Red Ponzi Update—Debt Ratio At New Record High

China’s debt will likely hit a record this year as the central bank tries to boost credit and shore up the struggling economy, according to a government-backed think tank.

China’s debt will likely hit a record this year as the central bank tries to boost credit and shore up the struggling economy, according to a government-backed think tank.

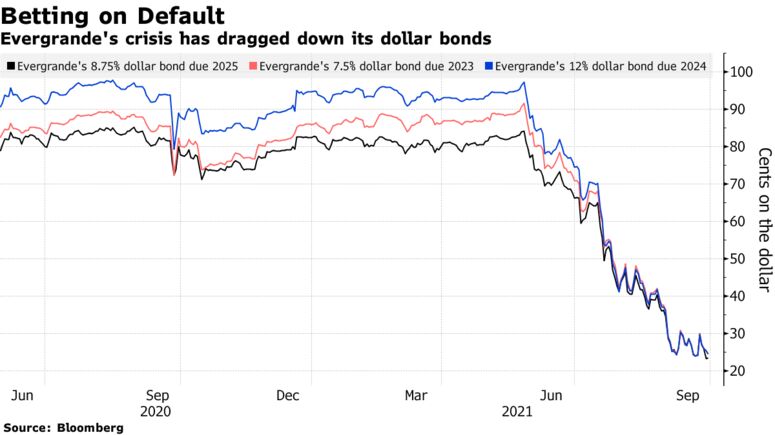

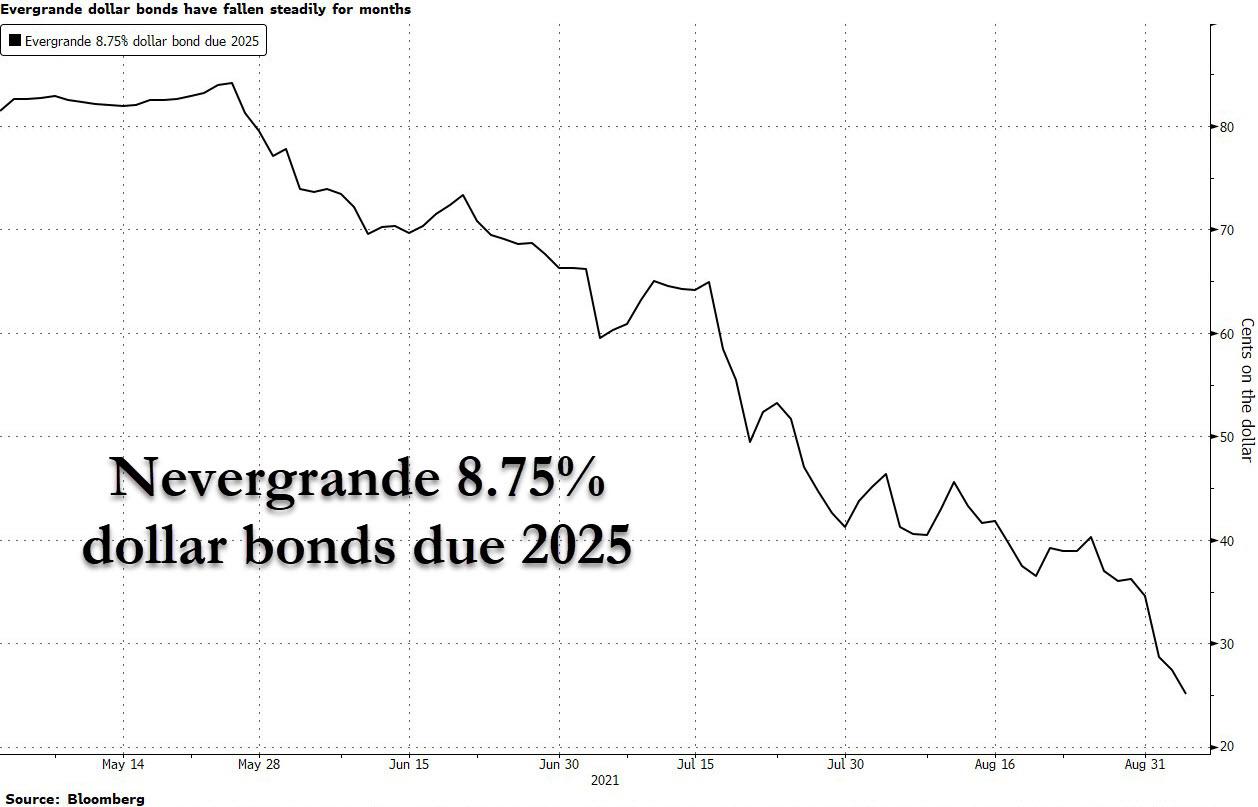

The party has ended. Years of aggressive borrowing have collided with Beijing’s crackdown on debt, leaving the giant developer on the brink of collapse. Construction of Evergrande’s projects in many cities has stopped. The company has faced a litany of complaints and protests from suppliers, small investors and home buyers who sank their savings into properties the company promised to deliver.

Evergrande owes over $300 billion – to banks and non-bank financial institutions, domestic and international bond holders, suppliers and apartment buyers. It has bank borrowings of $90 billion, including from Agricultural Bank of China, China Minsheng Banking Corp and China CITIC Bank Corp (reports have 128 banks with exposure). Thousands of suppliers are on the hook for $100 billion.

https://creditbubblebulletin.blogspot.com/2021/09/weekly-commentary-evergrande-moment.html

Still, the company needs to sell even more assets to plug its financial hole. Evergrande had around $104 billion of interest-bearing debt as of March, but that isn’t even the most urgent problem. It doesn’t have any bonds due until March next year. The bigger worry comes from its unpaid suppliers and contractors—many have sued to get their money back and some have managed to get some of Evergrande’s assets frozen.

The red dragon’s fire breath was already dying out before the Coronavirus pandemic had slain the beast. After more than 20 years of exponential growth, the paper tiger’s roar became a whimper thanks to the housing collapse, trade war, and public health crisis. The fragility of China’s economy is on full display as the world learns of the financial troubles brewing in Beijing. China is on life support, and it may be too late to resuscitate the nation whose situation is a lot worse than global financial markets are anticipating.

As Covid-19 works its way through the rest of Asia, Europe and the Americas — forcing countries into lockdown, driving up unemployment and pummeling small-business owners — analysts say it’s only a matter of time before stretched households globally start to default on their loans. The early indicators from China aren’t pretty. Overdue credit-card debt swelled last month by about 50% from a year earlier, according to executives at two banks who asked not to be named discussing internal figures.

Copyright © 2024 Subsidium LLC. All Rights Reserved.