that could be readily dispensed with. But that makes the “jobs count” game all the more ridiculous.

Taken together, the goods producing sector plus core private business services and government outside of education constitute the “breadwinner economy”. Average pay rates are upwards of $50K annually and in many areas of the country approximate the median household income and provide the basis to support a family. Yet at the Friday count of 68.6 million breadwinner jobs, were still 3.3 million jobs short of the December 2007 peak. In fact, there are 5% few breadwinner jobs today than there were in January 2000.

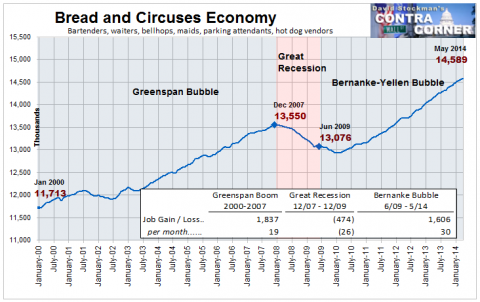

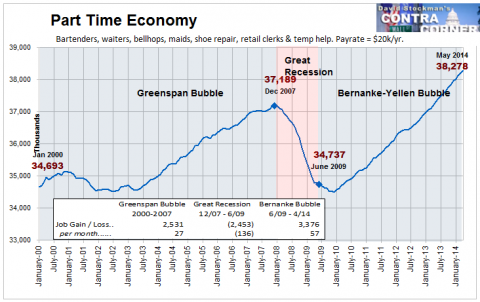

As shown below, on the margin these disappearing high wage breadwinner jobs are being replaced with part time gigs in bars, restaurants, retail and temp agencies where pay rates of $20K annualized are not even two-fifths of the level which pertains in the breadwinner economy.

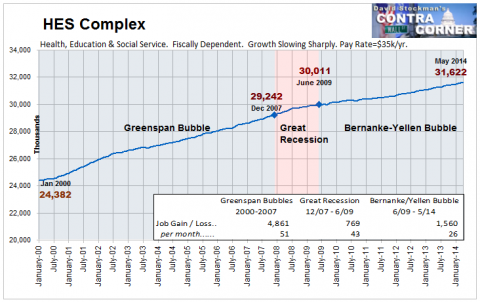

Outside of the Part-Time economy the only other source of job growth during the last 77 months was in the HES Complex—health education and social services. Here the Friday print of 31.6 million jobs was up by 2.4 million or 8% from the last cyclical peak.

But the problem here is two-fold. In the first instance, the nearly 32 million jobs in this sector pay only an average of 35K per year and are heavily dominated by low pay jobs in education, home health services, nursing homes and social welfare agencies.

But secondly, and more importantly, these jobs are overwhelmingly fiscally dependent. That is, funding of production and employment in the HES Complex comes from local, state and Federal spending or through the back-door of some $300 billion in Federal tax expenditures for employer health plans and education tax credits.

Not surprisingly, as the fiscal noose continues to tighten, the rate of monthly jobs growth in the HES Complex has steadily eroded. During the Greenpsan Bubble from 2000-2007, the jobs count expanded at 51k per month. But it then fell to 43K during the Great Recession and has clocked in at just 27K per month since June 2009.

At the present time, the number is being given a small boost by the inception of Obamacare, but at the end of the day the fact that the US has reached peak fiscal debt will over-ride all else. Stated differently, it is surely a truism that we can’t borrow or tax our way into more jobs for the indefinite future. What has been America’s de facto jobs machine since the turn of the century has long ago seen its heyday.

What is left is the picture below. Namely, an economy that has not generated a single net new job for 14 years outside of HES Complex—-that is, jobs which were bought and paid for by taxpayers and the debts that have been created in their behalf. Only in a world gone mad for Keynesian money printing and serial bubble finance could a knuckle head like Steve Leisman conclude that we are on the road to recovery because we got another favorable print on “jobs Friday”.