Folks, this is starting to sound pretty ominous. The Washington War Party is coming unhinged and appears to be leaving no stone unturned when it comes to provoking Putin’s Russia and numerous others. The recent collapse of cooperation in Syria—-based on the false claim that Assad and his Russian allies are waging genocide in Aleppo—- is only the latest example.

David Stockman On “Wall Street Week”: Get Out of Harms’ Way Now—–The Casino Is Heading For A Crash

Former Reagan Budget Director David Stockman on the Federal Reserve and what is needed to boost the U.S. economy.

One Percent Don And The Latest Folly Of Trump-O-Nomics

Why are we not surprised? Having just signed the BUBB (Big Ugly Budget Buster), aka the Big Beautiful Bill, the Donald has wasted not even a New York minute pivoting to a demand that the Fed now crank up its printing presses red hot to finance the new flood of red ink. We are referring […]

TACO Tuesday

What in the hell is the Donald talking about now? The Tariff Man has just further decreed that Brazil, Russia, India, China, South Africa and any new fellow travelers will pay an extra 10% tariff for just being members of the informal BRICs bloc. Their sin, apparently, is that they have not been keen on […]

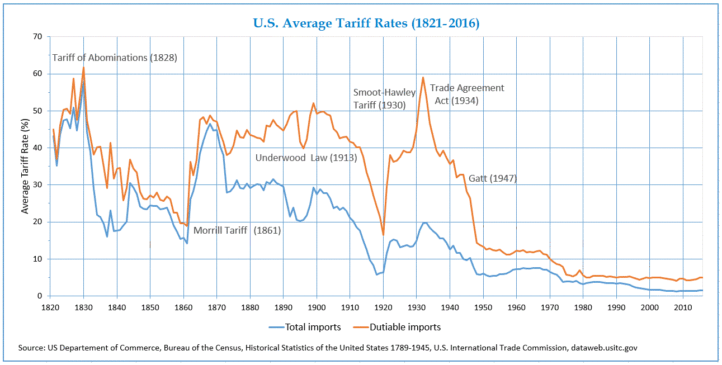

Why The Donald Is Foolishly Threatening Foreign Dollar-Holders

Oh c’mon. Here is the Donald’s latest entry in the annals of economic crackpottery and it’s a dozy. He’s now threatening 100% tariffs on any nation that looks sideways at the Almighty Dollar. The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. […]

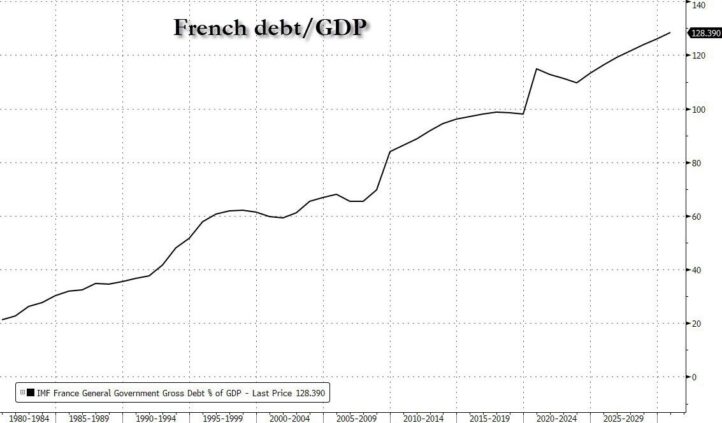

The Government Debt Disease Is Contagious….Viz France

The June Jobs Report: School’s Out…..Not!

Once upon a time June was “school’s out” month and as far as we know it still is. But apparently not by the lights of the BLS, which reported this morning that state and local school authorities hired an additional 64,000 teachers and administrators in June! In turn, this acute rebuke to normal seasonality accounted […]

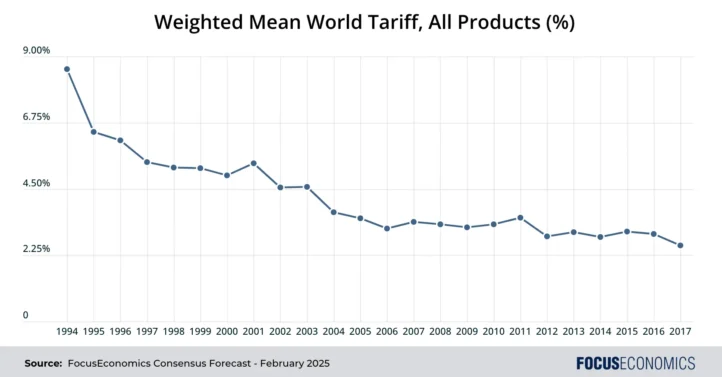

Nope, Donald, Foreign Tariffs Ain’t The Problem

Until The Donald, Tariffs Were So Yesterday!

Sell The Bonds, Sell The Stocks…..Demolition Donald Can’t Save Us, Part 2

Self-evidently, what passes for Trump-O-Nomics is likely to result in colossal failure because it functions exactly like an unhinged two-footed driver. That is, navigating with one foot hard upon the accelerator and the other pressing stoutly on the brake pedal. At the same time. Thus, massive Federal deficits and the Donald’s prescription for 1-2% interest […]

Sell The Bonds, Sell The Stocks….Cuz Demolition Donald Can’t Save Us

There is only one explanation as to how the so-called conservative party looked 10-year baseline deficits of $22 trillion straight in the eye, yet then genuflected to the King of Debt and voted to add $5 trillion more red ink on top. Or even more egregiously, GOP policy-makers were was told by CBO that the […]

6 Basis Points Of Fiscal Humbug From The White House CEA

Well, this figures. Back in the day we had to keep a close watch on Martin Feldstein, who was the Chairman of the Council of Economic Advisors in the Reagan White House. That’s because he was a closet Keynesian looking to polish his curriculum vitae—the president’s supply-side policy to the contrary notwithstanding. So we are […]