The FOMC statement this week made a great deal about what amounts to charges of statistical impropriety toward the BEA’s GDP figures. The first quarter always seems to amount to a slow part of the season, which it really is because there is the massive Christmas buildup. It is clear that the Federal Reserve, referring to this not just in its FOMC statement but also in a blog by the Atlanta Fed and a paper by the San Francisco Fed, is quite bothered about all this. It is, after all, very difficult for them to proclaim smooth sailing for their recovery when even GDP deviates so drastically and so frequently.

The BEA has responded with some good detail on the subject, if still keeping the nuts and bolts under their covers. They recognize and admit that there are places where “residual seasonality” might exist, but at the same time they also note that that is something they work on every year.

Each spring, BEA conducts an extensive review–receiving updated seasonally adjusted data from the agencies that supply us with data used in our calculation of GDP. Most of the data the feeds into GDP is seasonally adjusted by the source agency, not BEA. At the same time, BEA examines its own seasonal factors for those series that BEA seasonally adjusts itself. All that work takes place in preparation for BEA’s annual revision to GDP and its major components, which will be released on July 30.

If the Fed is correct about Q1 2015, they better then suggest ways that the BEA missed this in all the Q1’s previously. To offer some focus, the BEA admits to three areas where “residual seasonality” might be actionable in the next July 30 update round. They are; 1. federal government defense services spending; 2. “certain” inventory investment series; and 3. “a number of series” derived from the QSS.

Those first two don’t exactly amount to what the Fed is trying to portray, in any way. They are relatively minor inconveniences and their inclusion, even to the point of being highlighted, more than suggests actually contradiction against the complaint. The Fed says Q1 GDP is totally flawed, and the BEA “agrees” in that some very small and minor parts are affected by this seasonal thingy.

The third relates to PCE Services, or consumer spending, but even here the BEA takes a shot at the Fed’s doubts:

Currently, these series are smoothed using a four-quarter moving average to attempt to smooth out seasonal trends in the data. While BEA’s review had not identified residual seasonality in the PCE services estimates, applying statistical seasonal adjustment techniques to these indicators will improve the accuracy of the underlying trends in PCE estimates. [emphasis added]

In other words, the BEA has found absolutely no “residual seasonality” in PCE Services to this point but will conduct seasonal adjustments anyway. That leaves the Fed’s whole “seasonal problem” with GDP amounting to nothing other than defense spending, inventory subcomponents and PCE Services where there was no problem to begin with. That doesn’t sound much at all like the BEA agrees with them about the state of their GDP calculation.

The entire blog post from the BEA is overly academic and dry, but in reading through it becomes clear that the BEA is not confirming the Fed’s view but absolutely contradicting it. This may be the most exciting an intra-governmental spat can get, but the BEA just told the Fed, very publicly, to “stop blaming us for your policy failures.”

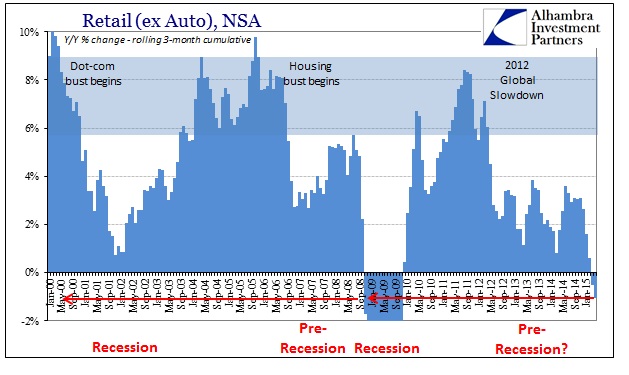

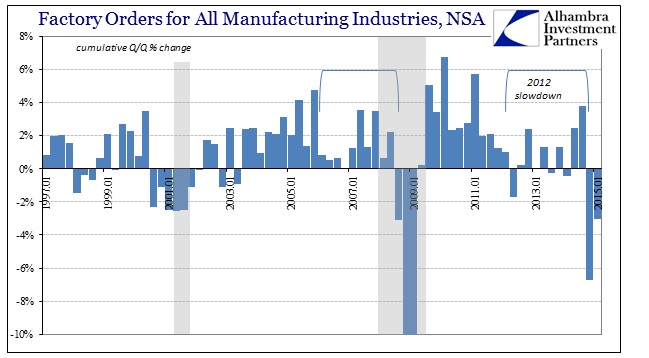

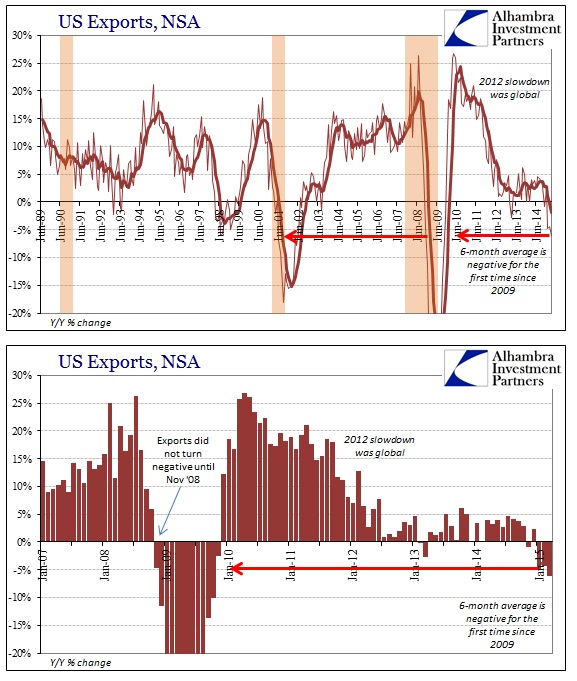

As it is, there is a very easy way to overcome these statistical adjustments, by using the unadjusted figures as confirmation. In terms of a broad array of unadjusted growth rates, the BEA is on quite solid ground about very little “residual seasonality”, a fact made plain by the disastrous subcomponents of the US economy. Negative numbers abound and they have nothing to do with the BEA.

Janet Yellen and the FOMC are really painting themselves into a corner by harping on the BEA’s procedures, as that only attempts mitigation against problems in Q1(s) alone. What are they going to do when Q2 is almost or just as bad? As of right now, the Atlanta Fed is projected just +0.7% for Q2 where there are, to this point anyway, no seasonal excuses. In fact, that latest figure includes the industrial production update from the Federal Reserve itself which projects real business fixed investment to decline by 2.3% instead of 0.6%. Since those are second quarter estimates and amount to continued negative capex for the national economy overall, why are we talking about Christmas hangovers in Q1 regression models?

To ask that question is to answer it. I have never been much an admirer of the BEA (from a philosophical perspective) but I might have to give them a little more respect for throwing it all right back to Yellen, which makes this week’s FOMC statement that much more embarrassing.

Not seasonally adjusted: