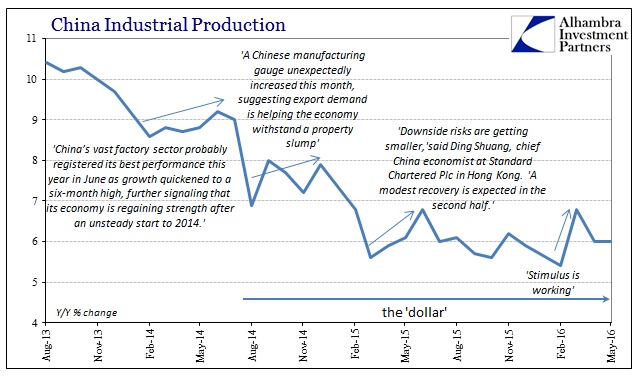

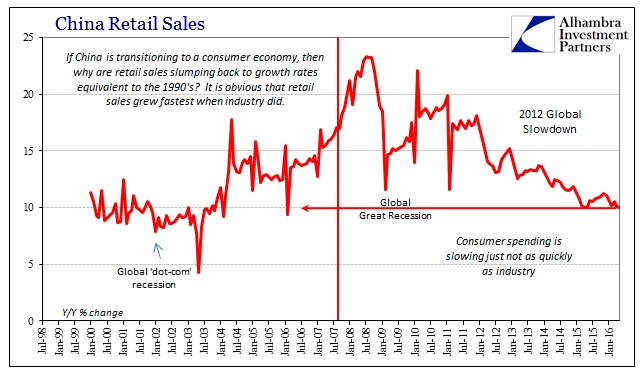

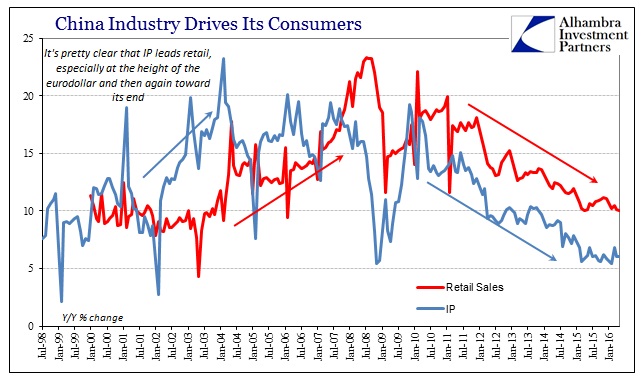

As always, there is the attempt to put a brave face on what is shaping up to be the worst year yet. China’s “big 3” economic data were all disappointing in the context of what the last “brave face” was supposed to suggest – where weakness at the start of the year was only due to “global turmoil” and would quickly recede. Instead, industrial production stayed at 6% while retail sales expanded at only 10%, matching the worst growth rate (April 2015) of the last ten years.

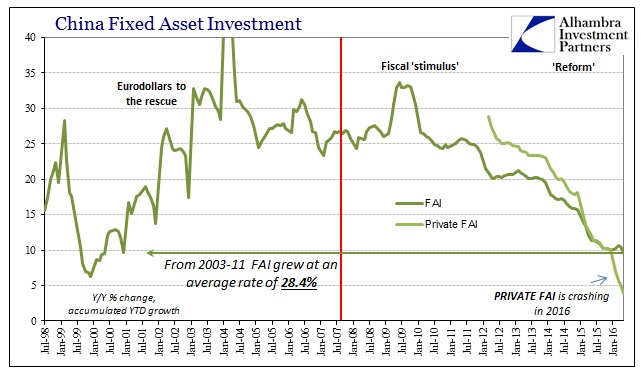

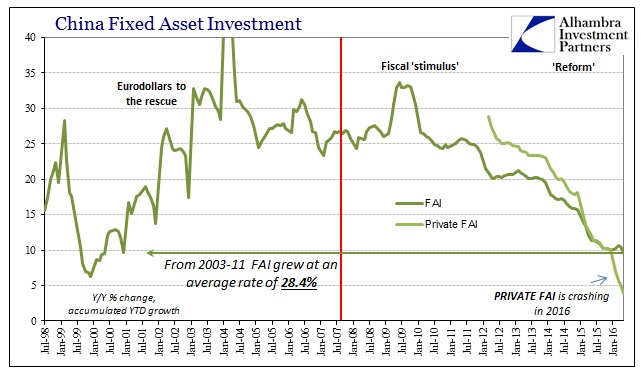

The real problem, however, is as noted last month: fixed asset investment. FAI was the heart of both the Chinese “miracle” as well as the government efforts to deal with the fallout from its curious end coincident to the eurodollar system’s. The latest figures are suggesting a growing disaster. Total FAI, which includes fiscal activities (“stimulus”), grew by just 9.6% in the January to May period (the National Bureau of Statistics reports FAI in accumulated totals). That was the first rate below 10% since December 2000!

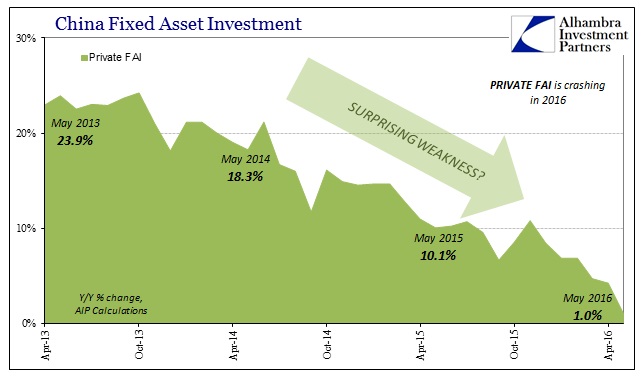

For just the private economy, the accumulated growth rate was 3.9% in the first five months of 2016, down sharply from 5.2% in the four months including April and 10.1% for 2015 as a whole. By my calculation, private FAI in May was up just 1.0% from May 2015 leaving the Chinese economy careening toward disaster.

The mainstream is finally acknowledging the precarious state of Chinese fortunes but once again being careful to “balance” it all out with hopes placed squarely upon consumers.

A slowdown in private investment is particularly worrisome because it indicates that companies are holding off spending, signaling limited confidence in the future and denying the economy what is often more effective and sustainable investment than government spending.

Sheng Laiyun, a spokesman with the country’s National Bureau of Statistics, cited overcapacity and a difficulty in obtaining financing as reasons private companies are reluctant to invest, though he said China’s economic fundamentals remain sound. “The slowdown in private investment shows that economic growth momentum needs to be strengthened,” he said.

“Though…China’s economic fundamentals remain sound”? These are just words stripped of all meaning as the first quoted paragraph devastates any idea of a “sound” economy. The spokesman basically claimed that the economy is sound except for all the primary and basic foundations which are not. The Wall Street Journal does its orthodox job of trying to put consumers at the leading edge of Chinese growth rather than at the end where the economy actually places them. The article starts off by claiming that “other, more upbeat economic data” were overshadowed by all this weakness, including the proper reference to “difficulty in obtaining financing.” That last part is the key which brings together the entire global transition.

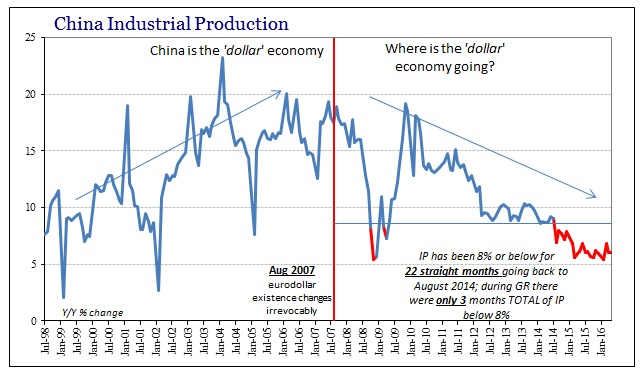

The Chinese economy is FAI, which is why the mainstream media is starting to take notice. The idea that consumers will apply a “soft landing” transition from export-oriented industrial overcapacity to a more Western-style services economy is wishing, not analysis.

Not only will the Chinese consumer need to overcome the global “headwind” of the collapse in global trade, the non-industrial economy now has the job of further convincing Chinese firms to start reinvesting for all this advertised consumer demand. The service/consumer economy will not only have to grow at a robust enough rate to propel the whole economy, it must now do so that much more intensely to offset this further export/industrial setback. Retail sales continually slowing with a lag to IP is still in the wrong direction. That would suggest a far different interpretation of private FAI in 2016 as opposed to even 2015. In other words, it is far more likely, in my view, that Chinese firms have given up on the consumer economy of late due to the events of the past year and in full view of nothing but further slowing everywhere.

That does seem to be the trajectory since December 2015, where a steady deceleration quickened to where a negative sign is very likely for next month (and how many months thereafter?).

I actually doubt whether Chinese businesses ever believed in the consumer myth at all, but even if they did it is very likely they don’t now. Twelve months ago, we were told exactly these same things in almost exactly these same words. Retail sales had “rebounded” from that decade-low of 10.0% (April 2015) to 10.1% (May 2015), to which CNBC declared:

A slew of data from China, including retail sales and industrial production, matched analysts’ expectations, offering some indication the worst of the mainland’s economic slowdown may be over.

The expectation was that the “steadying” consumer spending numbers would eventually take over the rest of the economic setting. They didn’t; and it was just as easy then to see why that was nothing more than wishful thinking. As I wrote in response:

If those weren’t the weakest of foundations upon which to build a case for renewed economic robustness in China, Fixed Asset Investment continues to sink, and sink fast, which calls into immediate question any assessments that see an end to the downdraft. Estimates for Private FAI are even worse in terms of momentum. In other words, it seems far more likely that China continues on its way toward new depths and that any pause in IP or retail sales is just normal variation contained within that overarching trend.

The problem remains one of orthodox perspective. Economists (and so the media) are only allowed to view either expansion or contraction in the strictest cyclical sense. If China’s economy (or the US) isn’t in recession it must be in expansion; even to the point that commentary must strain the bounds of sense to find it. If industry is taxed by massive overcapacity but still no recession, then in the orthodox view that must mean Chinese consumers are taking up the slack and will only continue to.

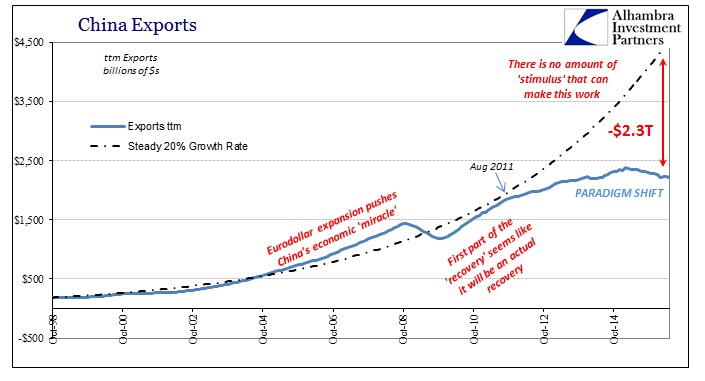

Activity, or lack of it, in FAI especially the private side shows without ambiguity that Chinese businesses, those closest to and most familiar with Chinese consumers, just aren’t buying it. This is not a Chinese cycle; it is a global paradigm shift. There is in this context nothing upbeat about it, especially as the longer it takes the higher the cost of the transition; especially as central banks and fiscal policies attempt to hold it off that much longer. Time and opportunity cost are already immense sunk costs since the transition has been in process for at least five years now, and in the most basic sense dating back to August 2007 at nearly a decade of imbalance. The financial/monetary system was built for pre-2007 operations but more so expectations. There is nothing Chinese consumers, or American consumers, can do now to push back time to get the economy back to that world.

Some economic and financial agents have already figured that out; others will follow the mainstream and never do so even as everything continues to shift out from under them.